Instructions for Form 990 EZ

What is the Instructions for Form 990 EZ

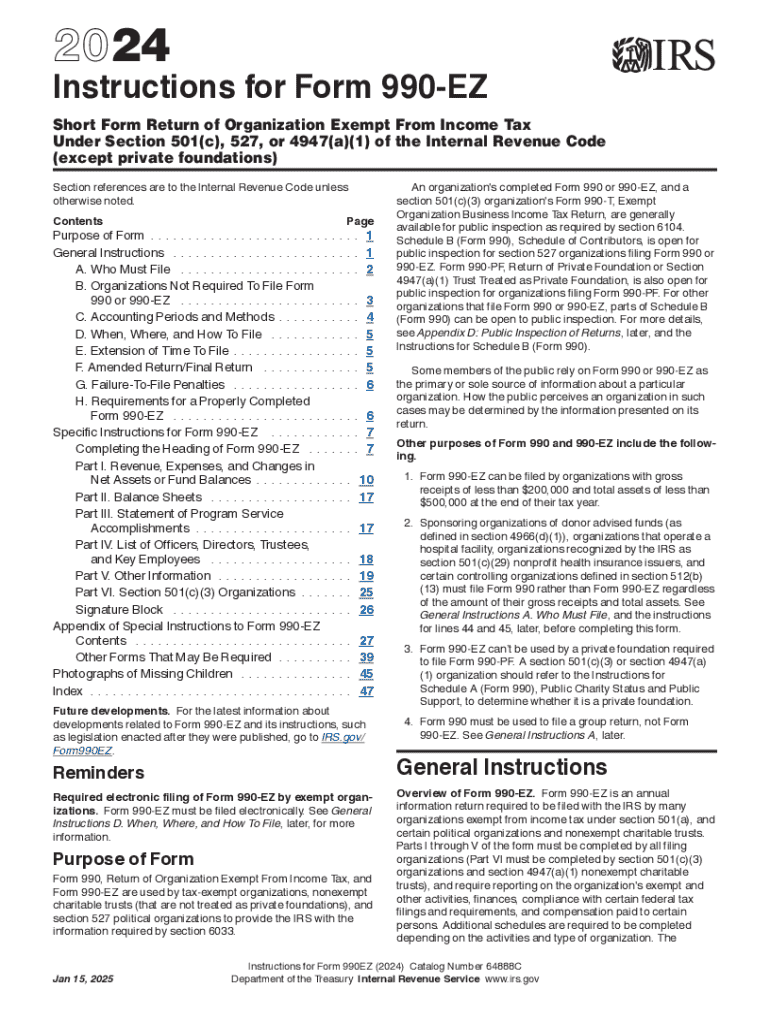

The instructions for Form 990 EZ provide guidance for organizations that are required to file this simplified version of the annual information return. Form 990 EZ is primarily designed for small tax-exempt organizations with gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. The instructions detail the specific information that must be reported, including financial data, governance practices, and compliance with tax laws. Understanding these instructions is crucial for ensuring accurate and timely filing, which helps maintain the organization’s tax-exempt status.

Steps to Complete the Instructions for Form 990 EZ

Completing the instructions for Form 990 EZ involves several key steps:

- Gather necessary financial information, including income, expenses, and asset details.

- Review the specific sections of the form, such as Part I, which covers revenue and expenses, and Part II, which addresses balance sheets.

- Ensure compliance with disclosure requirements, including information about the organization’s mission and activities.

- Double-check all calculations and ensure that all required fields are completed accurately.

- Prepare any additional schedules that may be required based on the organization’s activities.

Key Elements of the Instructions for Form 990 EZ

Several key elements are essential when reviewing the instructions for Form 990 EZ:

- Filing Requirements: Organizations must determine if they qualify to use Form 990 EZ based on their financial thresholds.

- Sections and Parts: The form is divided into various parts, each focusing on different aspects of the organization’s finances and operations.

- Compliance Information: The instructions outline necessary disclosures regarding governance and operational practices.

- Signature Requirement: The form must be signed by an authorized individual, affirming the accuracy of the submitted information.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with Form 990 EZ. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s accounting period. For most organizations operating on a calendar year, this means the form is due on May fifteenth. If this date falls on a weekend or holiday, the due date is extended to the next business day. Organizations may apply for an automatic extension, but they must submit Form 8868 to do so.

Form Submission Methods

Form 990 EZ can be submitted through various methods, depending on the organization’s preference and capabilities:

- Online Submission: Organizations can file electronically using the IRS e-file system, which is often faster and more efficient.

- Mail Submission: The form can also be printed and mailed to the appropriate IRS address, as specified in the instructions.

- In-Person Submission: While less common, some organizations may choose to deliver their forms directly to IRS offices.

Penalties for Non-Compliance

Failure to file Form 990 EZ on time or providing inaccurate information can result in penalties. The IRS imposes a penalty for late filings, which can accumulate daily until the form is submitted. Additionally, organizations that do not comply with the filing requirements risk losing their tax-exempt status. Maintaining accurate records and adhering to the filing deadlines is essential for avoiding these consequences and ensuring continued compliance with IRS regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 990 ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions for form 990 ez?

The instructions for form 990 ez provide detailed guidance on how to complete the form accurately. This includes information on eligibility, required schedules, and filing deadlines. Following these instructions ensures compliance with IRS regulations and helps avoid potential penalties.

-

How can airSlate SignNow assist with completing form 990 ez?

airSlate SignNow simplifies the process of completing form 990 ez by allowing users to fill out and eSign documents electronically. Our platform provides templates and easy-to-follow workflows that align with the instructions for form 990 ez. This streamlines the filing process and enhances accuracy.

-

What features does airSlate SignNow offer for form 990 ez?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing form 990 ez. These features help users adhere to the instructions for form 990 ez while ensuring that their documents are organized and accessible.

-

Is there a cost associated with using airSlate SignNow for form 990 ez?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that can assist with the instructions for form 990 ez, ensuring that you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for form 990 ez?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage form 990 ez. These integrations allow you to streamline your workflow and ensure that you are following the instructions for form 990 ez efficiently.

-

What are the benefits of using airSlate SignNow for form 990 ez?

Using airSlate SignNow for form 990 ez offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By following the instructions for form 990 ez on our platform, you can ensure that your submissions are accurate and timely, which is crucial for compliance.

-

How does airSlate SignNow ensure the security of my form 990 ez documents?

airSlate SignNow prioritizes the security of your documents, including form 990 ez. We utilize advanced encryption and secure cloud storage to protect your sensitive information. This commitment to security allows you to follow the instructions for form 990 ez with peace of mind.

Get more for Instructions For Form 990 EZ

Find out other Instructions For Form 990 EZ

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile