Business Personal Property Rendition of Taxable Property Form

What is the Business Personal Property Rendition of Taxable Property

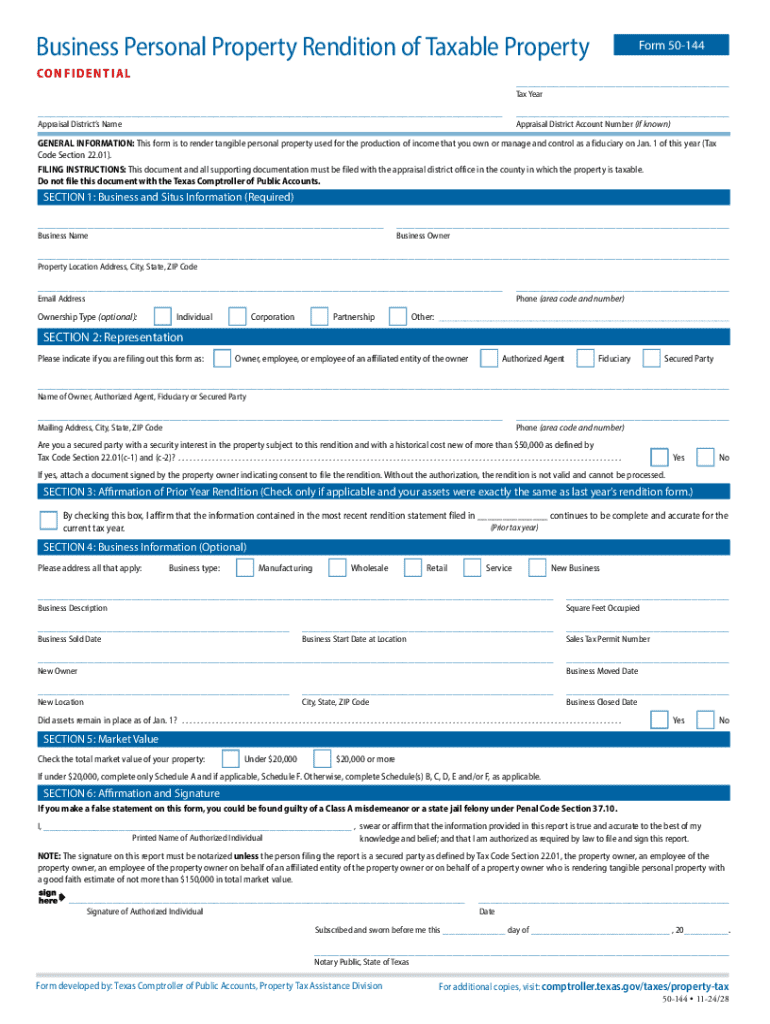

The Business Personal Property Rendition of Taxable Property, commonly referred to as form 50-144, is a document used by businesses in Texas to report personal property to the local appraisal district. This form is essential for ensuring that businesses comply with state tax laws, as it provides the necessary information for the assessment of property taxes. The form typically includes details about the type of personal property owned, its estimated value, and the location of the property. Accurate reporting is crucial as it affects the tax liability of the business.

Steps to Complete the Business Personal Property Rendition of Taxable Property

Completing the form 50-144 involves several key steps:

- Gather necessary information about your business's personal property, including equipment, furniture, and inventory.

- Determine the fair market value of each item. This can be based on purchase price, depreciation, or market comparisons.

- Fill out the form accurately, ensuring all sections are completed, including the identification of the property and its location.

- Review the form for any errors or omissions before submission.

- Submit the form to your local appraisal district by the specified deadline.

Legal Use of the Business Personal Property Rendition of Taxable Property

The legal use of form 50-144 is governed by Texas property tax laws. Businesses are required to file this form annually to report their personal property to local appraisal districts. Failure to file can result in penalties, including the potential for the appraisal district to estimate the value of the property, which may not reflect its actual worth. Understanding the legal obligations surrounding this form is essential for compliance and to avoid unnecessary tax liabilities.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines for form 50-144. Typically, the form must be submitted by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses should keep track of these dates to ensure timely submission and avoid penalties. Additionally, some appraisal districts may have specific rules regarding extensions, so it is advisable to check with local authorities.

Required Documents

When completing form 50-144, businesses may need to provide supporting documents to substantiate the information reported. Required documents can include:

- Purchase invoices for personal property

- Depreciation schedules

- Previous tax returns related to personal property

- Any other documentation that verifies the value and existence of the reported property

Having these documents ready can facilitate a smoother filing process and help ensure compliance with local tax regulations.

Who Issues the Form

Form 50-144 is issued by the Texas Comptroller of Public Accounts. This state agency is responsible for overseeing property tax assessments and ensuring that businesses comply with state tax laws. Local appraisal districts also play a role in the administration of the form, as they are the entities that receive and process the submissions. It is important for businesses to understand the roles of both the state and local authorities in relation to this form.

Handy tips for filling out Business Personal Property Rendition Of Taxable Property online

Quick steps to complete and e-sign Business Personal Property Rendition Of Taxable Property online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for maximum efficiency. Use signNow to electronically sign and send out Business Personal Property Rendition Of Taxable Property for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business personal property rendition of taxable property 771935692

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 50 144 and how can airSlate SignNow help?

Form 50 144 is a document used for specific regulatory purposes. airSlate SignNow simplifies the process of filling out and eSigning form 50 144, ensuring compliance and efficiency. With our platform, you can easily manage and send this form securely.

-

How much does it cost to use airSlate SignNow for form 50 144?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage form 50 144 effectively. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing form 50 144?

Our platform provides a range of features for managing form 50 144, including customizable templates, secure eSigning, and real-time tracking. These features streamline the process, making it easier to handle important documents efficiently.

-

Can I integrate airSlate SignNow with other applications for form 50 144?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for form 50 144. You can connect with tools like Google Drive, Salesforce, and more to ensure a smooth document management experience.

-

What are the benefits of using airSlate SignNow for form 50 144?

Using airSlate SignNow for form 50 144 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are handled with care and compliance, saving you time and resources.

-

Is airSlate SignNow secure for handling sensitive form 50 144 documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your form 50 144 documents. You can trust our platform to keep your sensitive information safe and secure.

-

How can I get started with airSlate SignNow for form 50 144?

Getting started with airSlate SignNow for form 50 144 is easy. Simply sign up for an account, choose a pricing plan, and start creating or uploading your documents. Our user-friendly interface will guide you through the process.

Get more for Business Personal Property Rendition Of Taxable Property

- Guide to becoming a guardian without a lawyer cuny school of form

- Come now form

- Rule 10 counterclaims cross claims and third party claims form

- Come now plaintiffs form

- Mississippi lis pendens formsdeedscom

- Filing a complaint mississippi commission on judicial performance

- This action came on for hearing on the motion of the plaintiff for a default judgment form

- In the circuit court of mississippi state of mississippi v case no form

Find out other Business Personal Property Rendition Of Taxable Property

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple