Clear Print Real Estate Withholding Payment Vouche Form

Understanding the Clear Print Real Estate Withholding Payment Voucher

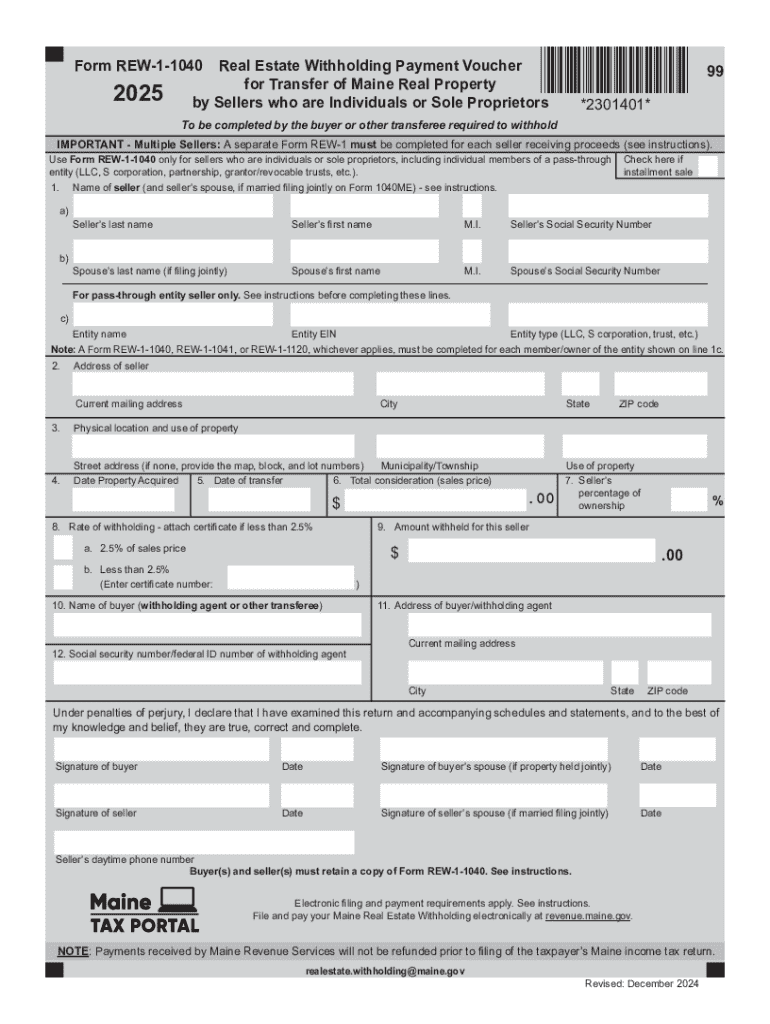

The Clear Print Real Estate Withholding Payment Voucher is a crucial document used in the state of Maine for real estate transactions involving non-resident sellers. This form is designed to ensure that the appropriate amount of state tax is withheld from the proceeds of the sale. It is essential for compliance with Maine tax laws, particularly for individuals or entities that are not residents of the state but are selling property located within its borders.

Steps to Complete the Clear Print Real Estate Withholding Payment Voucher

Completing the Clear Print Real Estate Withholding Payment Voucher involves several key steps:

- Gather necessary information, including the seller's details, property address, and sale price.

- Calculate the withholding amount based on the sale price and applicable tax rates.

- Fill out the voucher accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

Taking these steps carefully can help avoid delays and ensure compliance with state tax regulations.

Legal Use of the Clear Print Real Estate Withholding Payment Voucher

The Clear Print Real Estate Withholding Payment Voucher serves a legal purpose in the context of real estate transactions. It is required by the state of Maine for non-resident sellers to ensure that taxes are collected at the time of sale. Failure to use this form appropriately can lead to penalties and complications during the tax filing process.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Clear Print Real Estate Withholding Payment Voucher. Generally, the voucher must be submitted at the time of the property sale. Additionally, any taxes withheld must be remitted to the state within a specified timeframe, typically within a month following the sale. Keeping track of these deadlines is crucial to avoid penalties.

Required Documents for Submission

When submitting the Clear Print Real Estate Withholding Payment Voucher, certain documents may be required to accompany the form. These typically include:

- Proof of sale, such as a purchase and sale agreement.

- Identification documents for the seller.

- Any previous tax filings that may be relevant.

Having these documents ready can facilitate a smoother submission process.

Examples of Using the Clear Print Real Estate Withholding Payment Voucher

There are various scenarios in which the Clear Print Real Estate Withholding Payment Voucher is used. For instance, a non-resident individual selling a vacation home in Maine would need to complete this form to ensure that the state tax is withheld appropriately. Similarly, a corporation selling commercial property in Maine must also adhere to this requirement. Understanding these examples can clarify the importance of the voucher in real estate transactions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clear print real estate withholding payment vouche

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine REW 1 1040 form?

The Maine REW 1 1040 form is a state tax return document that residents of Maine must file to report their income and calculate their tax obligations. It is essential for ensuring compliance with state tax laws and can be easily managed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the Maine REW 1 1040 form?

airSlate SignNow simplifies the process of completing and submitting the Maine REW 1 1040 form by allowing users to fill out, sign, and send documents electronically. This not only saves time but also reduces the risk of errors associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the Maine REW 1 1040?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value for the features offered, especially for those frequently dealing with documents like the Maine REW 1 1040.

-

What features does airSlate SignNow offer for the Maine REW 1 1040 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for managing the Maine REW 1 1040 form. These features enhance efficiency and ensure that all necessary steps are completed accurately.

-

Can I integrate airSlate SignNow with other software for the Maine REW 1 1040?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your Maine REW 1 1040 form alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax forms like the Maine REW 1 1040?

Using airSlate SignNow for tax forms like the Maine REW 1 1040 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are handled safely and can be accessed anytime, anywhere.

-

Is airSlate SignNow user-friendly for filing the Maine REW 1 1040?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the process of filing the Maine REW 1 1040. The intuitive interface allows users to complete their forms quickly and efficiently, even without prior experience.

Get more for Clear Print Real Estate Withholding Payment Vouche

- Electronic monitoring as a jail alternative in california form

- Underwriting agreement by internet com corp law insider form

- Second amended and restated development and license form

- Scg holding corporation form

- Form of employee matters agreement secgov

- Employee matters agreement dated as of october secgov form

- To exit db plan motorola buys group annuity from prudential form

- In service withdrawal definition investopedia form

Find out other Clear Print Real Estate Withholding Payment Vouche

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed