Arizona Form AZ 140V

What is the Arizona Form AZ 140V

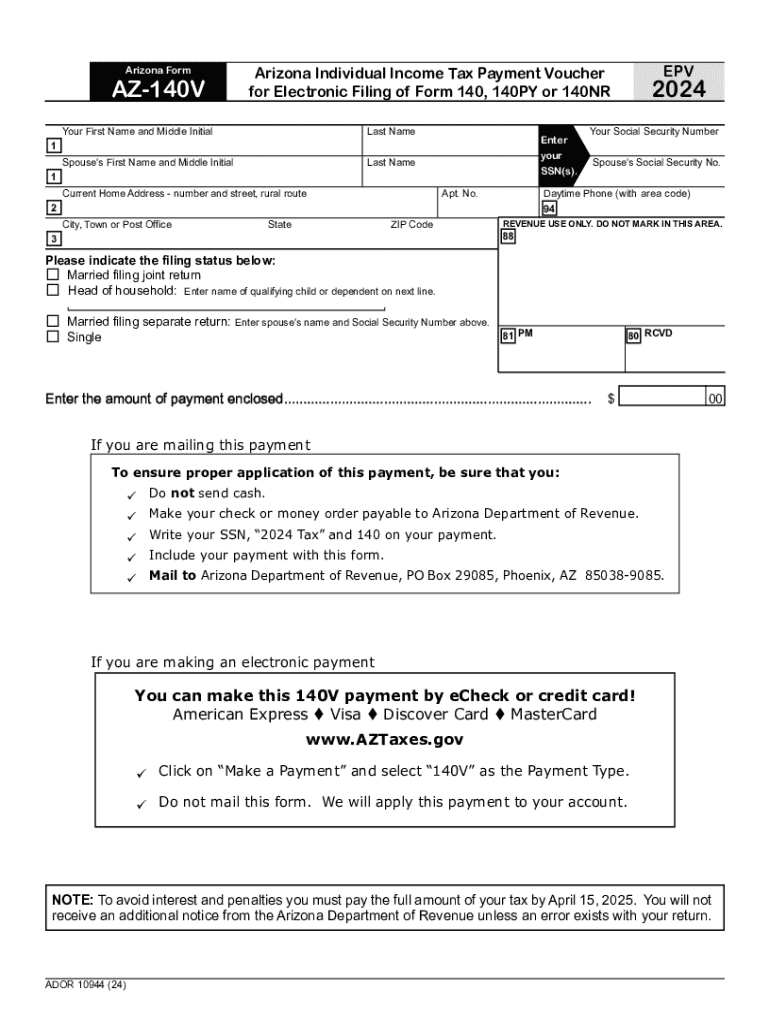

The Arizona Form AZ 140V is an income tax payment voucher used by taxpayers in Arizona to submit payments for their state income taxes. This form is essential for individuals who owe taxes and wish to make a payment directly to the Arizona Department of Revenue. The AZ 140V form is particularly useful for those who are filing their taxes electronically but prefer to send their payment via mail. By using this form, taxpayers can ensure that their payment is properly credited to their account.

How to use the Arizona Form AZ 140V

To use the Arizona Form AZ 140V, taxpayers should first complete their income tax return. Once the return is finalized, the taxpayer can calculate the amount owed. The AZ 140V form requires the taxpayer to provide personal information, including their name, address, and Social Security number, along with the payment amount. After filling out the form, the taxpayer should send it along with their payment to the appropriate address provided by the Arizona Department of Revenue. This process helps ensure that payments are processed efficiently.

Steps to complete the Arizona Form AZ 140V

Completing the Arizona Form AZ 140V involves several straightforward steps:

- Obtain the form from the Arizona Department of Revenue website or a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the payment amount you are submitting.

- Review the form for accuracy to avoid any potential issues.

- Mail the completed form along with your payment to the designated address.

Following these steps ensures that your payment is processed correctly and on time.

Key elements of the Arizona Form AZ 140V

The Arizona Form AZ 140V contains several key elements that are crucial for proper submission:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Payment Amount: Clearly state the amount you are submitting.

- Signature: Your signature is required to validate the form.

- Submission Instructions: Follow the provided instructions for mailing the form and payment.

Understanding these elements helps ensure that the form is filled out correctly.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Arizona Form AZ 140V. Typically, the deadline for submitting your state income tax return and any associated payments is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify the specific dates for the current tax year, as they can change. Timely submission of the AZ 140V form is critical to avoid penalties and interest on late payments.

Form Submission Methods

The Arizona Form AZ 140V can be submitted through various methods:

- By Mail: Complete the form and send it along with your payment to the Arizona Department of Revenue.

- Online Payment: While the AZ 140V itself is a paper form, taxpayers may also have the option to pay their taxes online through the Arizona Department of Revenue's website.

- In-Person: Taxpayers can visit local Department of Revenue offices to submit their payment and form directly.

Choosing the right submission method can help ensure that your payment is processed promptly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form az 140v 771933941

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona AZ140V form?

The Arizona AZ140V form is a tax form used for submitting payments for individual income tax returns in Arizona. It is essential for taxpayers who need to make a payment along with their tax return. Understanding the Arizona AZ140V form can help ensure compliance with state tax regulations.

-

How can I fill out the Arizona AZ140V form using airSlate SignNow?

You can easily fill out the Arizona AZ140V form using airSlate SignNow's intuitive interface. Simply upload the form, fill in the required fields, and eSign it securely. Our platform streamlines the process, making it quick and efficient to complete your Arizona AZ140V form.

-

Is there a cost associated with using airSlate SignNow for the Arizona AZ140V form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a cost associated with using our services, the investment is often outweighed by the time and resources saved when managing documents like the Arizona AZ140V form. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for the Arizona AZ140V form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for the Arizona AZ140V form. These features enhance the efficiency of document management and ensure that your forms are completed accurately and securely.

-

Can I integrate airSlate SignNow with other applications for the Arizona AZ140V form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Arizona AZ140V form. Whether you use CRM systems or cloud storage solutions, our integrations help you manage your documents seamlessly.

-

What are the benefits of using airSlate SignNow for the Arizona AZ140V form?

Using airSlate SignNow for the Arizona AZ140V form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign your forms quickly, ensuring you meet deadlines without hassle.

-

How secure is airSlate SignNow when handling the Arizona AZ140V form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when handling the Arizona AZ140V form. You can trust that your sensitive information is safe and secure while using our platform.

Get more for Arizona Form AZ 140V

- Nurse practitioner residency program holyoke health center form

- Military spouse ppp form

- Canada application pension plan form

- Release of obligation under deed of trust form

- Appointment order template form

- Seancesimmigration quebecgouvqccaapplication for permanent selection entrepreneur program form

- Fillable online vacation brental lease agreementb drummond form

- 18 printable florida association of realtors forms templates pdffiller

Find out other Arizona Form AZ 140V

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service