Arizona Tax Form 8879 2011

What is the Arizona Tax Form 8879

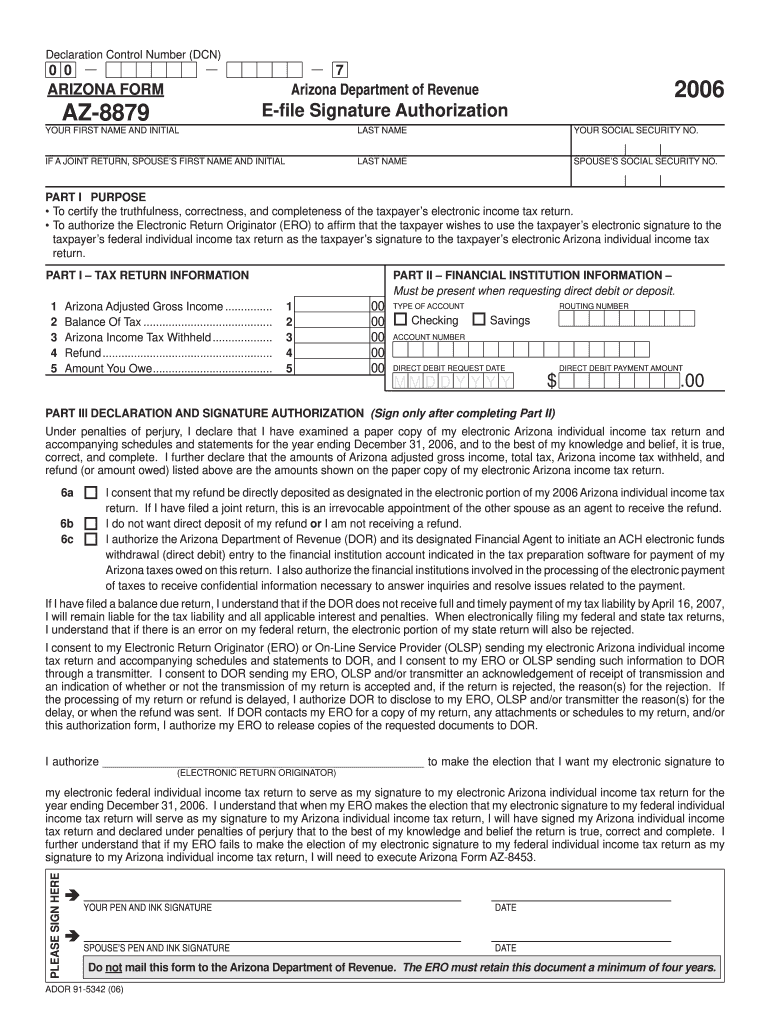

The Arizona Tax Form 8879 is an essential document used by taxpayers in Arizona to authorize the electronic filing of their state income tax returns. This form serves as the taxpayer's declaration of the accuracy of the information provided in their tax return. By signing this form, individuals confirm that they have reviewed their return and that it is complete and correct. The Arizona Tax Form 8879 is particularly important for those who choose to file their taxes electronically, as it provides the necessary consent for the e-filing process.

How to use the Arizona Tax Form 8879

Using the Arizona Tax Form 8879 involves several straightforward steps. First, ensure that you have completed your tax return accurately. Once your return is ready, fill out the form by providing your personal information, including your name, Social Security number, and address. Next, review the completed tax return to confirm that all details are correct. After verifying the information, sign the form electronically. This signature indicates your approval for the electronic submission of your tax return. Finally, submit the form along with your tax return to the appropriate tax authority.

Steps to complete the Arizona Tax Form 8879

Completing the Arizona Tax Form 8879 requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your completed tax return.

- Enter your personal information accurately on the form.

- Review your tax return for any errors or omissions.

- Sign the form electronically to authorize the e-filing.

- Submit the form along with your tax return to the Arizona Department of Revenue.

Legal use of the Arizona Tax Form 8879

The Arizona Tax Form 8879 is legally binding when completed and signed properly. It complies with electronic signature laws, including the ESIGN Act and UETA, which recognize e-signatures as valid and enforceable. To ensure the legal validity of your form, use a reputable e-signature platform that provides security features such as encryption and audit trails. These measures help protect your personal information and confirm the authenticity of your signature.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Tax Form 8879 align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their state tax returns by April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these dates, as timely filing helps avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Arizona Tax Form 8879, you will need several key documents:

- Your completed Arizona state income tax return.

- Personal identification information, such as your Social Security number.

- Any relevant tax documents, including W-2s, 1099s, and other income statements.

- Documentation for any deductions or credits claimed.

Examples of using the Arizona Tax Form 8879

There are various scenarios in which the Arizona Tax Form 8879 is utilized. For instance, self-employed individuals may use the form to authorize the e-filing of their business income and expenses. Similarly, families filing joint returns can use the form to confirm their shared tax information. Additionally, taxpayers who have received assistance from tax professionals often need to complete this form to allow their preparer to file on their behalf electronically.

Quick guide on how to complete arizona tax form 8879 2006

Effortlessly Prepare Arizona Tax Form 8879 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Arizona Tax Form 8879 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to edit and eSign Arizona Tax Form 8879 effortlessly

- Locate Arizona Tax Form 8879 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Arizona Tax Form 8879 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona tax form 8879 2006

Create this form in 5 minutes!

How to create an eSignature for the arizona tax form 8879 2006

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Arizona Tax Form 8879?

The Arizona Tax Form 8879 is a declaration of electronic filing, allowing taxpayers to authorize e-filing of their income tax returns. This form is essential for ensuring that your tax return is submitted electronically to the Arizona Department of Revenue without any complications.

-

How can airSlate SignNow help with the Arizona Tax Form 8879?

airSlate SignNow provides an efficient platform for signing and sending the Arizona Tax Form 8879 securely. With our electronic signature features, you can quickly complete and submit your form, ensuring a smooth e-filing process.

-

What features does airSlate SignNow offer for Arizona Tax Form 8879?

airSlate SignNow offers various features for handling the Arizona Tax Form 8879, including templates, cloud storage, and advanced security options. These features streamline the signing process and ensure that your documents are stored safely and can be accessed anytime.

-

Is airSlate SignNow cost-effective for managing the Arizona Tax Form 8879?

Yes, airSlate SignNow is a cost-effective solution for managing the Arizona Tax Form 8879. Our flexible pricing plans cater to various needs, making it affordable for individuals and businesses alike to send and eSign their tax documents.

-

Can I integrate airSlate SignNow with other software for Arizona Tax Form 8879?

Absolutely! airSlate SignNow can be integrated with various software tools, enhancing the workflow for the Arizona Tax Form 8879. By integrating with accounting software, you can streamline the filing process and ensure all forms are completed accurately.

-

What are the benefits of using airSlate SignNow for Arizona Tax Form 8879?

Using airSlate SignNow for the Arizona Tax Form 8879 offers numerous benefits, including speed, security, and ease of use. It simplifies the signing process, reduces paper usage, and allows for quick adjustments or re-signing if needed, all while maintaining the integrity of your documents.

-

How secure is the submission of the Arizona Tax Form 8879 through airSlate SignNow?

airSlate SignNow prioritizes the security of your documents. When submitting the Arizona Tax Form 8879, our platform uses advanced encryption and secure cloud storage to protect your sensitive information, ensuring that your data is safe throughout the process.

Get more for Arizona Tax Form 8879

- Howard county md library card form

- Blue avocado executive director evaluation form

- Pmw 3120 form

- Jimmy johns application form

- Special occasion permit form

- Cmta application for permit to be on railroad right of way capmetro form

- Medical vision form dpsmv2015

- Vp 262 abandoned vehicle lien transfer 2 23 form

Find out other Arizona Tax Form 8879

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip