Instructions for Form 4797

What is the Instructions For Form 4797

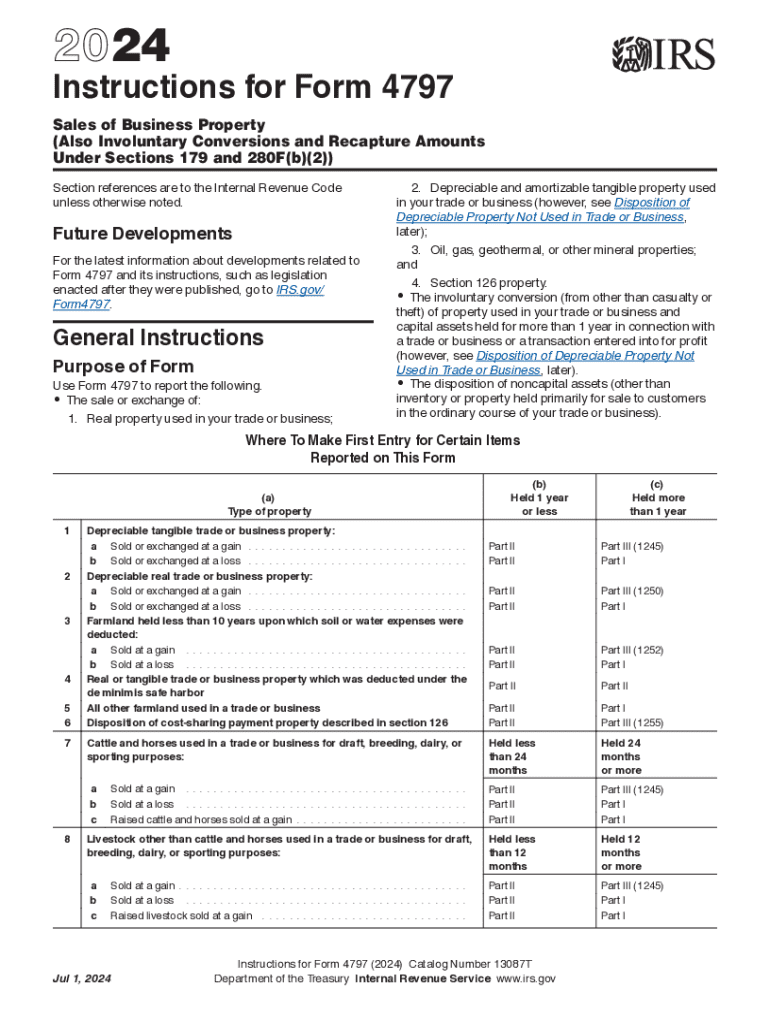

The Instructions for Form 4797 provide detailed guidance for taxpayers who need to report the sale of business property, including real estate and depreciable assets. This form is essential for individuals and businesses that have disposed of property used in a trade or business. It allows taxpayers to calculate gains or losses from these transactions, ensuring compliance with IRS regulations. Understanding these instructions is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the Instructions For Form 4797

Completing the Instructions for Form 4797 involves several key steps:

- Gather necessary information: Collect details about the property sold, including the date of acquisition, date of sale, and original cost.

- Determine the type of property: Identify whether the property is real estate, personal property, or a combination of both.

- Calculate gains or losses: Use the provided worksheets to compute the gain or loss from the sale, taking into account depreciation and other adjustments.

- Complete the form: Fill out the form accurately, following the line-by-line instructions to ensure all relevant information is included.

- Review for accuracy: Double-check all entries for correctness before submission to minimize the risk of errors.

How to obtain the Instructions For Form 4797

The Instructions for Form 4797 can be obtained directly from the IRS website. They are available as a downloadable PDF, which provides the most current information and guidelines. Additionally, printed copies may be available at local IRS offices or through tax preparation services. It is important to ensure you have the latest version to comply with any recent changes in tax law.

IRS Guidelines

The IRS guidelines for Form 4797 outline the specific requirements for reporting the sale of business property. These guidelines include details on how to report different types of property, the treatment of gains and losses, and the implications of depreciation recapture. Taxpayers are encouraged to read these guidelines thoroughly to understand their obligations and avoid common pitfalls during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for Form 4797 typically align with the general tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following tax year. However, if you are self-employed or operate a business, the deadlines may vary based on your entity type. It is crucial to stay informed about these dates to ensure timely filing and avoid penalties.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of Form 4797 can result in significant penalties. These may include fines for late filing, inaccuracies in reporting, or failure to report gains or losses altogether. The IRS may impose additional penalties if the discrepancies are deemed to be intentional. Understanding these potential consequences emphasizes the importance of accurate and timely submission of the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 4797

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4797 and why is it important?

Form 4797 is used to report the sale of business property, including real estate and depreciable assets. Understanding how to properly fill out form 4797 is crucial for accurate tax reporting and compliance. Using airSlate SignNow can simplify the process of preparing and signing this form, ensuring you meet all necessary requirements.

-

How can airSlate SignNow help with completing form 4797?

airSlate SignNow provides an intuitive platform for creating, editing, and eSigning documents like form 4797. With its user-friendly interface, you can easily input the required information and send the form for signatures, streamlining the entire process. This ensures that your form 4797 is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 4797?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of features like unlimited document signing and secure storage. Investing in airSlate SignNow can save you time and reduce errors when handling form 4797.

-

What features does airSlate SignNow offer for managing form 4797?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for documents like form 4797. These tools enhance efficiency and ensure that all parties involved can easily access and sign the form. Additionally, the platform supports various file formats, making it versatile for your needs.

-

Can I integrate airSlate SignNow with other software for form 4797?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications, allowing you to manage form 4797 alongside your existing tools. This integration helps streamline your workflow, ensuring that all necessary data is synchronized and easily accessible. You can connect with CRM systems, cloud storage, and more.

-

What are the benefits of using airSlate SignNow for form 4797?

Using airSlate SignNow for form 4797 offers numerous benefits, including enhanced security, ease of use, and faster turnaround times. The platform ensures that your documents are securely stored and transmitted, reducing the risk of data bsignNowes. Additionally, the ability to eSign documents expedites the process, allowing you to focus on other important tasks.

-

Is airSlate SignNow compliant with legal standards for form 4797?

Yes, airSlate SignNow complies with all legal standards for electronic signatures, making it a reliable choice for handling form 4797. The platform adheres to regulations such as the ESIGN Act and UETA, ensuring that your electronically signed documents are legally binding. This compliance gives you peace of mind when submitting your form 4797.

Get more for Instructions For Form 4797

- Optional but preferred your social security number form

- Georgia statutory financial power of attorney division of form

- How to get a quick divorcelegalzoom form

- Control number nm p010 pkg form

- Zip desiring to execute a limited power of attorney hereby appoint form

- Declarant having executed a statutory power of attorney form

- Control number nm p011 pkg form

- Control number nm p012 pkg form

Find out other Instructions For Form 4797

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form