TRS Form 1099 R

What is the TRS Form 1099 R

The TRS Form 1099 R is a tax document used in the United States to report distributions from retirement plans, including pensions and annuities. Specifically issued by the Teacher Retirement System of Texas (TRS), this form details the amount of money distributed to retirees and beneficiaries during the tax year. It is essential for individuals receiving retirement benefits to understand this form, as it plays a crucial role in accurately reporting income to the Internal Revenue Service (IRS).

How to obtain the TRS Form 1099 R

To obtain the TRS Form 1099 R, retirees and beneficiaries can access it through the Teacher Retirement System of Texas website. Typically, the form is made available online in January each year for the previous tax year. Individuals may also receive a physical copy by mail if they have opted for that delivery method. It is important to ensure that your contact information is up to date with TRS to receive the form promptly.

Steps to complete the TRS Form 1099 R

Completing the TRS Form 1099 R involves a few key steps:

- Review the form for accuracy, ensuring that your personal information, such as name and Social Security number, is correct.

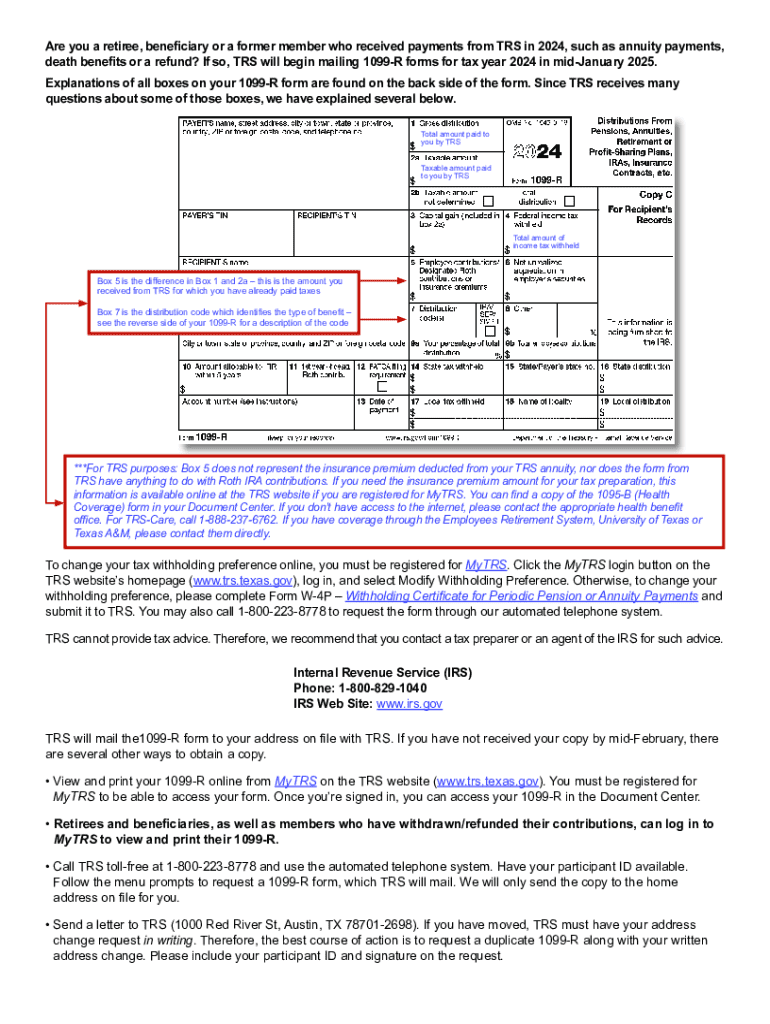

- Identify the total distribution amount reported in Box 1, which reflects the gross distribution you received.

- Check Box 2a to determine the taxable amount of your distribution.

- Note any federal income tax withheld, which is reported in Box 4, as this may affect your overall tax liability.

- Consult IRS guidelines or a tax professional if you have questions about how to report this information on your tax return.

Key elements of the TRS Form 1099 R

The TRS Form 1099 R includes several important elements that recipients need to understand:

- Box 1: Total distribution amount.

- Box 2a: Taxable amount of the distribution.

- Box 4: Amount of federal income tax withheld.

- Box 7: Distribution code, which indicates the type of distribution received.

- Recipient's information: Personal details including name, address, and Social Security number.

Legal use of the TRS Form 1099 R

The TRS Form 1099 R is legally required for reporting retirement distributions to the IRS. Recipients must use this form to accurately report their income when filing their federal tax returns. Failure to report the income or discrepancies in the form can lead to penalties or audits by the IRS. It is crucial for recipients to retain this form for their records and to ensure compliance with tax regulations.

Filing Deadlines / Important Dates

For individuals receiving the TRS Form 1099 R, it is important to be aware of key filing deadlines. The IRS typically requires that tax returns be filed by April 15 of each year. However, if you receive this form, you should ensure that you have all necessary documents well in advance of this date to avoid last-minute issues. Additionally, if you need to amend your return due to errors on the 1099 R, be mindful of the deadlines for corrections to avoid penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trs form 1099 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TRS 1099 R form?

The TRS 1099 R form is a tax document used to report distributions from retirement plans, including pensions and annuities. It is essential for individuals who have received retirement benefits to accurately report their income during tax season. Understanding the TRS 1099 R form can help ensure compliance with tax regulations.

-

How can airSlate SignNow help with TRS 1099 R forms?

airSlate SignNow provides a seamless solution for electronically signing and sending TRS 1099 R forms. With its user-friendly interface, you can easily prepare and distribute these important tax documents to recipients. This not only saves time but also enhances the security and efficiency of your document management process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to essential features for managing documents, including TRS 1099 R forms. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with numerous applications, making it easier to manage your TRS 1099 R forms alongside other business tools. Popular integrations include CRM systems, cloud storage services, and productivity apps. These integrations streamline your workflow and enhance overall efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which are beneficial for managing TRS 1099 R forms. The platform allows you to create, edit, and send documents effortlessly. Additionally, you can monitor the status of your documents to ensure timely completion.

-

Is airSlate SignNow secure for handling sensitive documents like TRS 1099 R forms?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your TRS 1099 R forms and other sensitive documents are protected. The platform employs advanced encryption and authentication measures to safeguard your data. You can trust airSlate SignNow to handle your important documents securely.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage your TRS 1099 R forms on the go. The mobile app provides access to all essential features, enabling you to sign and send documents from anywhere. This flexibility enhances productivity and convenience for busy professionals.

Get more for TRS Form 1099 R

- Reg 1 form indiana

- Application for tax deduction for disabled veterans form

- Indiana state form 12662

- Kansas department of revenue webfile kansasgov form

- Kansas business form cr 108

- Compensating tax exemption certificate letter pr 74 compensating tax exemption certificate letter pr 74 form

- Form 92a300 9 13

- Kentucky form 740 ez kentucky simple individual income

Find out other TRS Form 1099 R

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed