Iowa SalesUseExcise Tax Exemption Certificaterev Form

Understanding the Iowa Sales Tax Exemption Certificate

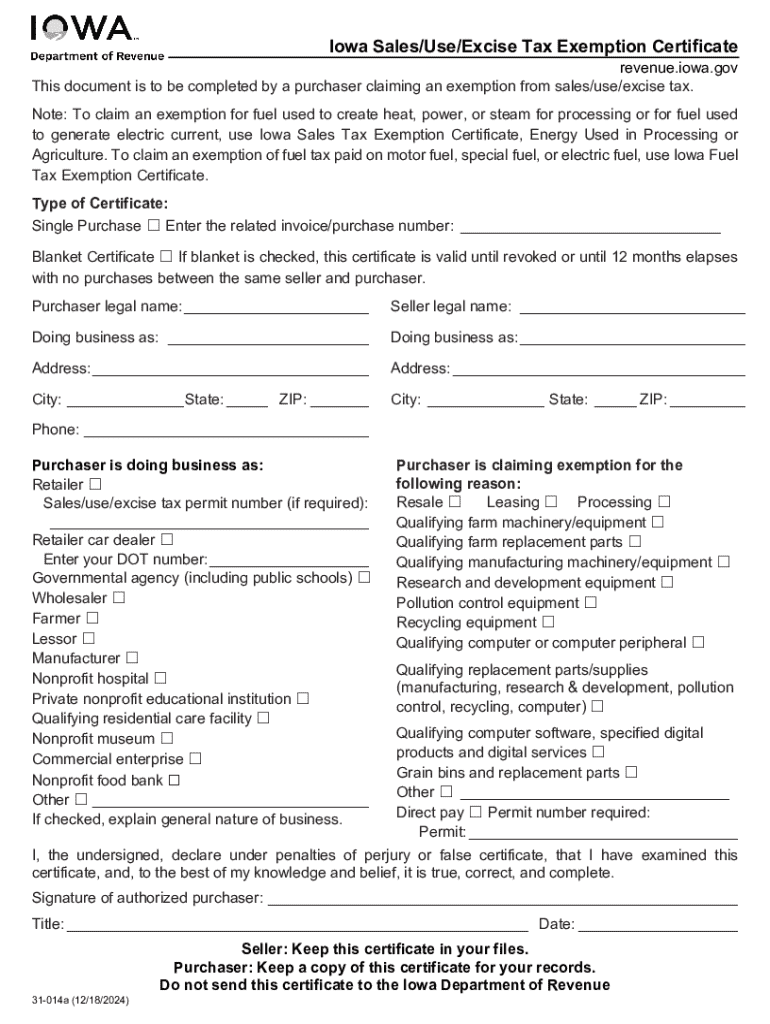

The Iowa Sales Tax Exemption Certificate is a crucial document for individuals and businesses seeking to claim exemption from sales tax on qualifying purchases. This certificate allows eligible buyers to avoid paying sales tax when acquiring items for resale or for specific exempt purposes as defined by Iowa law. Understanding what qualifies for exemption is essential for compliance and proper usage of this certificate.

Steps to Complete the Iowa Sales Tax Exemption Certificate

Filling out the Iowa Sales Tax Exemption Certificate involves several key steps:

- Obtain the correct form from the Iowa Department of Revenue.

- Fill in the purchaser's name and address accurately.

- Provide a description of the items being purchased.

- Indicate the reason for the exemption, ensuring it aligns with Iowa tax laws.

- Sign and date the certificate to validate it.

Each step is important to ensure that the certificate is completed correctly and is legally valid.

Eligibility Criteria for the Iowa Sales Tax Exemption Certificate

To qualify for the Iowa Sales Tax Exemption Certificate, the purchaser must meet specific eligibility criteria. Generally, the exemption is available for:

- Resale purchases made by retailers.

- Purchases by non-profit organizations for exempt activities.

- Certain government entities and educational institutions.

It is essential to review the Iowa Department of Revenue guidelines to confirm eligibility before applying for the exemption.

Legal Use of the Iowa Sales Tax Exemption Certificate

The legal use of the Iowa Sales Tax Exemption Certificate is governed by state tax laws. Misuse of the certificate, such as claiming exemptions for ineligible purchases, can lead to penalties. It is important to understand the legal ramifications and ensure that the certificate is used only for its intended purposes.

Obtaining the Iowa Sales Tax Exemption Certificate

The Iowa Sales Tax Exemption Certificate can be obtained through the Iowa Department of Revenue's official website or by contacting their office directly. It is advisable to ensure that you have the most current version of the form to avoid complications during the filing process.

Examples of Using the Iowa Sales Tax Exemption Certificate

Common scenarios for using the Iowa Sales Tax Exemption Certificate include:

- A retailer purchasing inventory for resale.

- A non-profit organization buying supplies for charitable events.

- A government agency acquiring equipment for public service.

These examples illustrate how various entities can utilize the exemption certificate to reduce their tax liabilities effectively.

Handy tips for filling out Iowa SalesUseExcise Tax Exemption Certificaterev online

Quick steps to complete and e-sign Iowa SalesUseExcise Tax Exemption Certificaterev online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant service for optimum straightforwardness. Use signNow to electronically sign and send Iowa SalesUseExcise Tax Exemption Certificaterev for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iowa salesuseexcise tax exemption certificaterev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa sales tax exemption certificate form?

The Iowa sales tax exemption certificate form is a document that allows businesses to purchase goods without paying sales tax. This form is essential for qualifying organizations, such as nonprofits, to ensure they are not taxed on purchases related to their exempt activities. By using the Iowa sales tax exemption certificate form, businesses can save money and streamline their purchasing process.

-

How can I obtain the Iowa sales tax exemption certificate form?

You can obtain the Iowa sales tax exemption certificate form from the Iowa Department of Revenue's website. The form is available for download and can be filled out electronically or printed for manual completion. Ensure that you meet the eligibility requirements before submitting the Iowa sales tax exemption certificate form to your suppliers.

-

What are the benefits of using the Iowa sales tax exemption certificate form?

Using the Iowa sales tax exemption certificate form allows eligible organizations to avoid paying sales tax on qualifying purchases. This can lead to signNow cost savings, especially for nonprofits and government entities. Additionally, it simplifies the purchasing process, making it easier to manage expenses and budgets.

-

Is there a fee associated with the Iowa sales tax exemption certificate form?

There is no fee to obtain or submit the Iowa sales tax exemption certificate form. However, businesses must ensure they meet the criteria for exemption to avoid any potential penalties. It's important to keep accurate records of all transactions made using the Iowa sales tax exemption certificate form.

-

Can airSlate SignNow help with the Iowa sales tax exemption certificate form?

Yes, airSlate SignNow can assist you in managing the Iowa sales tax exemption certificate form by providing an easy-to-use platform for eSigning and sending documents. Our solution streamlines the process, ensuring that your forms are completed and submitted efficiently. With airSlate SignNow, you can keep track of all your exemption certificates in one place.

-

What features does airSlate SignNow offer for managing tax exemption forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to help you manage your Iowa sales tax exemption certificate form effectively. You can create templates for quick access and ensure compliance with state regulations. Our platform also integrates with various applications to enhance your workflow.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents, including the Iowa sales tax exemption certificate form. We use advanced encryption methods and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards to ensure that your data remains safe and confidential.

Get more for Iowa SalesUseExcise Tax Exemption Certificaterev

- Observation of student engagement data sheet form

- There is a problem with your name andor taxpayer identification number tin on your 2015 tax return irs form

- Use this form if you are 16 years or over and

- Lifeguard timesheet guardsrealmanagecom form

- Da form 137 2

- Ohio virtual academy ownertenant affidavit form

- Pre medicalpre veterinarypre dental form

- Leave of absence form

Find out other Iowa SalesUseExcise Tax Exemption Certificaterev

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT