Arizona Form 140EZ

What is the Arizona Form 140EZ

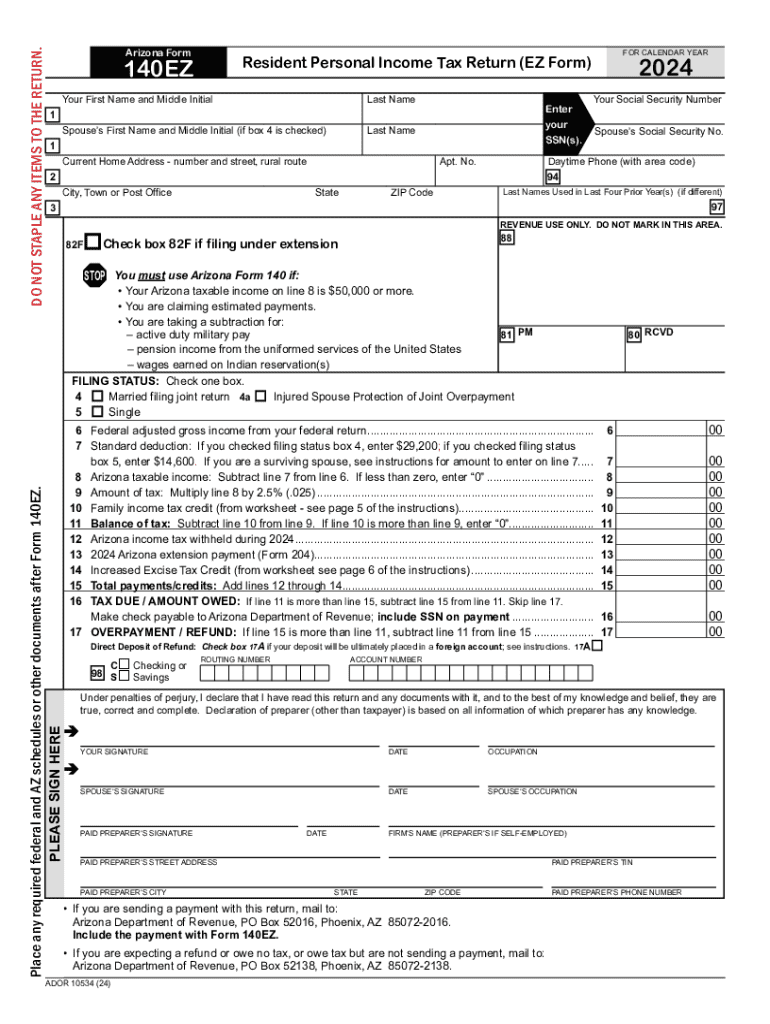

The Arizona Form 140EZ is a simplified income tax return designed for eligible individual taxpayers in Arizona. This form is specifically intended for those with straightforward tax situations, allowing them to file their state income tax returns efficiently. It is generally used by single or married taxpayers who do not have dependents and whose taxable income falls below a specified threshold. The form streamlines the filing process, making it easier for individuals to report their income and calculate their tax obligations.

How to use the Arizona Form 140EZ

Using the Arizona Form 140EZ involves several straightforward steps. First, ensure that you meet the eligibility criteria, which typically include having a simple tax situation with no complex deductions or credits. Next, download the form from the Arizona Department of Revenue website or access it through authorized platforms. Fill out the required fields, including your personal information, income details, and tax calculations. Finally, review your completed form for accuracy before submitting it either electronically or via mail.

Steps to complete the Arizona Form 140EZ

Completing the Arizona Form 140EZ can be accomplished in a few organized steps:

- Gather necessary documents: Collect your W-2 forms, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income from all sources, ensuring accuracy in reporting.

- Calculate tax: Use the provided tax tables to determine your tax liability based on your income.

- Claim any credits: If eligible, include any state tax credits that apply to your situation.

- Review and sign: Double-check all entries for accuracy and sign the form before submission.

Required Documents

To successfully complete the Arizona Form 140EZ, you will need to gather several essential documents:

- W-2 forms: These documents report your wages and withheld taxes from your employer.

- 1099 forms: If you have income from freelance work or other non-employment sources, include these forms.

- Previous year’s tax return: Having your prior tax return can help ensure consistency and accuracy.

- Proof of any deductions: If applicable, documentation for any state tax credits or deductions should be collected.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for timely submission of the Arizona Form 140EZ. The standard deadline for filing your state income tax return is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may apply for, which can provide additional time to file but not to pay any taxes owed. Always verify current deadlines with the Arizona Department of Revenue to ensure compliance.

Eligibility Criteria

To qualify for using the Arizona Form 140EZ, taxpayers must meet specific eligibility criteria. Generally, this form is available to individuals with:

- Single or married filing jointly status: The form is not intended for married filing separately or head of household.

- Income below a certain threshold: Taxable income must fall within the limits set by the Arizona Department of Revenue.

- No dependents: Taxpayers cannot claim dependents when using this simplified form.

- Standard deductions only: The form is designed for those who do not itemize deductions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 140EZ?

The Arizona Form 140EZ is a simplified tax return form designed for eligible Arizona residents. It allows individuals to file their state income taxes quickly and easily, making it ideal for those with straightforward tax situations. Using airSlate SignNow, you can eSign and submit your Arizona Form 140EZ securely and efficiently.

-

How can airSlate SignNow help with the Arizona Form 140EZ?

airSlate SignNow streamlines the process of completing and submitting the Arizona Form 140EZ by providing an easy-to-use platform for eSigning documents. With our solution, you can fill out the form digitally, sign it, and send it directly to the Arizona Department of Revenue. This eliminates the hassle of printing and mailing paper forms.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form 140EZ?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our secure eSigning and document management features. You can choose a plan that best fits your requirements for handling the Arizona Form 140EZ.

-

What features does airSlate SignNow offer for the Arizona Form 140EZ?

airSlate SignNow provides a range of features to enhance your experience with the Arizona Form 140EZ, including customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that you can manage your tax documents efficiently and with confidence. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other applications for the Arizona Form 140EZ?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Arizona Form 140EZ. Whether you use accounting software or document management systems, our integrations help you manage your documents seamlessly and efficiently.

-

What are the benefits of using airSlate SignNow for the Arizona Form 140EZ?

Using airSlate SignNow for the Arizona Form 140EZ provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform reduces the risk of errors associated with manual entry and ensures that your documents are securely stored and easily accessible. This makes the tax filing process much more manageable.

-

Is airSlate SignNow secure for submitting the Arizona Form 140EZ?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Arizona Form 140EZ and other documents are protected. We use advanced encryption and secure servers to safeguard your information. You can trust that your sensitive data is handled with the utmost care when using our platform.

Get more for Arizona Form 140EZ

Find out other Arizona Form 140EZ

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe