Maryland Form 502INJ Injured Spouse Claim Form

What is the Maryland Form 502INJ Injured Spouse Claim Form

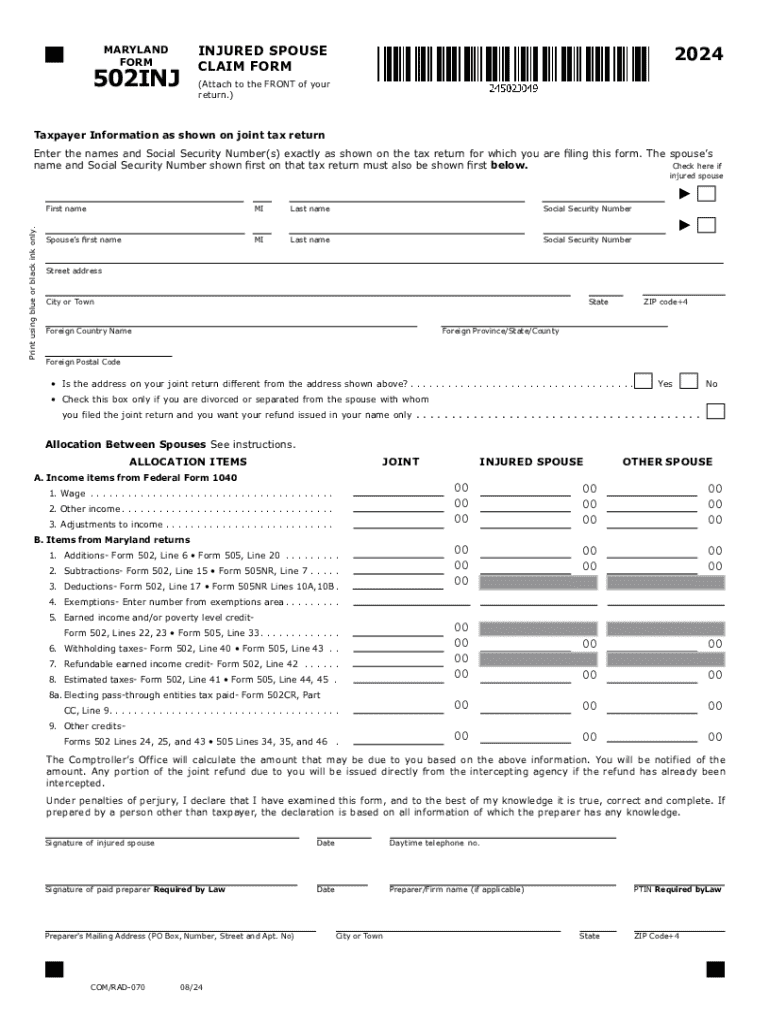

The Maryland Form 502INJ, also known as the Injured Spouse Claim Form, is designed for individuals who are married and wish to claim their portion of a tax refund that may be withheld due to their spouse's debts, such as unpaid taxes or child support. This form allows the injured spouse to assert their right to a refund that is otherwise subject to being applied against their spouse's obligations. It is essential for ensuring that both spouses receive their rightful share of any tax refund, particularly in cases where one spouse may have financial liabilities that affect the couple's joint tax return.

How to use the Maryland Form 502INJ Injured Spouse Claim Form

To use the Maryland Form 502INJ, the injured spouse must complete the form accurately and submit it alongside their joint tax return. The form requires information about both spouses, including their names, Social Security numbers, and the details of the tax refund being claimed. It is important to provide accurate financial information to demonstrate the injured spouse's eligibility for the claim. Once completed, the form should be filed with the Maryland State Comptroller's office to ensure the injured spouse's portion of the refund is protected from being offset by the other spouse's debts.

Steps to complete the Maryland Form 502INJ Injured Spouse Claim Form

Completing the Maryland Form 502INJ involves several key steps:

- Gather necessary documents, including your joint tax return and any relevant financial statements.

- Fill out the form with accurate information for both spouses, ensuring to include Social Security numbers and financial details.

- Clearly indicate the portion of the refund that belongs to the injured spouse.

- Review the completed form for accuracy and completeness before submission.

- File the form with your joint tax return or separately, as required by the Maryland State Comptroller's guidelines.

Key elements of the Maryland Form 502INJ Injured Spouse Claim Form

The Maryland Form 502INJ contains several critical elements that must be filled out correctly. Key components include:

- Spouse Information: Names, Social Security numbers, and addresses of both spouses.

- Tax Refund Details: The amount of the tax refund being claimed and how it is divided between the spouses.

- Signature: Both spouses must sign the form to validate the claim.

- Documentation: Any supporting documents that prove the injured spouse's claim to the refund.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 502INJ are typically aligned with the state tax return deadlines. For most taxpayers, the deadline to file is April fifteenth of each year. However, if additional time is needed, a six-month extension may be requested, allowing for a later submission. It is crucial to adhere to these deadlines to ensure that the injured spouse's claim is processed in a timely manner and to avoid any potential penalties or issues with the tax return.

Eligibility Criteria

To be eligible to file the Maryland Form 502INJ, the injured spouse must meet specific criteria:

- The individual must be married and filing a joint tax return.

- The injured spouse must have earned income that is subject to tax.

- The claim must be related to a tax refund that is being withheld due to the other spouse's debts.

- Both spouses must agree to the filing of the claim and provide necessary signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502inj injured spouse claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the claim md 502 feature in airSlate SignNow?

The claim md 502 feature in airSlate SignNow allows users to efficiently manage and process medical claims. This feature streamlines the documentation process, ensuring that all necessary forms are completed accurately and submitted on time. By utilizing claim md 502, businesses can enhance their workflow and reduce errors in claims processing.

-

How does airSlate SignNow help with claim md 502 pricing?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling claim md 502. Our pricing structure is designed to be cost-effective, allowing organizations to choose a plan that fits their budget while still accessing essential features. This ensures that you can manage your claims without overspending.

-

What are the key benefits of using airSlate SignNow for claim md 502?

Using airSlate SignNow for claim md 502 provides numerous benefits, including increased efficiency and reduced turnaround times for document processing. The platform's user-friendly interface simplifies the eSigning process, making it easier for teams to collaborate. Additionally, enhanced security features protect sensitive information related to medical claims.

-

Can airSlate SignNow integrate with other software for claim md 502?

Yes, airSlate SignNow offers seamless integrations with various software solutions that support claim md 502. This allows users to connect their existing systems, such as EHRs and practice management software, to streamline the claims process. Integrating these tools enhances productivity and ensures a smooth workflow.

-

Is there a mobile app for managing claim md 502 with airSlate SignNow?

Absolutely! airSlate SignNow provides a mobile app that allows users to manage claim md 502 on the go. This mobile solution ensures that you can send, sign, and track documents from anywhere, making it convenient for busy professionals. The app maintains all the essential features of the desktop version for a consistent experience.

-

How secure is the claim md 502 process with airSlate SignNow?

The claim md 502 process with airSlate SignNow is highly secure, employing advanced encryption and compliance measures to protect sensitive data. We prioritize the confidentiality of your documents and ensure that all transactions are secure. This commitment to security helps build trust with your clients and partners.

-

What types of documents can be managed with claim md 502 in airSlate SignNow?

airSlate SignNow allows users to manage a variety of documents related to claim md 502, including claim forms, patient consent forms, and billing statements. This versatility ensures that all necessary documentation can be handled within a single platform. By centralizing these documents, businesses can improve their operational efficiency.

Get more for Maryland Form 502INJ Injured Spouse Claim Form

Find out other Maryland Form 502INJ Injured Spouse Claim Form

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF