Form 952 Application for Manufactured Home Personal Property Exemption 2025-2026

What is the Form 952 Application For Manufactured Home Personal Property Exemption

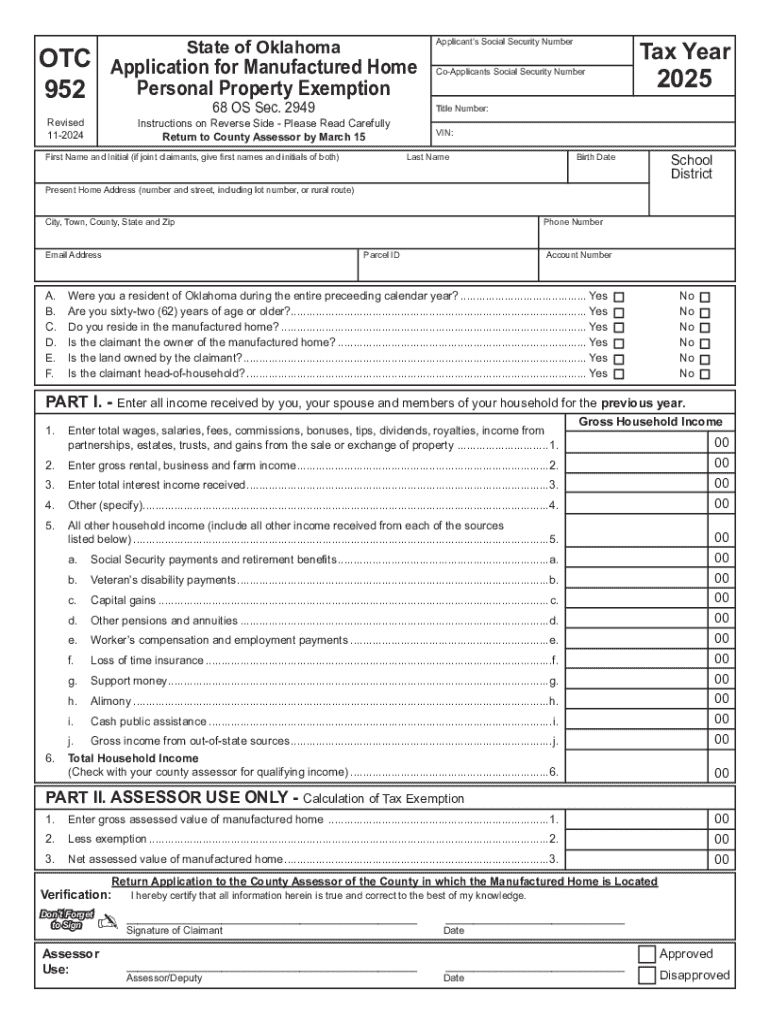

The Form 952 Application For Manufactured Home Personal Property Exemption is a legal document used by property owners in the United States to apply for an exemption on personal property taxes related to manufactured homes. This form is crucial for homeowners seeking to reduce their tax burden by qualifying for specific exemptions available under state laws. By submitting this application, individuals can demonstrate their eligibility for tax relief, which can significantly impact their financial obligations.

How to use the Form 952 Application For Manufactured Home Personal Property Exemption

Using the Form 952 involves several straightforward steps. First, ensure you have all necessary information and documentation, such as proof of ownership and residency. Next, fill out the form accurately, providing details about the manufactured home and your personal information. Once completed, submit the form to the appropriate local tax authority, following any specific instructions provided for your state. It is essential to keep a copy of the submitted form for your records.

Steps to complete the Form 952 Application For Manufactured Home Personal Property Exemption

Completing the Form 952 requires careful attention to detail. Follow these steps for a successful application:

- Gather necessary documents, including proof of ownership and residency.

- Fill out the form with accurate personal and property information.

- Review the form for any errors or omissions.

- Submit the completed form to your local tax office by the specified deadline.

Ensure you understand any state-specific requirements that may apply to your application process.

Eligibility Criteria

To qualify for the exemption using Form 952, applicants must meet specific eligibility criteria, which can vary by state. Generally, homeowners must own the manufactured home and use it as their primary residence. Additionally, certain income thresholds or age requirements may apply. It is advisable to check with your local tax authority to understand the precise criteria that must be met to qualify for the exemption.

Required Documents

Submitting the Form 952 typically requires several supporting documents to verify your eligibility. Commonly required documents include:

- Proof of ownership, such as a title or bill of sale.

- Documentation of residency, like a utility bill or lease agreement.

- Any additional forms or evidence as specified by your state’s tax authority.

Gathering these documents ahead of time can streamline the application process and help avoid delays.

Form Submission Methods

The Form 952 can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local tax authority's website.

- Mailing the completed form to the designated office.

- In-person delivery at local tax offices.

Be sure to check with your local tax authority for the preferred submission method and any specific instructions that may apply.

Create this form in 5 minutes or less

Find and fill out the correct form 952 application for manufactured home personal property exemption

Create this form in 5 minutes!

How to create an eSignature for the form 952 application for manufactured home personal property exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 952 Application For Manufactured Home Personal Property Exemption?

The Form 952 Application For Manufactured Home Personal Property Exemption is a document that allows homeowners to apply for tax exemptions on their manufactured homes. This form is essential for reducing property taxes and ensuring compliance with local regulations. By using airSlate SignNow, you can easily complete and eSign this form online.

-

How can airSlate SignNow help with the Form 952 Application For Manufactured Home Personal Property Exemption?

airSlate SignNow streamlines the process of completing the Form 952 Application For Manufactured Home Personal Property Exemption by providing an intuitive platform for document creation and eSigning. Users can fill out the form digitally, ensuring accuracy and saving time. Additionally, our platform allows for easy sharing and tracking of the application.

-

Is there a cost associated with using airSlate SignNow for the Form 952 Application For Manufactured Home Personal Property Exemption?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your requirements for managing the Form 952 Application For Manufactured Home Personal Property Exemption.

-

What features does airSlate SignNow offer for managing the Form 952 Application For Manufactured Home Personal Property Exemption?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Form 952 Application For Manufactured Home Personal Property Exemption. These features enhance the user experience by making the application process more efficient and organized. Additionally, users can collaborate in real-time, ensuring all necessary parties are involved.

-

Can I integrate airSlate SignNow with other applications for the Form 952 Application For Manufactured Home Personal Property Exemption?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Form 952 Application For Manufactured Home Personal Property Exemption. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Form 952 Application For Manufactured Home Personal Property Exemption?

Using airSlate SignNow for the Form 952 Application For Manufactured Home Personal Property Exemption provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere. This convenience allows you to focus on other important tasks while managing your exemption application.

-

How secure is the airSlate SignNow platform for the Form 952 Application For Manufactured Home Personal Property Exemption?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your data while completing the Form 952 Application For Manufactured Home Personal Property Exemption. You can trust that your sensitive information is safe and secure throughout the entire process.

Get more for Form 952 Application For Manufactured Home Personal Property Exemption

- Division officers personnel record form

- Printable texas dps forms dl 43

- I864ez form

- Puc hawaii 6961447 form

- 2014 schedule i form 1041 alternative minimum tax estates and trusts irs ustreas

- County verification of business location 12 13 11 state of indiana form

- Guardian annual report form

- It 203 f 83399162 form

Find out other Form 952 Application For Manufactured Home Personal Property Exemption

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer