Tax Alaska 2019-2026

What is the Tax Alaska

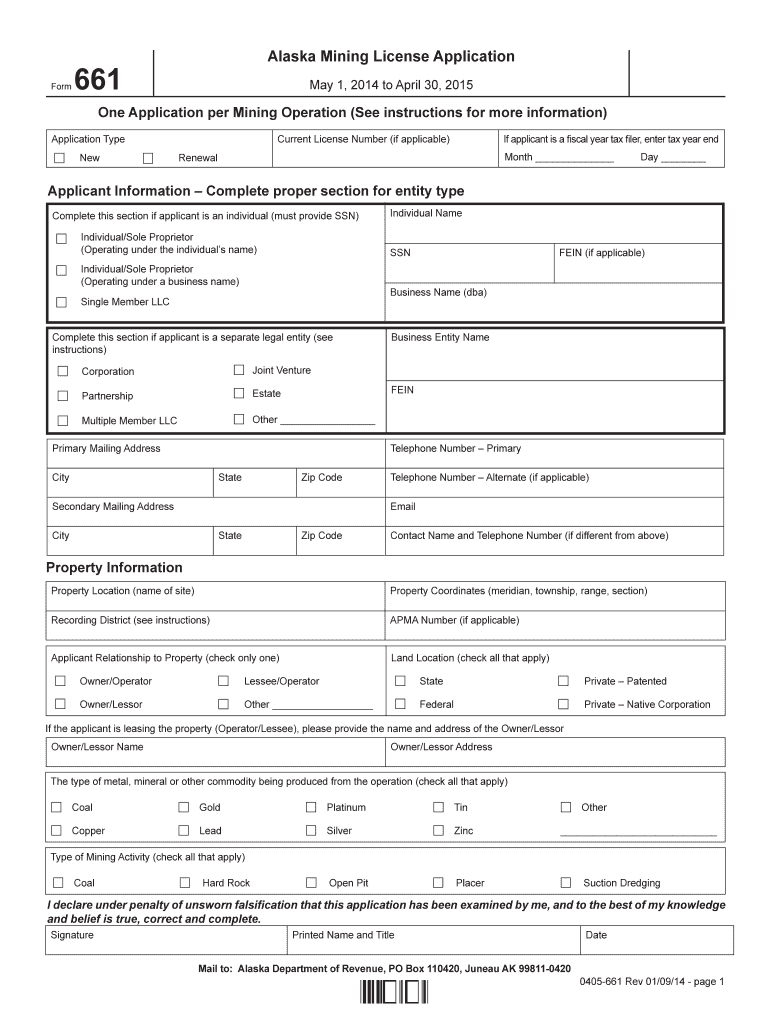

The Tax Alaska form is a specific document used for tax purposes within the state of Alaska. It serves as a means for residents and businesses to report their income, claim deductions, and calculate their tax obligations. This form is essential for ensuring compliance with state tax laws and regulations. Understanding its purpose and requirements is crucial for accurate tax reporting.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure proper completion and submission. Begin by gathering all necessary financial documents, such as W-2s and 1099s, which provide details of your income. Next, follow the instructions provided with the form to fill it out accurately. Be sure to double-check all entries for accuracy before submission. Finally, submit the completed form either electronically or by mail, depending on your preference and the guidelines set by the state.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires careful attention to detail. Start with the following steps:

- Gather Documentation: Collect all relevant financial records, including income statements and previous tax returns.

- Fill Out the Form: Carefully enter your personal information, income details, and any deductions or credits you are eligible for.

- Review for Accuracy: Check all entries for mistakes or omissions to avoid delays in processing.

- Submit the Form: Choose your submission method—either electronically through a secure platform or by mailing a physical copy to the appropriate tax office.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws. It is essential to ensure that the form is completed in accordance with these laws to avoid penalties or legal issues. The form must be signed and dated, and it is advisable to keep a copy of the submitted form for your records. Compliance with all relevant regulations, including deadlines for submission, is critical to maintaining legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are typically set by the state’s Department of Revenue. It is important to be aware of these dates to avoid late fees or penalties. Generally, tax returns are due on April fifteenth of each year, but this can vary based on specific circumstances or extensions. Keeping track of these important dates ensures timely compliance with tax obligations.

Required Documents

To successfully complete the Tax Alaska form, certain documents are required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure accurate reporting.

Quick guide on how to complete tax alaska 6967266

Complete Tax Alaska with ease on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Tax Alaska on any device using airSlate SignNow Android or iOS applications and enhance any document-related processes today.

How to modify and eSign Tax Alaska effortlessly

- Locate Tax Alaska and click on Get Form to begin.

- Use the provided tools to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Alaska and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967266

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967266

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the primary benefit of using airSlate SignNow for Tax Alaska documents?

The primary benefit of using airSlate SignNow for Tax Alaska documents is the streamlined eSignature process, allowing businesses to send, sign, and manage their tax documents efficiently. With a user-friendly interface, it simplifies compliance and documentation, ensuring that you can focus on your business rather than paperwork.

-

How does airSlate SignNow ensure the security of Tax Alaska documents?

airSlate SignNow ensures the security of Tax Alaska documents through advanced encryption technology and compliance with industry standards. This guarantees that your sensitive tax information is protected during transmission and storage, giving you peace of mind while handling confidential documents.

-

What pricing options does airSlate SignNow offer for Tax Alaska users?

airSlate SignNow offers flexible pricing plans tailored for Tax Alaska users, including a free trial and various subscription tiers. This allows businesses of all sizes to choose a plan that fits their budget while accessing essential eSignature features for tax documents.

-

Can I integrate airSlate SignNow with other software for managing Tax Alaska files?

Yes, airSlate SignNow seamlessly integrates with various software solutions that are commonly used for managing Tax Alaska files. This ensures that you can work with your existing tools, enhancing workflow efficiency and simplifying the document management process.

-

Is airSlate SignNow compliant with Alaska tax regulations?

Absolutely! airSlate SignNow is designed to meet legal and compliance standards, ensuring that it aligns with Alaska tax regulations. This compliance helps safeguard your documents and provides assurance that your electronic signatures are legally binding in Alaska.

-

How does airSlate SignNow improve the efficiency of filing Tax Alaska documents?

airSlate SignNow enhances the efficiency of filing Tax Alaska documents by automating signature requests and document workflows. This reduces delays associated with manual processes, allowing for quicker submission of tax forms and improving overall business productivity.

-

What features does airSlate SignNow provide for Tax Alaska professionals?

airSlate SignNow provides a variety of features tailored for Tax Alaska professionals, including customizable templates, bulk sending, and status tracking. These features empower tax professionals to manage their documents more effectively and maintain a clear overview of all document activities.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed