Arizona Form 352

What is the Arizona Form 352

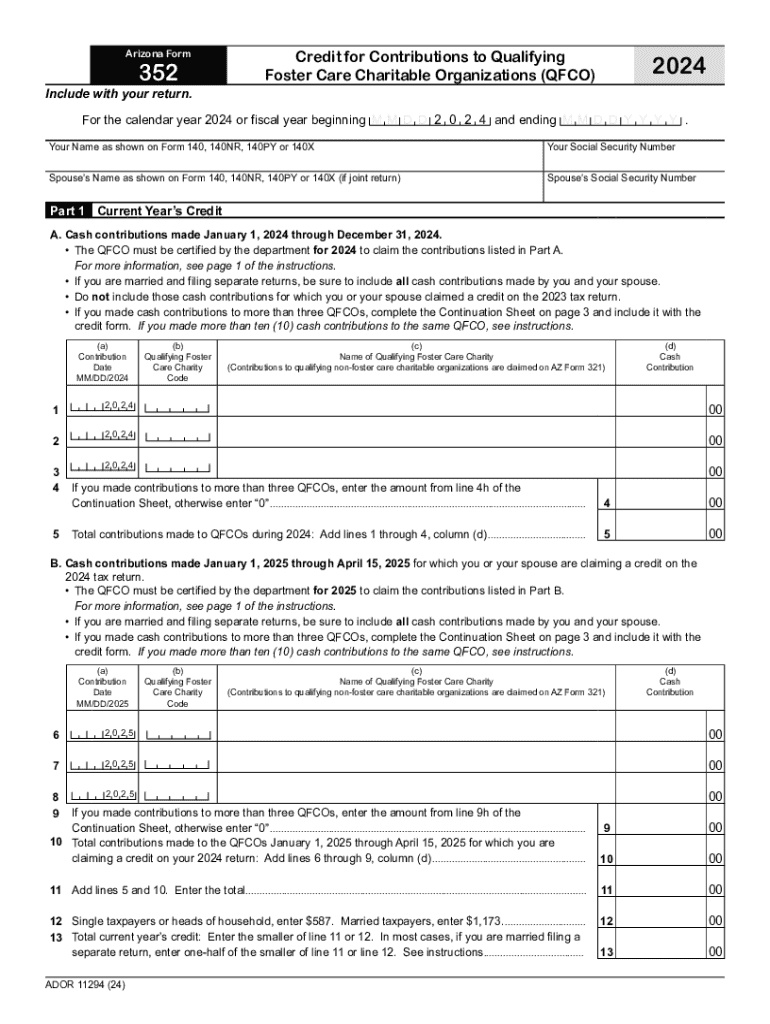

The Arizona Form 352, also known as the Arizona 352 form, is a document used primarily for reporting qualifying charitable contributions. This form is essential for individuals and businesses in Arizona looking to claim tax credits for donations made to qualifying organizations. It serves as a means to facilitate the process of supporting charitable causes while benefiting from tax incentives provided by the state.

How to use the Arizona Form 352

To effectively use the Arizona Form 352, individuals must first ensure they meet the eligibility criteria for claiming the tax credit. After confirming eligibility, the next step is to accurately complete the form by providing all necessary information, including details about the contributions made. Once completed, the form should be submitted along with the appropriate tax return to the Arizona Department of Revenue.

Steps to complete the Arizona Form 352

Completing the Arizona Form 352 involves several key steps:

- Gather documentation of all qualifying charitable contributions.

- Fill out personal information, including name, address, and taxpayer identification number.

- Detail the contributions made, specifying the amounts and names of the charitable organizations.

- Review the completed form for accuracy and completeness.

- Submit the form with your Arizona state tax return.

Legal use of the Arizona Form 352

The Arizona Form 352 is legally recognized for claiming tax credits on qualifying charitable contributions. It is important for users to understand the specific guidelines set forth by the Arizona Department of Revenue regarding eligible organizations and contribution amounts. Adhering to these regulations ensures compliance and maximizes the benefits derived from the form.

Key elements of the Arizona Form 352

Key elements of the Arizona Form 352 include:

- Taxpayer identification information.

- Details of the qualifying contributions.

- Signature and date of submission.

- Instructions for claiming the tax credit.

Who Issues the Form

The Arizona Form 352 is issued by the Arizona Department of Revenue. This state agency is responsible for overseeing the collection of state taxes and ensuring compliance with tax laws. They provide guidance on the proper use of the form and any updates or changes to the regulations surrounding charitable contributions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 352

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az form 352 and how can airSlate SignNow help?

The az form 352 is a specific document used in Arizona for various administrative purposes. airSlate SignNow simplifies the process of completing and signing this form by providing an intuitive platform that allows users to eSign documents securely and efficiently.

-

How much does it cost to use airSlate SignNow for az form 352?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Users can choose from monthly or annual subscriptions, ensuring that they can manage their az form 352 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing az form 352?

airSlate SignNow provides a range of features for managing the az form 352, including customizable templates, automated workflows, and secure cloud storage. These features streamline the signing process, making it easier for users to handle their documents efficiently.

-

Can I integrate airSlate SignNow with other applications for az form 352?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for the az form 352. Whether you use CRM systems, cloud storage, or project management tools, you can easily connect them to streamline your document management.

-

What are the benefits of using airSlate SignNow for the az form 352?

Using airSlate SignNow for the az form 352 provides numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. This solution empowers businesses to manage their documents more effectively while ensuring compliance with legal standards.

-

Is airSlate SignNow user-friendly for completing az form 352?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the az form 352. The platform's intuitive interface allows users to navigate through the signing process without any technical expertise.

-

How secure is airSlate SignNow when handling az form 352?

Security is a top priority for airSlate SignNow. When handling the az form 352, users can trust that their documents are protected with advanced encryption and secure storage, ensuring that sensitive information remains confidential.

Get more for Arizona Form 352

- Medical assessment on filing an application for instituting protective supervision or homologating a mandate form

- Medical assessment on filing an application for instituting protective supervision or homologating a mandate 393068260 form

- Jd cl 12 1370635 form

- Wilmington city wage tax refund form 2020

- Download kansas power of attorney for vehicle only form

- It 1040x ohio amended individual income tax return formytaxcom

- Va form 21 0960f 2 skin diseases disability benefits questionnaire 5367872

- Project identification form pif vba va

Find out other Arizona Form 352

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free