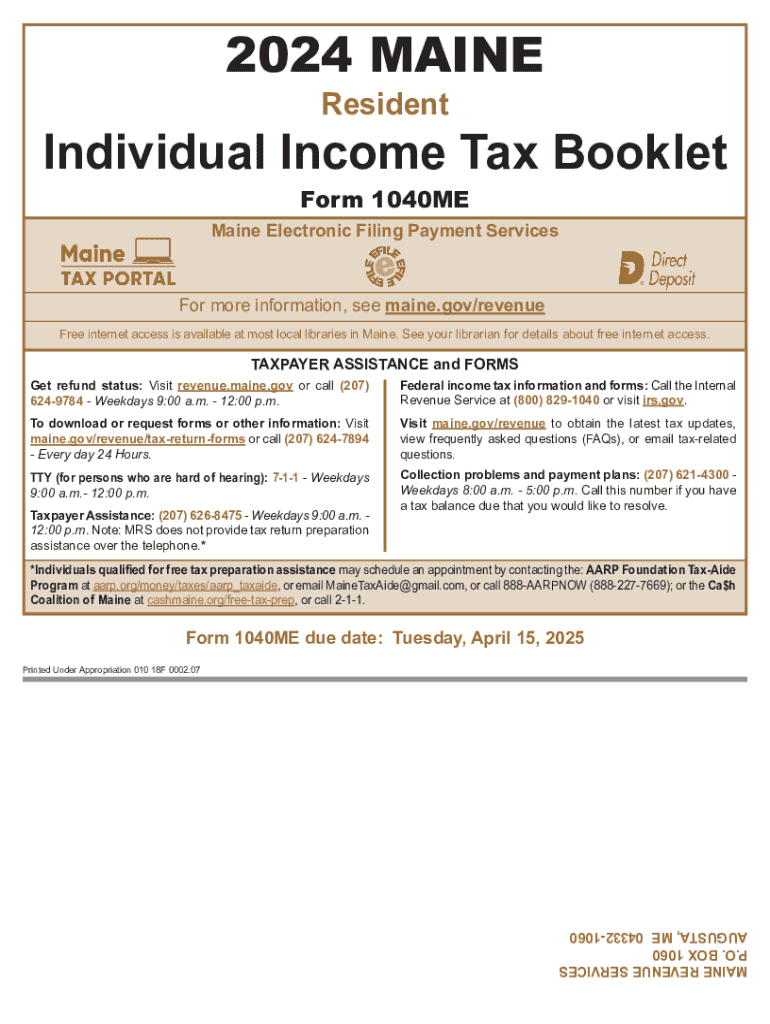

MAINE Resident Individual Income Tax Booklet Form

What is the Maine Individual Income Tax Booklet

The Maine Individual Income Tax Booklet is a comprehensive guide provided by the State of Maine for residents to understand and complete their individual income tax returns. This booklet includes essential information about tax rates, deductions, and credits available to taxpayers. It serves as a valuable resource for individuals preparing their Maine income tax returns, ensuring compliance with state tax laws.

How to Use the Maine Individual Income Tax Booklet

To effectively use the Maine Individual Income Tax Booklet, taxpayers should first read through the entire document to familiarize themselves with its contents. The booklet outlines the necessary forms, instructions for filling them out, and information about various tax credits and deductions. It is crucial to follow the guidelines provided to ensure accurate reporting of income and expenses, which can help maximize potential refunds or minimize tax liabilities.

Steps to Complete the Maine Individual Income Tax Booklet

Completing the Maine Individual Income Tax Booklet involves several steps:

- Gather all necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Review the instructions in the booklet to understand the specific requirements for your tax situation.

- Fill out the appropriate forms, ensuring all information is accurate and complete.

- Calculate your tax liability using the provided tables and worksheets.

- Double-check your calculations and ensure all required signatures are included.

- Submit your completed forms by the specified deadline.

How to Obtain the Maine Individual Income Tax Booklet

The Maine Individual Income Tax Booklet can be obtained through various methods. Taxpayers can download the booklet online from the Maine Revenue Services website. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to obtain the most current version of the booklet, especially for the 2024 tax year, to ensure compliance with any changes in tax laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of key filing deadlines to avoid penalties. For most individuals, the deadline to file the Maine Individual Income Tax return is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to check for any updates or changes in deadlines each tax year to ensure timely submission of tax returns.

Required Documents

When preparing to complete the Maine Individual Income Tax Booklet, taxpayers need to gather several important documents, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Previous year’s tax return for reference

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine resident individual income tax booklet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine individual income tax booklet?

The Maine individual income tax booklet is a comprehensive guide that provides taxpayers with the necessary forms and instructions to file their state income taxes. It includes information on deductions, credits, and filing requirements specific to Maine residents.

-

How can I obtain the Maine individual income tax booklet?

You can obtain the Maine individual income tax booklet online through the Maine Revenue Services website or by visiting local tax offices. Additionally, airSlate SignNow offers features that allow you to easily access and eSign tax documents, including the Maine individual income tax booklet.

-

Is there a cost associated with the Maine individual income tax booklet?

The Maine individual income tax booklet is typically provided free of charge by the state. However, if you choose to use services like airSlate SignNow for eSigning and managing your tax documents, there may be associated fees for those services.

-

What features does airSlate SignNow offer for handling the Maine individual income tax booklet?

airSlate SignNow offers a user-friendly platform that allows you to upload, eSign, and share the Maine individual income tax booklet securely. Its features include templates, automated workflows, and integration with various applications to streamline your tax filing process.

-

Can I integrate airSlate SignNow with other tax software for the Maine individual income tax booklet?

Yes, airSlate SignNow can be integrated with various tax software solutions, making it easier to manage the Maine individual income tax booklet alongside your other tax documents. This integration helps ensure a seamless workflow and enhances your overall tax filing experience.

-

What are the benefits of using airSlate SignNow for the Maine individual income tax booklet?

Using airSlate SignNow for the Maine individual income tax booklet offers several benefits, including time savings, enhanced security, and the ability to track document status. The platform simplifies the eSigning process, allowing you to complete your tax filings quickly and efficiently.

-

How does airSlate SignNow ensure the security of my Maine individual income tax booklet?

airSlate SignNow prioritizes the security of your documents, including the Maine individual income tax booklet, by employing advanced encryption and secure cloud storage. This ensures that your sensitive tax information remains protected throughout the eSigning process.

Get more for MAINE Resident Individual Income Tax Booklet

- Notice to landlord sexual harassment form

- I will expect my security deposit to be refunded in form

- However i wish to form

- Security deposit and landlords responsibilities form

- Practical guide for tenants and landlords form

- 12 13 11 0204 2064 22176 motion for new trial notice of form

- To advise you of the following breaches of your obligation to keep the premises clean and form

- Notice to tenant failure of tenant to dispose from dwelling unit all ashes rubbish form

Find out other MAINE Resident Individual Income Tax Booklet

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed