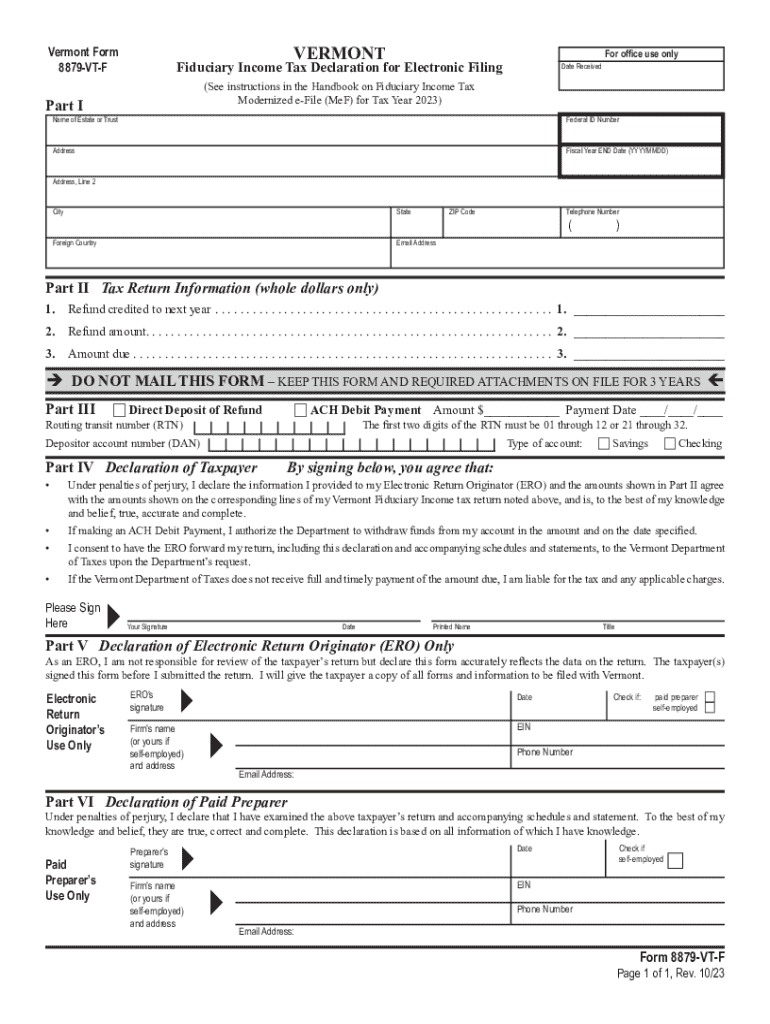

Corporation, Business, and Fiduciary E Filing Form

What is the Corporation, Business, And Fiduciary E filing

The Corporation, Business, and Fiduciary E filing is a digital process that allows businesses and fiduciaries to submit necessary forms and documents electronically to the appropriate state or federal agencies. This streamlined method enhances efficiency, reduces paperwork, and minimizes the risk of errors associated with traditional paper filing. It encompasses various forms related to business operations, including tax submissions, compliance documents, and fiduciary responsibilities.

How to use the Corporation, Business, And Fiduciary E filing

Using the Corporation, Business, and Fiduciary E filing involves several straightforward steps. First, ensure you have the correct forms required for your specific business type or fiduciary duty. Next, gather all necessary information and documentation, such as identification numbers, financial records, and any supporting documents. Once prepared, access the designated e-filing platform, complete the forms, and submit them electronically. Always review your entries for accuracy before final submission to avoid delays or rejections.

Steps to complete the Corporation, Business, And Fiduciary E filing

Completing the Corporation, Business, and Fiduciary E filing involves a series of methodical steps:

- Identify the specific forms required for your business or fiduciary role.

- Collect all relevant information and documentation.

- Access the e-filing platform designated for your state or federal agency.

- Fill out the forms accurately, ensuring all fields are completed.

- Review your submission for any errors or missing information.

- Submit the forms electronically and save a copy of the confirmation for your records.

Required Documents

To successfully complete the Corporation, Business, and Fiduciary E filing, you will need various documents, which may include:

- Employer Identification Number (EIN) or Social Security Number (SSN)

- Financial statements or tax returns

- Operating agreements or bylaws for corporations

- Proof of identity for all signatories

- Any additional state-specific forms or documentation

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for compliance. Each state may have its own specific deadlines for the Corporation, Business, and Fiduciary E filing. Generally, these deadlines align with tax reporting periods or specific business registration timelines. It is advisable to consult the appropriate state agency or the IRS for detailed information on important dates to ensure timely submissions.

Legal use of the Corporation, Business, And Fiduciary E filing

The legal use of the Corporation, Business, and Fiduciary E filing is governed by federal and state regulations. This electronic filing method is recognized as a valid and legally binding way to submit documents. It is essential to ensure that all filings comply with applicable laws, including accurate reporting and timely submissions. Failure to adhere to these legal requirements can result in penalties or legal complications.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corporation business and fiduciary e filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Corporation, Business, And Fiduciary E filing?

Corporation, Business, And Fiduciary E filing refers to the electronic submission of documents required for business registration and compliance. This process simplifies the filing of necessary paperwork, ensuring that your corporation or business meets legal requirements efficiently. With airSlate SignNow, you can manage these filings seamlessly.

-

How does airSlate SignNow facilitate Corporation, Business, And Fiduciary E filing?

airSlate SignNow streamlines the Corporation, Business, And Fiduciary E filing process by providing an intuitive platform for document preparation and electronic signatures. Users can easily create, send, and sign documents online, reducing the time and effort needed for traditional filing methods. This enhances productivity and ensures compliance.

-

What are the pricing options for airSlate SignNow's Corporation, Business, And Fiduciary E filing services?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features specifically designed for Corporation, Business, And Fiduciary E filing, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for Corporation, Business, And Fiduciary E filing?

Our platform includes features such as customizable templates, secure electronic signatures, and real-time tracking for Corporation, Business, And Fiduciary E filing. These tools help you manage your documents efficiently and ensure that all filings are completed accurately and on time. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

What are the benefits of using airSlate SignNow for Corporation, Business, And Fiduciary E filing?

Using airSlate SignNow for Corporation, Business, And Fiduciary E filing offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution allows you to complete filings faster while maintaining compliance with legal standards. This ultimately saves you time and resources, allowing you to focus on growing your business.

-

Can airSlate SignNow integrate with other business tools for Corporation, Business, And Fiduciary E filing?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your Corporation, Business, And Fiduciary E filing experience. This integration allows for better workflow management and data synchronization, ensuring that all your documents are in one place. You can connect with popular platforms like Google Drive, Salesforce, and more.

-

Is airSlate SignNow secure for Corporation, Business, And Fiduciary E filing?

Absolutely! airSlate SignNow prioritizes security for all Corporation, Business, And Fiduciary E filing activities. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

Get more for Corporation, Business, And Fiduciary E filing

- Texas acknowledgment of certified copy of a non recordable document form

- Texas acknowledgment for a natural person acting in his own right form

- Texas acknowledgment for individual short version form

- Texas jurat acknowledgment form

- Texas acknowledgment of oath or affirmation form

- Texas acknowledgment of protest form

- Texas acknowledgment by public officer form

- Washington acknowlegment for witnessing or attesting a signature form

Find out other Corporation, Business, And Fiduciary E filing

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself