Ca Rejection Latest Form

Understanding the de 174 Form

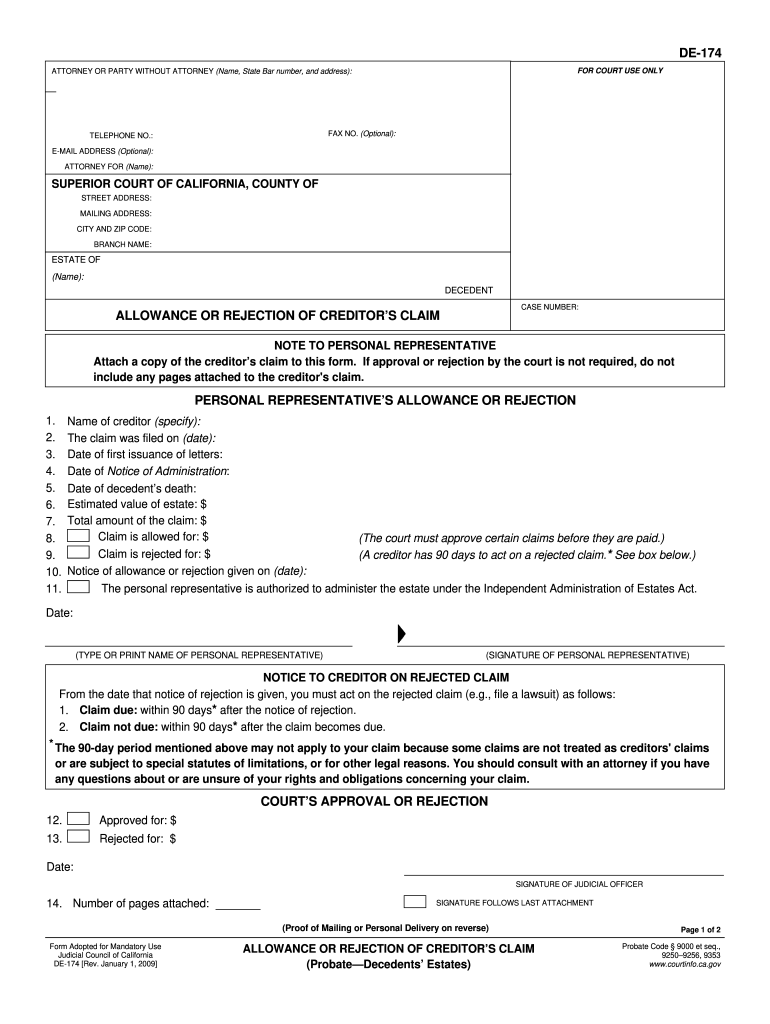

The de 174 form, also known as the California Rejection Creditor Claim, is a crucial document used in the context of bankruptcy proceedings. It allows creditors to formally reject a claim made against them. Understanding the legal implications and requirements of this form is essential for both creditors and debtors involved in the process.

Steps to Complete the de 174 Form

Completing the de 174 form requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary information, including the debtor's details and the nature of the claim.

- Fill out the form with accurate and complete information, ensuring all required fields are addressed.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form to validate it.

- Submit the completed form as per the guidelines provided by the court or relevant authority.

Legal Use of the de 174 Form

The de 174 form must be used in compliance with specific legal standards to ensure its validity. It is important to understand that a properly executed form can serve as a legally binding document. The form should be completed in accordance with the laws governing bankruptcy in California, including adherence to deadlines and submission protocols.

Required Documents for the de 174 Form

When preparing to submit the de 174 form, certain documents may be required to support the claim. These can include:

- Proof of the original claim against the debtor.

- Any correspondence related to the claim.

- Documentation that verifies the creditor's identity and standing.

Form Submission Methods

The de 174 form can be submitted through various methods, depending on the requirements set by the court. Common submission methods include:

- Online submission through the court's electronic filing system.

- Mailing the completed form to the appropriate court address.

- In-person submission at the court clerk's office.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the de 174 form can lead to significant consequences. These may include:

- Rejection of the claim, which could affect the creditor's ability to recover debts.

- Legal penalties or sanctions imposed by the court.

- Increased costs associated with re-filing or correcting the submission.

Quick guide on how to complete ca rejection latest

Complete Ca Rejection Latest effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Ca Rejection Latest on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centered procedure today.

How to modify and eSign Ca Rejection Latest without hassle

- Obtain Ca Rejection Latest and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Ca Rejection Latest and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca rejection latest

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is de174 and how does airSlate SignNow utilize it?

De174 is a powerful tool integrated into airSlate SignNow that enables users to manage document signing and workflows efficiently. By leveraging de174, businesses can streamline their document processes, ensuring quick and secure eSigning. This allows teams to save time and enhance productivity with a simple, user-friendly interface.

-

What are the pricing options for airSlate SignNow with de174?

AirSlate SignNow offers competitive pricing plans including options that incorporate the features of de174. You can choose from various subscription levels based on your business needs, ensuring you only pay for what you use. Additionally, a free trial is available to explore de174's functionalities before committing.

-

What features does de174 offer in airSlate SignNow?

De174 adds robust features to airSlate SignNow, including customizable templates, real-time tracking of document status, and secure multi-signature capabilities. These features help streamline workflows while maintaining compliance and security for sensitive documents. With de174, you can efficiently manage all your signing needs from one platform.

-

How does airSlate SignNow with de174 benefit my business?

Using airSlate SignNow with de174 provides businesses with a cost-effective solution for document management and eSigning. The automation features reduce manual tasks, allowing employees to focus on more critical work. This increases overall productivity and enhances turnaround times for important documents.

-

Can I integrate airSlate SignNow with other tools using de174?

Yes, airSlate SignNow, powered by de174, offers seamless integration with a variety of applications such as CRM systems, email services, and more. This allows businesses to maintain a cohesive workflow while utilizing the strengths of different software. Integration options enhance the usability of de174 within your existing processes.

-

Is airSlate SignNow secure when using de174?

Absolutely, airSlate SignNow prioritizes security and compliance, especially when utilizing de174. The platform employs advanced encryption and authentication methods to protect your documents and data. You can trust that sensitive information remains confidential and secure throughout the signing process.

-

What industries benefit from airSlate SignNow's de174?

Various industries can benefit from airSlate SignNow's de174, including real estate, finance, healthcare, and legal sectors. These industries often require fast, reliable, and secure document signing solutions, which de174 provides effectively. By adopting airSlate SignNow, companies in these sectors can improve efficiency and meet compliance requirements.

Get more for Ca Rejection Latest

- Cyberdrive illinois rdp form

- Flis licapp 001 affidavit form

- Viora reaction consent facial techniques form

- Michigan statement victims impact form

- Atto di pubblicazione di matrimonio 09 2 pdf comune di comune salandra mt form

- Pos 050 form

- Pit cfr form

- Jv 260 notice of court hearing and temporary restraining order against a child judicial council forms

Find out other Ca Rejection Latest

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word