New Jersey Resident Return, Form NJ 1040

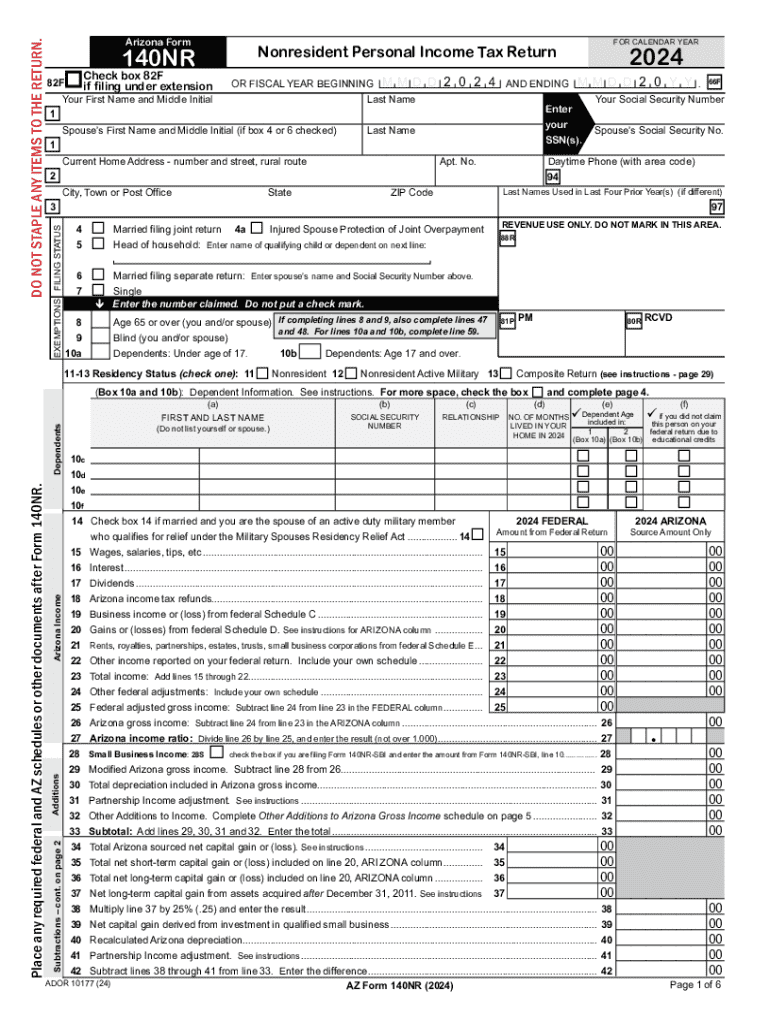

Understanding the Arizona Form 140NR

The Arizona Form 140NR is specifically designed for non-residents who earn income in Arizona. This form allows individuals who do not reside in Arizona but have income sourced from the state to report their earnings and pay any applicable taxes. It is essential for ensuring compliance with Arizona tax laws while accurately reflecting the income earned within the state.

Steps to Complete the Arizona Form 140NR

Filling out the Arizona Form 140NR involves several key steps:

- Gather all necessary income documents, including W-2s and 1099s.

- Begin by entering your personal information, such as your name, address, and Social Security number.

- Report your income earned in Arizona, ensuring to include only the income sourced from the state.

- Calculate your total tax liability based on the income reported.

- Complete any applicable schedules that pertain to your specific tax situation.

- Review your completed form for accuracy before submitting.

Filing Deadlines for Arizona Form 140NR

It is crucial to be aware of the filing deadlines associated with the Arizona Form 140NR. Typically, the form must be filed by April 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Timely filing helps avoid penalties and interest on any taxes owed.

Required Documents for Filing Arizona Form 140NR

To complete the Arizona Form 140NR accurately, you will need several documents:

- Your federal tax return, including any supporting documents.

- W-2 forms from Arizona employers.

- 1099 forms for any other income earned in Arizona.

- Records of any deductions or credits you plan to claim.

Submission Methods for Arizona Form 140NR

You can submit the Arizona Form 140NR through various methods:

- Online filing through the Arizona Department of Revenue's e-filing system.

- Mailing a paper copy of the form to the appropriate address provided by the Arizona Department of Revenue.

- In-person submission at designated tax offices, if available.

Penalties for Non-Compliance with Arizona Tax Laws

Failing to file the Arizona Form 140NR or underreporting income can result in significant penalties. The Arizona Department of Revenue may impose fines, interest on unpaid taxes, and additional charges for late filing. It is advisable to ensure all information is accurate and submitted on time to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new jersey resident return form nj 1040 771623608

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 140nr Arizona form?

The 140nr Arizona form is a tax return specifically designed for non-residents who earn income in Arizona. This form allows individuals to report their Arizona-sourced income and calculate their tax liability. Using airSlate SignNow, you can easily eSign and submit your 140nr Arizona form online.

-

How can airSlate SignNow help with the 140nr Arizona form?

airSlate SignNow provides a user-friendly platform to prepare, eSign, and manage your 140nr Arizona form efficiently. With our solution, you can streamline the signing process, ensuring that your tax documents are completed accurately and submitted on time. Our platform also offers templates to simplify your experience.

-

Is there a cost associated with using airSlate SignNow for the 140nr Arizona form?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and provides access to features that simplify the process of completing the 140nr Arizona form. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the 140nr Arizona form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage for your 140nr Arizona form. Additionally, our platform allows for real-time collaboration, making it easy to work with tax professionals or partners. These features enhance the overall efficiency of managing your tax documents.

-

Can I integrate airSlate SignNow with other applications for the 140nr Arizona form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. Whether you use accounting software or document management systems, you can easily incorporate the 140nr Arizona form into your existing processes for enhanced productivity.

-

What are the benefits of using airSlate SignNow for tax documents like the 140nr Arizona form?

Using airSlate SignNow for your 140nr Arizona form provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform ensures that your documents are signed and stored securely, reducing the risk of errors. Additionally, the ease of use allows you to focus on other important tasks.

-

Is airSlate SignNow compliant with Arizona tax regulations for the 140nr Arizona form?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the 140nr Arizona form. Our platform is regularly updated to reflect any changes in tax laws, ensuring that your documents meet the necessary requirements. You can trust us to help you stay compliant.

Get more for New Jersey Resident Return, Form NJ 1040

- Fill dirt program form

- How much will a social security disability lawyer or advocate form

- Courts orders and opinions regarding final resolution in form

- Ireland health service executive form

- Claim residence nil rate band form

- Schedule k 2 form

- Colorado dr 0617 instructionsampquot keyword found websites form

- Msc 5559 pebb cdl employee exam voucher msc 5559 pebb cdl employee exam voucher form

Find out other New Jersey Resident Return, Form NJ 1040

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT