It 40PNR Form

What is the IT 40PNR

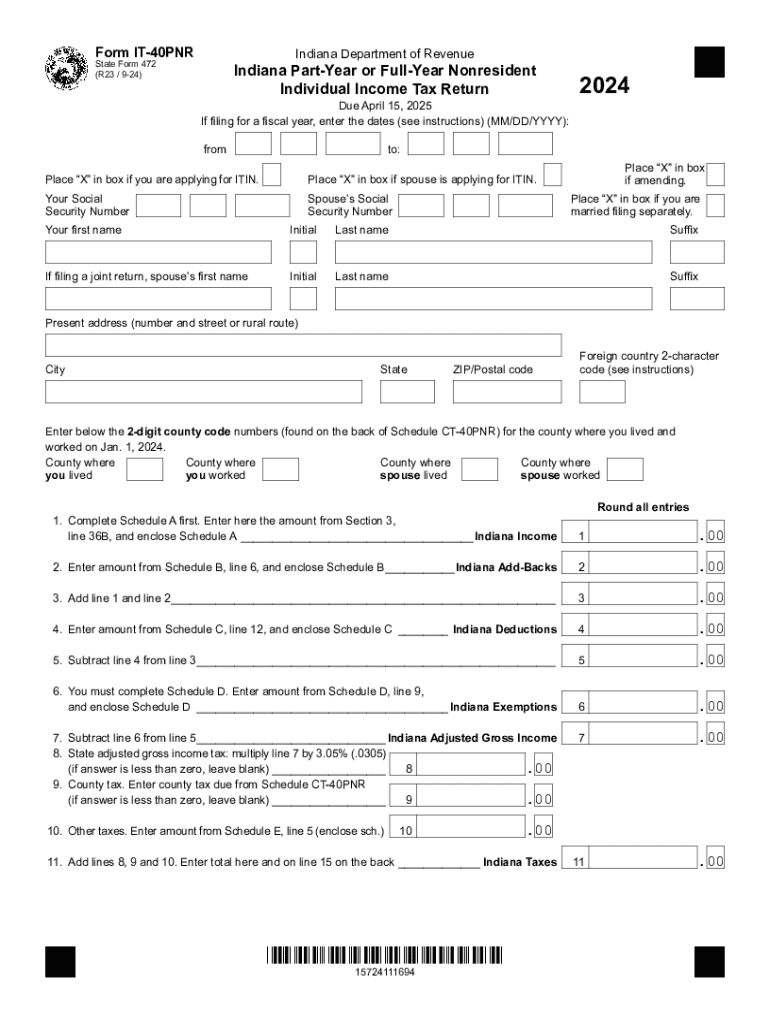

The IT 40PNR is a specific tax form used in the United States, primarily for reporting income and tax obligations for residents of Indiana. It is part of the Indiana Department of Revenue's suite of tax forms. This form is specifically designed for individuals who have income that is subject to Indiana state tax, and it helps ensure compliance with state tax laws. Understanding the purpose and requirements of the IT 40PNR is essential for accurate tax reporting and avoiding penalties.

How to use the IT 40PNR

Using the IT 40PNR involves several steps to ensure that all required information is accurately reported. Taxpayers must first gather all necessary financial documents, including W-2 forms, 1099 forms, and any other relevant income statements. Once the documents are collected, individuals can fill out the IT 40PNR by entering their personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid mistakes that could lead to delays or penalties.

Steps to complete the IT 40PNR

Completing the IT 40PNR requires a systematic approach:

- Gather all necessary documents, including income statements and deduction records.

- Fill in personal information, such as name, address, and Social Security number.

- Report total income from all sources accurately.

- Apply any eligible deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due.

- Review the completed form for accuracy before submission.

Legal use of the IT 40PNR

The IT 40PNR must be used in accordance with Indiana state tax laws. It is legally required for residents who earn income within the state to file this form annually. Failing to use the form as mandated can result in penalties, including fines and interest on unpaid taxes. It is crucial for taxpayers to understand their legal obligations regarding the IT 40PNR to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the IT 40PNR to ensure timely filing. Typically, the deadline for submitting the IT 40PNR is April 15 of each year, aligning with federal tax deadlines. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check for any updates or changes in deadlines from the Indiana Department of Revenue.

Required Documents

When preparing to file the IT 40PNR, certain documents are essential:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Records of any deductions or credits claimed.

- Previous year’s tax return for reference.

Having these documents ready will streamline the process and help ensure accurate reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 40pnr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it40pnr and how does it relate to airSlate SignNow?

The it40pnr is a unique identifier for our airSlate SignNow service, which empowers businesses to send and eSign documents efficiently. By using it40pnr, you can access specific features and benefits tailored to enhance your document management experience.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit various business needs. With the it40pnr, you can explore our competitive pricing tiers that provide cost-effective solutions for eSigning and document management.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features such as document templates, real-time tracking, and secure eSigning. Utilizing the it40pnr, you can unlock advanced functionalities that streamline your workflow and improve productivity.

-

How can airSlate SignNow benefit my business?

By implementing airSlate SignNow, businesses can signNowly reduce turnaround times for document signing. The it40pnr ensures that you leverage our platform's benefits, including enhanced security and compliance, which are crucial for modern businesses.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow is designed for seamless integration with various applications and platforms. With the it40pnr, you can easily connect to your existing tools, enhancing your overall document management process.

-

What security measures does airSlate SignNow have in place?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. The it40pnr ensures that your sensitive information is protected while using our eSigning solutions.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to send and eSign documents on the go. The it40pnr provides access to our mobile features, ensuring you can manage your documents anytime, anywhere.

Get more for IT 40PNR

- Tn mnpd form 720 davidson county

- Au sa457 form

- Cmo calificar para la cobertura mdica de medicaid y chip form

- Uslegal guide to form

- Checklist documents to show your divorce attorney family law form

- Instruction this is a model letter form

- You have turned 65 you are medicare eligible now what form

- Formulario it 40 state forms online catalog

Find out other IT 40PNR

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation