Fillable Online Maine Minimum Tax Credit Worksheet Maine 2021

What is the Fillable Online Maine Minimum Tax Credit Worksheet?

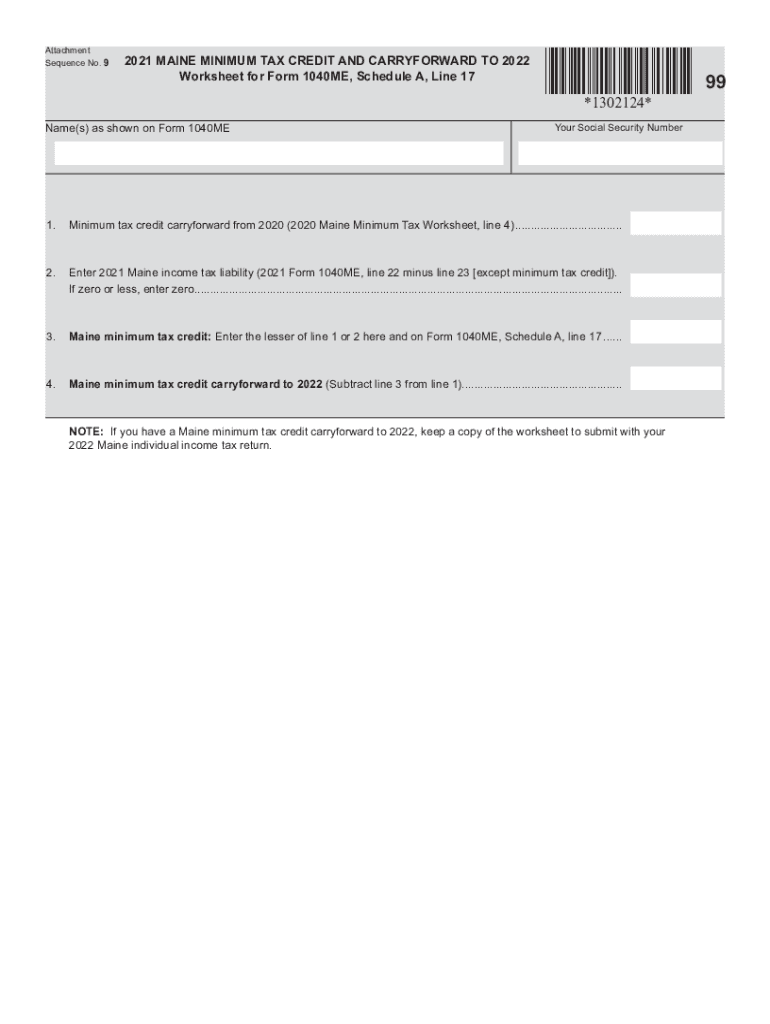

The Fillable Online Maine Minimum Tax Credit Worksheet is a specific form designed for taxpayers in Maine to calculate their eligibility for the minimum tax credit. This worksheet helps individuals determine the amount of credit they can claim on their state tax return. It is particularly useful for those whose income falls below a certain threshold, allowing them to reduce their tax liability. By utilizing this form, taxpayers can ensure they are taking advantage of available credits, ultimately benefiting their financial situation.

Steps to Complete the Fillable Online Maine Minimum Tax Credit Worksheet

Completing the Fillable Online Maine Minimum Tax Credit Worksheet involves several straightforward steps:

- Gather necessary documents, including previous tax returns and income statements.

- Access the fillable online form through a reliable platform.

- Input your personal information accurately, including your name, address, and Social Security number.

- Follow the prompts to enter your income details and any deductions you qualify for.

- Calculate your minimum tax credit using the provided formulas on the worksheet.

- Review all entered information for accuracy before submission.

How to Use the Fillable Online Maine Minimum Tax Credit Worksheet

Using the Fillable Online Maine Minimum Tax Credit Worksheet is designed to be user-friendly. After accessing the form, users can fill it out directly on their devices. The online format allows for easy navigation between sections, and calculations are often automated, reducing the risk of errors. Once completed, the form can be saved and printed for submission with your state tax return. This digital method streamlines the process, making it more efficient than traditional paper forms.

State-Specific Rules for the Fillable Online Maine Minimum Tax Credit Worksheet

Maine has specific regulations governing the use of the Minimum Tax Credit Worksheet. Taxpayers must ensure they meet the eligibility criteria, which typically include income limits and residency requirements. Additionally, the state may have deadlines for submitting the worksheet along with tax returns. Familiarizing oneself with these rules is crucial to avoid penalties and ensure compliance with Maine tax laws.

Legal Use of the Fillable Online Maine Minimum Tax Credit Worksheet

The legal use of the Fillable Online Maine Minimum Tax Credit Worksheet hinges on adherence to state tax regulations. When completed correctly, the form serves as a binding document for tax purposes. It is essential for users to provide accurate information and maintain compliance with relevant laws to ensure that their claims for credit are valid. Utilizing a trusted digital platform for completing this form can further enhance its legal standing, as these platforms often comply with eSignature laws and data protection standards.

Who Issues the Form?

The Fillable Online Maine Minimum Tax Credit Worksheet is issued by the Maine Revenue Services (MRS). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The MRS provides the necessary forms and guidance for individuals seeking to claim tax credits, including the minimum tax credit. Taxpayers can rely on the MRS for updates regarding any changes to the worksheet or associated tax laws.

Quick guide on how to complete fillable online maine minimum tax credit worksheet maine

Effortlessly Prepare Fillable Online Maine Minimum Tax Credit Worksheet Maine on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow offers you all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Fillable Online Maine Minimum Tax Credit Worksheet Maine on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Fillable Online Maine Minimum Tax Credit Worksheet Maine with Ease

- Find Fillable Online Maine Minimum Tax Credit Worksheet Maine and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you’d like to send your form, via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Edit and eSign Fillable Online Maine Minimum Tax Credit Worksheet Maine to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online maine minimum tax credit worksheet maine

Create this form in 5 minutes!

How to create an eSignature for the fillable online maine minimum tax credit worksheet maine

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

How to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the Maine minimum tax and how does it apply to businesses?

The Maine minimum tax is a tax requirement for corporations operating in the state, ensuring that all businesses contribute a minimum amount to state revenue. This tax can affect your overall financial planning, and understanding it is crucial for compliant business operations.

-

How does airSlate SignNow help manage documents related to Maine minimum tax?

With airSlate SignNow, you can easily create, send, and eSign tax documents related to the Maine minimum tax. Our platform streamlines the signing process, ensuring that your tax documents are handled promptly and securely to remain compliant.

-

What pricing plans does airSlate SignNow offer for businesses concerned about Maine minimum tax?

AirSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. These plans provide essential features to help manage documentation related to the Maine minimum tax efficiently without straining your budget.

-

What features of airSlate SignNow assist with compliance regarding the Maine minimum tax?

AirSlate SignNow includes features like customizable templates and automated workflows that help ensure compliance with the Maine minimum tax regulations. You can also track document statuses to confirm that all necessary forms are completed on time.

-

Can airSlate SignNow integrate with accounting software for Maine minimum tax preparation?

Yes, airSlate SignNow can integrate seamlessly with various accounting software to facilitate the preparation of documents related to the Maine minimum tax. This integration helps streamline your workflow, reducing the chances of errors when submitting tax documents.

-

What benefits do businesses gain from using airSlate SignNow for Maine minimum tax documents?

Businesses using airSlate SignNow benefit from improved efficiency, reduced paperwork, and faster document turnaround times for Maine minimum tax-related documents. Our eSigning solution ensures secure and legally binding signatures that save time and enhance productivity.

-

Is airSlate SignNow secure for handling sensitive Maine minimum tax documents?

Absolutely, airSlate SignNow prioritizes security with bank-level encryption protocols to protect all sensitive Maine minimum tax documents. Your data is safe throughout the signing process, ensuring confidentiality and compliance with relevant regulations.

Get more for Fillable Online Maine Minimum Tax Credit Worksheet Maine

- General power of attorney for care and custody of child or children new jersey form

- Small business accounting package new jersey form

- New jersey procedures form

- Nj revocation form

- Nj statutory form

- Newly divorced individuals package new jersey form

- New jersey revocation form

- Contractors forms package new jersey

Find out other Fillable Online Maine Minimum Tax Credit Worksheet Maine

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word