Print Clear Maine Minimum Tax Credit and Carr 2024-2026

What is the Print Clear Maine Minimum Tax Credit And Carr

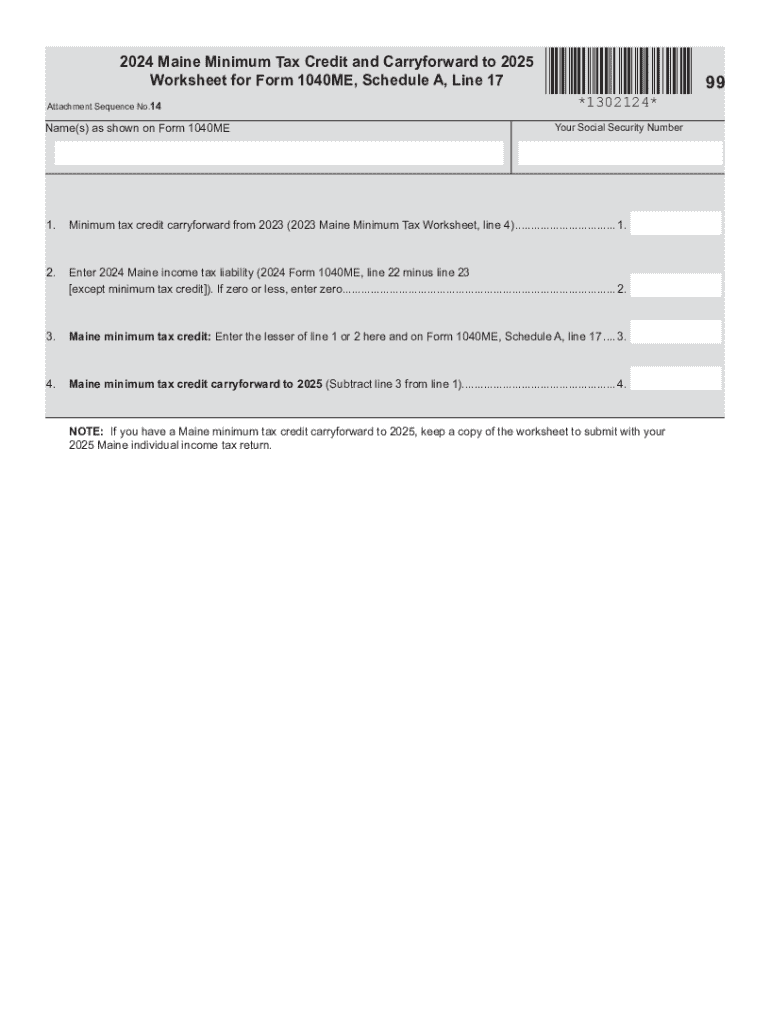

The Print Clear Maine Minimum Tax Credit and Carr is a tax credit designed to assist eligible taxpayers in Maine. This credit aims to reduce the tax burden for individuals and families who meet specific income and residency requirements. The program is particularly beneficial for low-income earners, providing them with financial relief during tax season. Understanding this credit is essential for taxpayers seeking to maximize their tax benefits and ensure compliance with state tax regulations.

How to use the Print Clear Maine Minimum Tax Credit And Carr

Using the Print Clear Maine Minimum Tax Credit and Carr involves several steps. Taxpayers must first determine their eligibility based on income levels and residency status. Once eligibility is confirmed, individuals can fill out the necessary forms, ensuring all information is accurate and complete. After completing the forms, taxpayers can submit them through the appropriate channels, whether online, by mail, or in person, depending on the submission guidelines provided by the state.

Steps to complete the Print Clear Maine Minimum Tax Credit And Carr

Completing the Print Clear Maine Minimum Tax Credit and Carr requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary financial documents, including income statements and tax returns.

- Review eligibility criteria to ensure compliance with state requirements.

- Fill out the required forms accurately, ensuring all personal and financial information is correct.

- Double-check the completed forms for any errors or omissions.

- Submit the forms through the designated method, adhering to any deadlines.

Eligibility Criteria

Eligibility for the Print Clear Maine Minimum Tax Credit and Carr is primarily based on income and residency. Taxpayers must be residents of Maine and meet specific income thresholds set by the state. These thresholds may vary based on filing status, such as single, married, or head of household. It is crucial for applicants to review the current eligibility guidelines to determine if they qualify for the credit.

Required Documents

To successfully apply for the Print Clear Maine Minimum Tax Credit and Carr, taxpayers must prepare several key documents. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous year’s tax return for reference.

- Identification documents to verify residency in Maine.

- Any additional forms required by the state for tax credits.

Form Submission Methods

Taxpayers can submit the Print Clear Maine Minimum Tax Credit and Carr through various methods. The available options include:

- Online submission via the state tax department’s website.

- Mailing the completed forms to the designated tax office.

- In-person submission at local tax offices or designated locations.

Each method has its own guidelines and deadlines, so it is important to choose the most convenient option while ensuring compliance with state requirements.

Create this form in 5 minutes or less

Find and fill out the correct print clear maine minimum tax credit and carr

Create this form in 5 minutes!

How to create an eSignature for the print clear maine minimum tax credit and carr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Print Clear Maine Minimum Tax Credit And Carr?

The Print Clear Maine Minimum Tax Credit And Carr is a tax credit designed to assist eligible taxpayers in Maine. It allows individuals to reduce their tax liability, making it easier to manage finances. Understanding this credit can help you maximize your tax benefits.

-

How can airSlate SignNow help with the Print Clear Maine Minimum Tax Credit And Carr?

airSlate SignNow provides a seamless way to eSign and send documents related to the Print Clear Maine Minimum Tax Credit And Carr. Our platform ensures that all necessary forms are completed accurately and submitted on time, simplifying the process for users.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that support the Print Clear Maine Minimum Tax Credit And Carr, ensuring you have the tools necessary for efficient document management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Print Clear Maine Minimum Tax Credit And Carr. These tools streamline the process, making it easier to handle tax-related documents efficiently.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those related to the Print Clear Maine Minimum Tax Credit And Carr. Our commitment to security and compliance ensures that your documents are handled safely and in accordance with the law.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your ability to manage the Print Clear Maine Minimum Tax Credit And Carr. This integration allows for a more streamlined workflow, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for tax credits?

Using airSlate SignNow for managing tax credits like the Print Clear Maine Minimum Tax Credit And Carr offers numerous benefits, including increased efficiency and reduced paperwork. Our platform simplifies the eSigning process, ensuring that you can focus on maximizing your tax benefits without the hassle of traditional methods.

Get more for Print Clear Maine Minimum Tax Credit And Carr

- Enclosed please find the form

- Indemnification agreement and warranty from customer form

- The waiver ottawa mountain bike association form

- Lease agreement or rental of a mobile home form

- Free bicycle bill of sale form wordpdfeformsfree

- Sample professional services agreement city of azusa form

- Informational postings el paso natural gas co llc

- It is with great regret that i inform you that as of date i will officially resign from my

Find out other Print Clear Maine Minimum Tax Credit And Carr

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure