Form MW506NRS Maryland Return of Income Tax Withholding for Nonresident Sale of Real Property

What is the Form MW506NRS Maryland Return Of Income Tax Withholding For Nonresident Sale Of Real Property

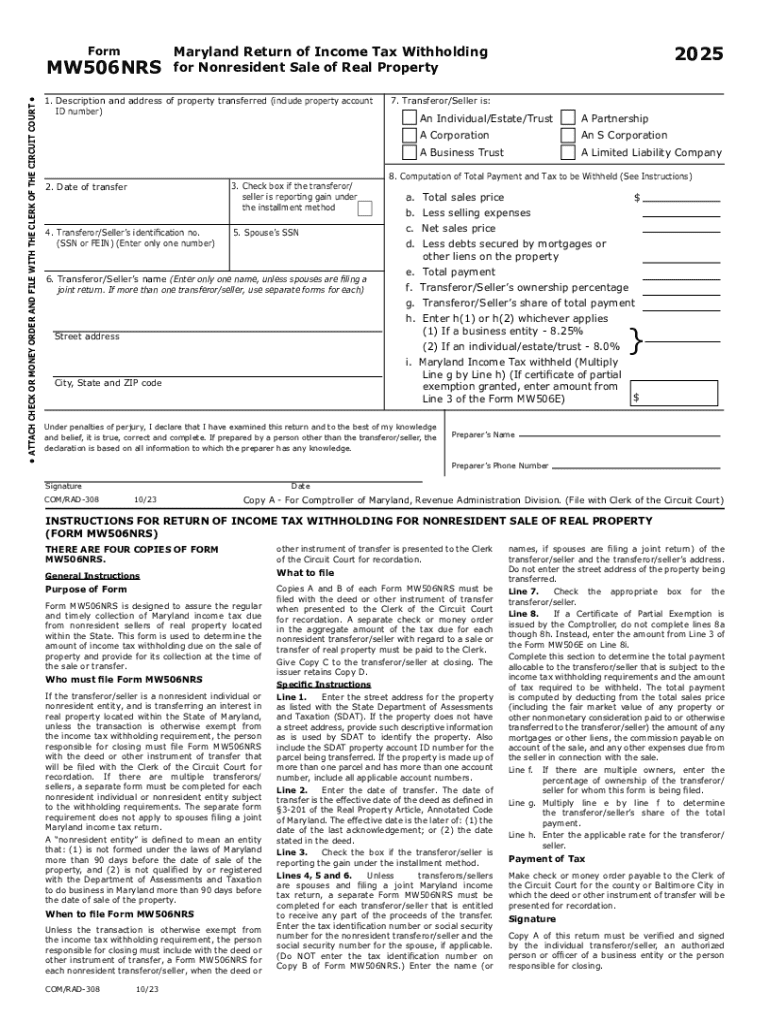

The Maryland Form MW506NRS is a tax document specifically designed for nonresidents who sell real property in Maryland. This form serves as the Maryland Return of Income Tax Withholding for Nonresident Sale of Real Property. It is essential for ensuring that the appropriate amount of state income tax is withheld from the proceeds of the sale. Nonresidents are required to file this form to report the sale and remit any withholding tax to the state, thus fulfilling their tax obligations under Maryland law.

How to use the Form MW506NRS Maryland Return Of Income Tax Withholding For Nonresident Sale Of Real Property

Using the Form MW506NRS involves several key steps. First, gather all necessary information regarding the property sale, including the sale price and any associated costs. Next, complete the form by providing your personal information, details about the property, and the calculation of the withholding tax. Once the form is filled out, it must be submitted to the Maryland Comptroller's office, either electronically or by mail, depending on your preference. It is crucial to ensure that the form is submitted accurately and on time to avoid any penalties.

Steps to complete the Form MW506NRS Maryland Return Of Income Tax Withholding For Nonresident Sale Of Real Property

Completing the Form MW506NRS requires attention to detail. Follow these steps:

- Obtain the form from the Maryland Comptroller's website or other authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the real property, such as its location and sale price.

- Calculate the withholding tax based on the sale price and applicable rates.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the appropriate state office.

Key elements of the Form MW506NRS Maryland Return Of Income Tax Withholding For Nonresident Sale Of Real Property

Several key elements must be included in the Form MW506NRS to ensure compliance. These elements include:

- Personal Information: Complete details of the nonresident seller, including identification numbers.

- Property Details: Information about the real property being sold, including its address and sale price.

- Withholding Calculation: A clear calculation of the withholding tax based on the sale price.

- Signature: The seller's signature is required to validate the information provided.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form MW506NRS. Typically, the form must be submitted within a specific timeframe following the sale of the property. Nonresidents should consult the Maryland Comptroller's office for the exact dates and ensure timely submission to avoid penalties. Keeping track of these important dates can help facilitate a smooth filing process and ensure compliance with state tax regulations.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form MW506NRS can result in significant penalties. Failing to file the form on time, providing inaccurate information, or not remitting the required withholding tax can lead to fines and interest charges. It is essential for nonresidents to understand the implications of non-compliance and take the necessary steps to fulfill their tax obligations. Consulting with a tax professional may provide additional guidance to avoid potential penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mw506nrs maryland return of income tax withholding for nonresident sale of real property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland form MW506NRS?

The Maryland form MW506NRS is a tax form used for reporting non-resident withholding on income earned in Maryland. It is essential for businesses and individuals who need to comply with Maryland tax regulations. Understanding this form is crucial for accurate tax reporting and avoiding penalties.

-

How can airSlate SignNow help with the Maryland form MW506NRS?

airSlate SignNow simplifies the process of completing and eSigning the Maryland form MW506NRS. With our platform, you can easily fill out the form, add signatures, and send it securely to the relevant parties. This streamlines your tax reporting process and ensures compliance with Maryland regulations.

-

Is there a cost associated with using airSlate SignNow for the Maryland form MW506NRS?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that make handling the Maryland form MW506NRS easier. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for managing the Maryland form MW506NRS?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Maryland form MW506NRS. These tools enhance your workflow, making it easier to manage tax documents efficiently. Additionally, our platform ensures that your documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other software for the Maryland form MW506NRS?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Maryland form MW506NRS. Whether you use accounting software or CRM systems, our integrations help you manage your documents seamlessly across platforms.

-

What are the benefits of using airSlate SignNow for the Maryland form MW506NRS?

Using airSlate SignNow for the Maryland form MW506NRS provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform reduces the risk of errors in tax reporting and ensures that your documents are signed and submitted on time. This efficiency can lead to better compliance and peace of mind.

-

Is airSlate SignNow user-friendly for completing the Maryland form MW506NRS?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Maryland form MW506NRS. Our intuitive interface guides you through the process, ensuring that you can fill out and eSign your documents without any hassle. You don’t need to be tech-savvy to use our platform effectively.

Get more for Form MW506NRS Maryland Return Of Income Tax Withholding For Nonresident Sale Of Real Property

- Warning if you lock the document and then complete the fields and then form

- I n st r u ct ion s th is w or k she e t is de sign e d t o be u se d by pe r son s con t e m pla t in g a divor ce form

- Pennsylvania deed formsquit claim warranty and special

- Grantor does hereby remise release and forever quitclaim and by these presents do remise release form

- Warranty deed south carolina bar form

- Sample llc operating agreement everything you need to know form

- Executory contracts in texas real estate lone star land law form

- Correction deed 481372329 form

Find out other Form MW506NRS Maryland Return Of Income Tax Withholding For Nonresident Sale Of Real Property

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now