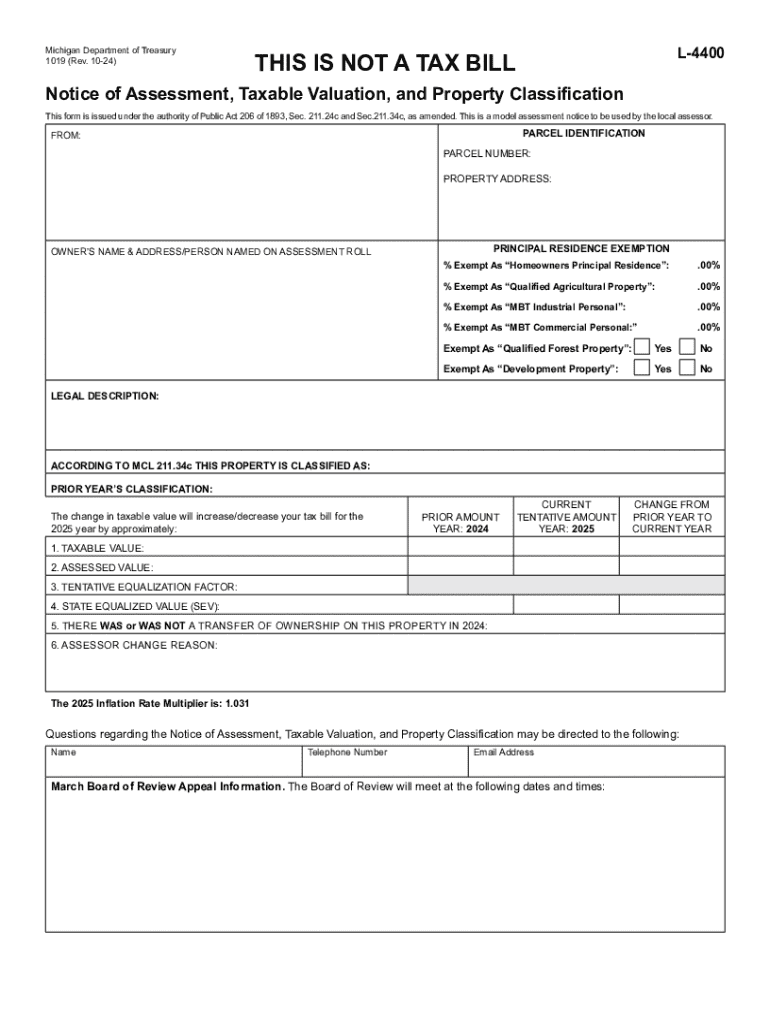

1019, Notice of Assessment, Taxable Valuation, and Property Classification Form

What is the Michigan Treasury 1019 Notice of Assessment?

The Michigan Treasury 1019 is an official document that provides property owners with a notice of assessment regarding their property’s taxable valuation and classification. This form is essential for understanding how property taxes are calculated and can impact the financial obligations of homeowners. The notice includes details about the assessed value of the property, which is crucial for determining the amount of property tax owed. It also outlines the classification of the property, which can influence tax rates and eligibility for certain exemptions.

Key Elements of the Michigan Treasury 1019 Notice of Assessment

The Michigan Treasury 1019 contains several key components that property owners should familiarize themselves with:

- Taxable Valuation: This is the assessed value of the property that is subject to taxation.

- Property Classification: Properties are classified for tax purposes, which can affect the tax rate applied.

- Assessment Date: The date on which the assessment is based, typically reflecting the property's value as of December 31 of the previous year.

- Appeal Rights: Information on how property owners can contest their assessment if they believe it is inaccurate.

How to Use the Michigan Treasury 1019 Notice of Assessment

Understanding how to use the Michigan Treasury 1019 is vital for property owners. The notice should be reviewed carefully to ensure that the taxable valuation and classification are accurate. If discrepancies are found, property owners have the right to appeal the assessment. This process typically involves filing a formal appeal with the local assessing office, often requiring supporting documentation to substantiate claims. Additionally, the notice can be used to inform financial planning, as it directly influences property tax obligations.

Steps to Complete the Michigan Treasury 1019 Notice of Assessment

Completing the Michigan Treasury 1019 involves several important steps:

- Review the Notice: Check the taxable valuation and property classification for accuracy.

- Gather Documentation: Collect any necessary documents that support your case if you plan to appeal.

- File an Appeal: If discrepancies are found, submit an appeal to the local assessing office by the specified deadline.

- Follow Up: Monitor the status of your appeal and ensure that any adjustments are reflected in future assessments.

Legal Use of the Michigan Treasury 1019 Notice of Assessment

The Michigan Treasury 1019 serves as a legally binding document that outlines the assessed value of a property for tax purposes. Property owners must comply with the information provided in the notice, as it dictates tax obligations. Failure to address inaccuracies or to appeal within the designated time frame can result in financial repercussions. Understanding the legal implications of the notice is crucial for effective property tax management.

Filing Deadlines and Important Dates for the Michigan Treasury 1019 Notice of Assessment

Property owners should be aware of key deadlines related to the Michigan Treasury 1019. Typically, the notice is mailed out in February, and property owners have a limited time frame to review and appeal the assessment. The exact deadline for filing an appeal varies by locality, but it is generally within a few weeks of receiving the notice. Keeping track of these dates is essential to ensure that property owners can exercise their rights effectively.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1019 notice of assessment taxable valuation and property classification 771949257

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Treasury 1019 form?

The Michigan Treasury 1019 form is a document used for reporting and remitting Michigan sales tax. It is essential for businesses operating in Michigan to ensure compliance with state tax regulations. Understanding how to properly fill out and submit the Michigan Treasury 1019 can help avoid penalties.

-

How can airSlate SignNow help with the Michigan Treasury 1019?

airSlate SignNow simplifies the process of completing and eSigning the Michigan Treasury 1019 form. Our platform allows users to easily fill out the form electronically, ensuring accuracy and compliance. With airSlate SignNow, you can streamline your tax reporting process and save valuable time.

-

What are the pricing options for using airSlate SignNow for Michigan Treasury 1019?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions ensure that you can manage your Michigan Treasury 1019 submissions without breaking the bank. Visit our pricing page to find the plan that best suits your needs.

-

Are there any integrations available for airSlate SignNow with Michigan Treasury 1019?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Michigan Treasury 1019 submissions. These integrations help streamline your workflow and ensure that all your documents are in one place. Check our integrations page for more details.

-

What features does airSlate SignNow offer for managing the Michigan Treasury 1019?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Michigan Treasury 1019. These tools enhance your document management process and ensure that you stay organized. Experience the ease of managing your tax forms with our user-friendly platform.

-

Can I access my Michigan Treasury 1019 documents from anywhere?

Absolutely! With airSlate SignNow, you can access your Michigan Treasury 1019 documents from any device with an internet connection. This flexibility allows you to manage your tax submissions on the go, ensuring that you never miss a deadline.

-

Is airSlate SignNow secure for handling sensitive documents like the Michigan Treasury 1019?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the Michigan Treasury 1019. Our platform uses advanced encryption and security protocols to protect your information. You can trust us to keep your data secure while you manage your tax forms.

Get more for 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

- Ebook vietnam education financing form

- Staples inc def 14a sec form

- Dialdata s form

- Agreement and plan of merger torvec subsidiary corp form

- Chapter 11 aspect software parent inc et al cases form

- Web advertising agreement mpath interactive inc and form

- Playbox us inc small business stock registration sb 2 form

- Softworks inc sc 14d9 on 122399 re softworks sec info form

Find out other 1019, Notice Of Assessment, Taxable Valuation, And Property Classification

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free