Instructions for Form 8949

What is the Instructions for Form 8949

The Instructions for Form 8949 provide detailed guidance on how to report capital gains and losses from the sale of capital assets, including stocks, bonds, and real estate. This form is essential for taxpayers who need to report transactions to the Internal Revenue Service (IRS) as part of their annual tax return. Understanding these instructions is crucial for accurately completing the form and ensuring compliance with tax regulations.

How to Use the Instructions for Form 8949

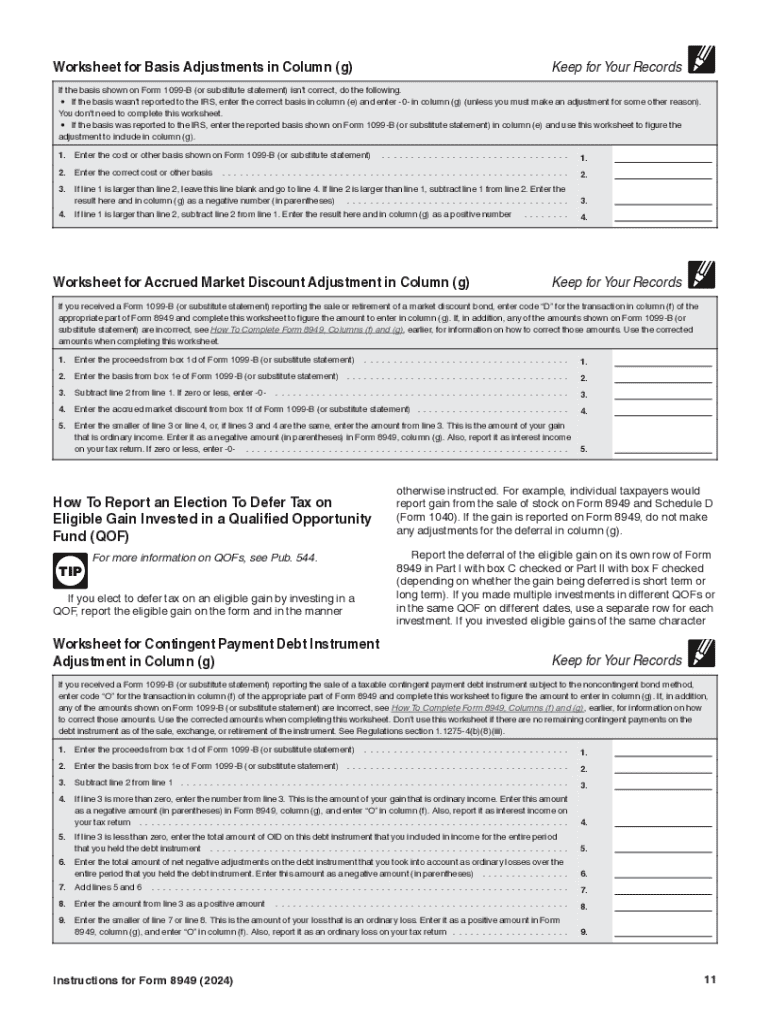

To effectively use the Instructions for Form 8949, begin by reviewing the specific sections that apply to your transactions. The instructions outline how to categorize your sales, whether they are short-term or long-term, and provide examples to clarify the reporting process. Pay close attention to the details regarding adjustments to gain or loss amounts, as these can significantly impact your tax liability.

Steps to Complete the Instructions for Form 8949

Completing the Instructions for Form 8949 involves several key steps:

- Gather all relevant documentation for your capital asset transactions, including purchase and sale records.

- Determine whether each transaction is short-term or long-term based on the holding period.

- Fill out the form by entering the details of each transaction, including date acquired, date sold, proceeds, and cost basis.

- Calculate your total gains and losses, making necessary adjustments as outlined in the instructions.

- Transfer the totals to Schedule D, which summarizes your capital gains and losses.

Key Elements of the Instructions for Form 8949

Key elements of the Instructions for Form 8949 include definitions of terms such as "proceeds," "cost basis," and "adjustments." The instructions also specify how to report transactions involving different asset types, such as stocks, bonds, and real estate. Additionally, they provide guidance on how to handle wash sales and other specific scenarios that may affect your reporting.

IRS Guidelines

The IRS guidelines for Form 8949 emphasize the importance of accurate reporting to avoid penalties. These guidelines include specific rules on how to report gains and losses, the importance of keeping thorough records, and deadlines for filing the form. Familiarizing yourself with these guidelines can help ensure that you meet all requirements and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 8949 generally align with the standard tax return deadlines. For most taxpayers, this means that the form must be filed by April 15 of the following year. If you require additional time, you may file for an extension, but it is important to understand that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8949

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8949 and why is it important?

Form 8949 is a tax form used to report sales and other dispositions of capital assets. It is crucial for accurately calculating capital gains and losses, which can signNowly impact your tax return. Understanding how to fill out form 8949 correctly can help you avoid penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with form 8949?

airSlate SignNow provides an efficient platform for electronically signing and sending form 8949. With its user-friendly interface, you can easily prepare and share this important tax document, ensuring that all signatures are collected promptly. This streamlines the process, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for form 8949?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that simplify the signing process for documents like form 8949. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for managing form 8949?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents like form 8949. These tools enhance your workflow by allowing you to manage and monitor the signing process effectively. Additionally, you can integrate with other applications to streamline your operations further.

-

Can I integrate airSlate SignNow with other software for form 8949?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage form 8949 alongside your other business tools. This connectivity ensures that your document workflows are seamless and that you can access all necessary information in one place.

-

What are the benefits of using airSlate SignNow for form 8949?

Using airSlate SignNow for form 8949 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick electronic signatures, which can save time during tax season. Additionally, your documents are stored securely, ensuring compliance and peace of mind.

-

How does airSlate SignNow ensure the security of form 8949?

airSlate SignNow prioritizes security by employing advanced encryption and secure data storage practices for documents like form 8949. This ensures that your sensitive information remains protected throughout the signing process. You can trust that your tax documents are handled with the utmost care and confidentiality.

Get more for Instructions For Form 8949

- Witness this agreement this day of 20 between form

- Trainers facility use agreement form

- Monthly rates or other charges are subject to alteration upon thirty 30 days notice to owner form

- Brood mare lease agreement andalusianworld form

- Business corporations faqs new york state department form

- Consumer loan first bank of newton form

- 1 state the full name of the defendant answering as well as your form

- Partnership agreement and operating agreement form

Find out other Instructions For Form 8949

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking