TAX F005 Resale Certificate Form

What is the Nevada resale certificate?

The Nevada resale certificate, often referred to as the NV form resale, is a legal document that allows businesses to purchase goods without paying sales tax. This form is essential for retailers and wholesalers who intend to resell products rather than consume them. By providing a resale certificate to suppliers, businesses can avoid the upfront cost of sales tax, which is crucial for maintaining cash flow and profitability.

How to use the Nevada resale certificate

To effectively use the Nevada resale certificate, a business must present the completed form to suppliers when making purchases intended for resale. It is important to ensure that the certificate includes accurate information about the buyer's business, including the name, address, and sales tax identification number. By submitting this document, the buyer certifies that the items purchased will be resold in the regular course of business.

Steps to complete the Nevada resale certificate

Completing the Nevada resale certificate involves several straightforward steps:

- Obtain the correct form, which can be found on the Nevada Department of Taxation website or through other official resources.

- Fill in the business name, address, and sales tax identification number accurately.

- Specify the type of goods that will be purchased for resale.

- Sign and date the form to validate the information provided.

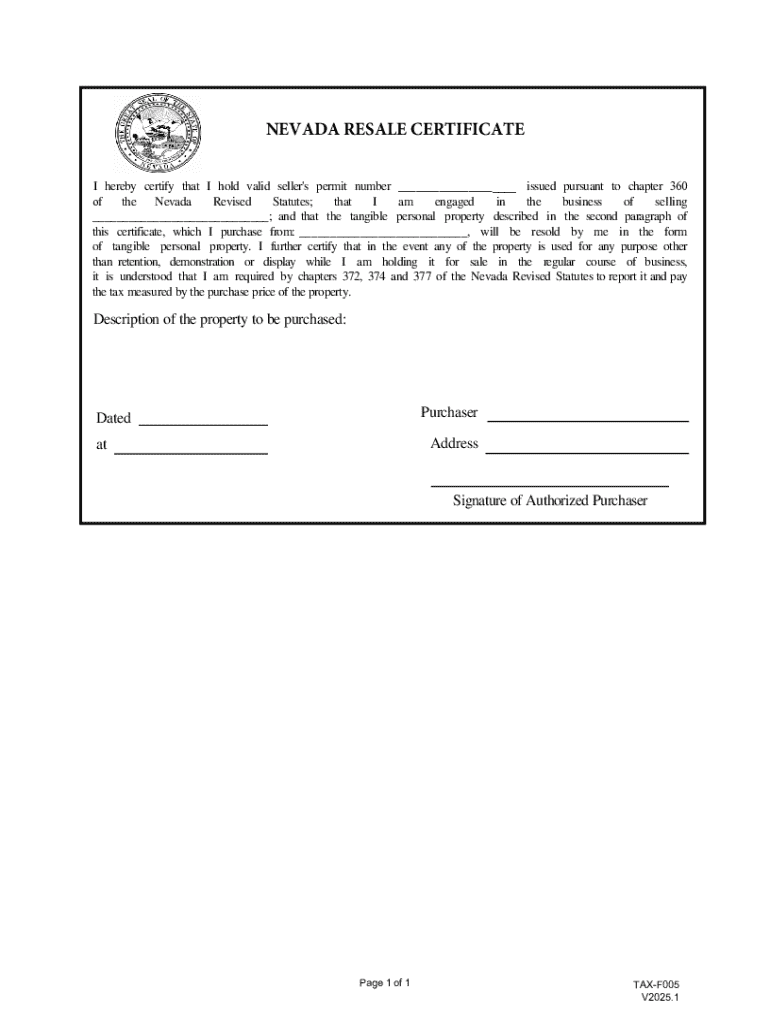

Key elements of the Nevada resale certificate

The Nevada resale certificate includes several key elements that must be present for it to be valid:

- The name and address of the purchaser.

- The sales tax identification number of the purchaser.

- A description of the property being purchased for resale.

- The signature of the purchaser or an authorized representative.

- The date the certificate is issued.

Eligibility criteria for the Nevada resale certificate

To qualify for a Nevada resale certificate, businesses must meet specific eligibility criteria. Primarily, the applicant must be engaged in the business of selling tangible personal property. Additionally, the business must possess a valid Nevada sales tax permit. It is essential for businesses to ensure they are compliant with state regulations regarding resale activities to avoid penalties.

Legal use of the Nevada resale certificate

The legal use of the Nevada resale certificate is governed by state tax laws. Businesses must use the certificate solely for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or items not intended for resale, can lead to penalties, including back taxes and fines. It is crucial for businesses to maintain accurate records of transactions involving the resale certificate to ensure compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax f005 resale certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nv form resale and how does it work?

The nv form resale is a specific document format designed for resale transactions in Nevada. It streamlines the process of signing and managing resale agreements, ensuring compliance with state regulations. With airSlate SignNow, you can easily create, send, and eSign nv form resale documents, making the process efficient and hassle-free.

-

How much does it cost to use airSlate SignNow for nv form resale?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling nv form resale documents. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements. You can start with a free trial to explore the platform before committing to a subscription.

-

What features does airSlate SignNow offer for nv form resale?

airSlate SignNow provides a range of features specifically beneficial for managing nv form resale documents. These include customizable templates, secure eSigning, document tracking, and automated workflows. These features enhance efficiency and ensure that your resale agreements are processed smoothly.

-

Can I integrate airSlate SignNow with other tools for nv form resale?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms to enhance your nv form resale process. You can connect it with CRM systems, cloud storage services, and other applications to streamline your workflow. This integration capability ensures that you can manage your documents efficiently across different platforms.

-

What are the benefits of using airSlate SignNow for nv form resale?

Using airSlate SignNow for nv form resale provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning, which speeds up the transaction process. Additionally, it ensures that all documents are securely stored and easily accessible when needed.

-

Is airSlate SignNow compliant with Nevada regulations for nv form resale?

Absolutely! airSlate SignNow is designed to comply with all relevant Nevada regulations regarding nv form resale. Our platform ensures that your documents meet legal standards, providing peace of mind as you manage your resale transactions. Compliance is a top priority for us, so you can focus on your business.

-

How can I get started with airSlate SignNow for nv form resale?

Getting started with airSlate SignNow for nv form resale is simple. You can sign up for a free trial on our website, which allows you to explore the features and functionalities. Once you're ready, you can choose a subscription plan that fits your needs and start creating and managing your nv form resale documents.

Get more for TAX F005 Resale Certificate

- Pro se answers pro bono attorney application arkansas form

- Order granting hearing and temporary letters testamentary form

- Supreme court rule 13 tennessee administrative office of form

- Legalslegal servicesstarkvilledailynewscom form

- Local rules for sixteenth chancery court district of form

- In the chancery court of the judicial district of form

- Comes now as executrix of the will and estate of form

- Appeal from the chancery court of the first judicial district form

Find out other TAX F005 Resale Certificate

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document