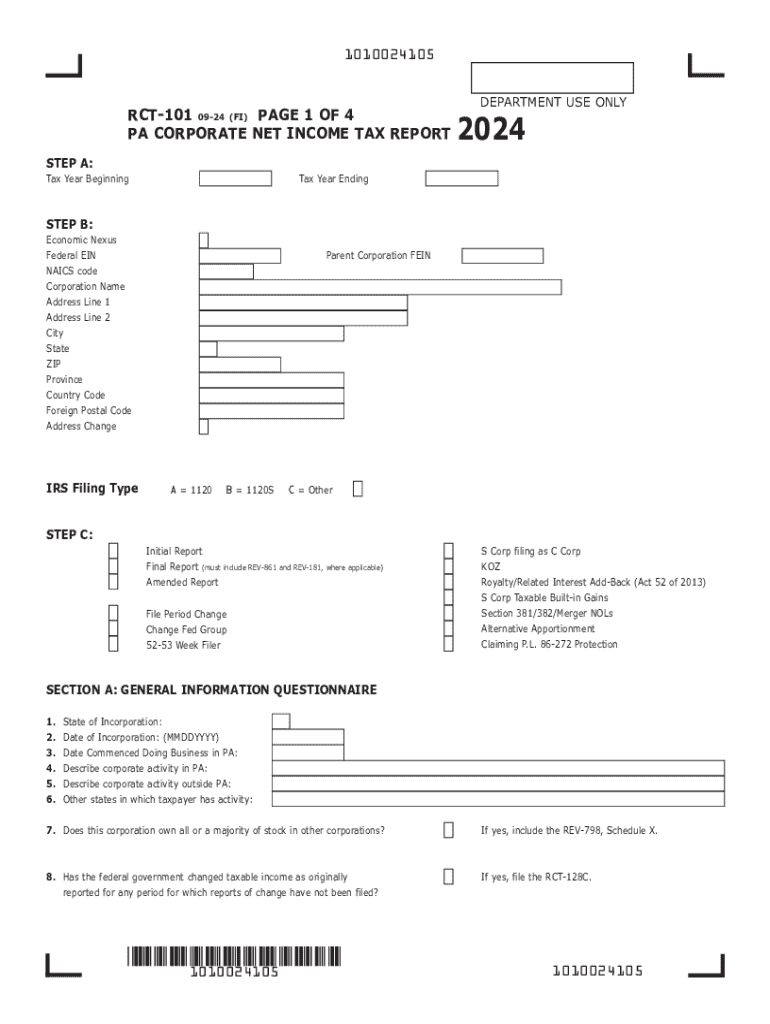

PA Corporate Net Income Tax Report RCT 101 Form

What is the PA Corporate Net Income Tax Report RCT 101

The PA Corporate Net Income Tax Report RCT 101 is a tax form used by corporations operating in Pennsylvania to report their income and calculate their corporate net income tax liability. This form is essential for all corporations, including limited liability companies (LLCs) taxed as corporations, that conduct business in Pennsylvania. The RCT 101 provides the Pennsylvania Department of Revenue with necessary financial information to assess the tax owed based on the corporation's taxable income.

Steps to complete the PA Corporate Net Income Tax Report RCT 101

Completing the RCT 101 involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, balance sheets, and expense records for the tax year.

- Calculate Taxable Income: Determine the corporation's taxable income by adjusting gross income for allowable deductions and credits.

- Fill Out the Form: Accurately complete each section of the RCT 101, ensuring all figures are correct and supported by documentation.

- Review and Sign: Double-check all entries for accuracy, then sign the form to certify its correctness.

- Submit the Form: File the completed RCT 101 with the Pennsylvania Department of Revenue by the designated deadline.

Key elements of the PA Corporate Net Income Tax Report RCT 101

The RCT 101 includes several critical components that taxpayers must complete:

- Identification Information: Basic details about the corporation, including name, address, and federal employer identification number (EIN).

- Income Section: A summary of the corporation's total income, including gross receipts and other income sources.

- Deductions: A detailed account of allowable deductions that reduce taxable income, such as operating expenses and depreciation.

- Tax Calculation: The calculation of the corporate net income tax based on the taxable income reported.

- Signature Section: Required signatures from authorized representatives of the corporation affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the RCT 101. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. It is crucial to file on time to avoid penalties and interest on any taxes owed.

Required Documents

To complete the RCT 101, corporations need to gather several documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for all deductions claimed, such as receipts and invoices.

- Previous year's tax returns for reference and consistency.

Form Submission Methods

The RCT 101 can be submitted to the Pennsylvania Department of Revenue through various methods:

- Online: Corporations can file electronically using the Pennsylvania Department of Revenue's online portal.

- Mail: Completed forms can be sent via postal mail to the appropriate address provided by the Department of Revenue.

- In-Person: Corporations may also deliver the form in person at designated Department of Revenue offices.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa corporate net income tax report rct 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 pa rct 101 and how does it work?

The 2024 pa rct 101 is a comprehensive guide designed to help businesses understand the latest regulations and requirements for electronic signatures. It outlines the steps necessary to ensure compliance while using airSlate SignNow for document management. By following the 2024 pa rct 101, users can streamline their processes and enhance their operational efficiency.

-

How much does airSlate SignNow cost in relation to the 2024 pa rct 101?

Pricing for airSlate SignNow is competitive and designed to fit various business needs. The cost may vary based on the features you choose, but it remains an affordable solution for those looking to comply with the 2024 pa rct 101. Investing in airSlate SignNow can save your business time and money while ensuring compliance.

-

What features does airSlate SignNow offer to support the 2024 pa rct 101?

airSlate SignNow offers a range of features that align with the 2024 pa rct 101, including secure eSigning, document templates, and real-time tracking. These features help businesses manage their documents efficiently while adhering to the latest regulations. By utilizing these tools, companies can ensure they meet the requirements set forth in the 2024 pa rct 101.

-

How can airSlate SignNow benefit my business in light of the 2024 pa rct 101?

Using airSlate SignNow can signNowly benefit your business by simplifying the eSigning process and ensuring compliance with the 2024 pa rct 101. This platform enhances productivity by reducing the time spent on document management. Additionally, it helps mitigate risks associated with non-compliance, providing peace of mind for your operations.

-

Does airSlate SignNow integrate with other tools to comply with the 2024 pa rct 101?

Yes, airSlate SignNow offers seamless integrations with various business tools and applications, making it easier to comply with the 2024 pa rct 101. These integrations allow for a more streamlined workflow, enabling users to manage documents across different platforms. This flexibility ensures that your business can maintain compliance while using the tools you already rely on.

-

Is airSlate SignNow secure for handling documents related to the 2024 pa rct 101?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling documents related to the 2024 pa rct 101. The platform employs advanced encryption and security protocols to protect sensitive information. This commitment to security ensures that your documents remain confidential and compliant with industry standards.

-

Can I customize my documents in airSlate SignNow to meet the 2024 pa rct 101 requirements?

Yes, airSlate SignNow allows users to customize documents to meet the specific requirements of the 2024 pa rct 101. You can create templates that include necessary fields and compliance statements. This customization ensures that your documents are not only compliant but also tailored to your business needs.

Get more for PA Corporate Net Income Tax Report RCT 101

- Request for admission of form

- Litigation interrogatories form

- Production of documents form

- Notice is hereby given that the notice of lis pendens recorded in the below named county at the form

- Application with affidavit form

- Florida bar newsamendments to the family law formsthe

- Forcible entry and detainer form

- Complaint for civil action form

Find out other PA Corporate Net Income Tax Report RCT 101

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now