612 Arizona Department of Revenue Azdor 2009

What is the 612 Arizona Department Of Revenue Azdor

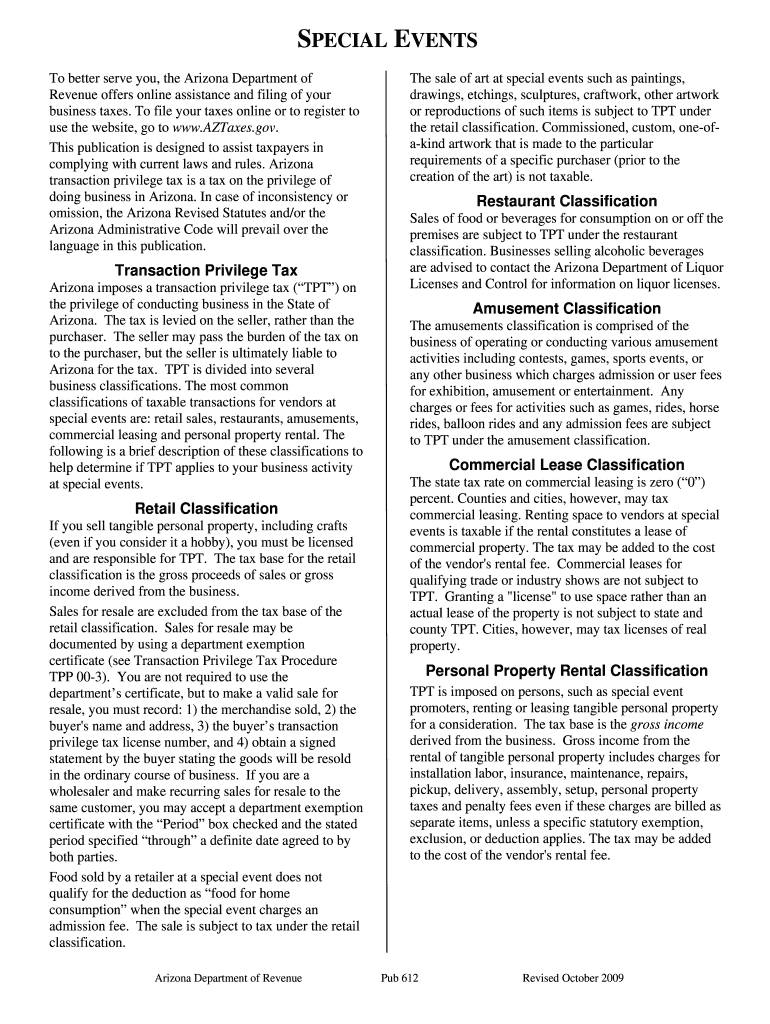

The 612 Arizona Department Of Revenue Azdor form is a crucial document used for tax purposes within the state of Arizona. This form is primarily utilized by taxpayers to report specific income and deductions, ensuring compliance with state tax regulations. Understanding the purpose of this form is essential for accurate tax filing and to avoid potential penalties.

How to use the 612 Arizona Department Of Revenue Azdor

Using the 612 Arizona Department Of Revenue Azdor form involves several steps to ensure proper completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, accurately fill out each section of the form, ensuring that all information is complete and correct. Finally, review the filled form for any errors before submission to avoid delays or issues with processing.

Steps to complete the 612 Arizona Department Of Revenue Azdor

Completing the 612 Arizona Department Of Revenue Azdor form requires attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Report your total income from all sources as required by the form.

- List any deductions you are eligible for, ensuring you have supporting documentation.

- Calculate your total tax liability based on the information provided.

- Sign and date the form to certify that the information is accurate.

Legal use of the 612 Arizona Department Of Revenue Azdor

The legal use of the 612 Arizona Department Of Revenue Azdor form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Additionally, the form must be signed by the taxpayer or an authorized representative. Compliance with these legal requirements helps ensure that your tax filings are accepted and reduces the risk of audits or penalties.

Form Submission Methods

The 612 Arizona Department Of Revenue Azdor form can be submitted through various methods. Taxpayers have the option to file online through the Arizona Department of Revenue's official website, which often provides a more efficient processing time. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated tax offices. Each submission method has its own advantages, so it is important to choose the one that best suits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the 612 Arizona Department Of Revenue Azdor form are critical for compliance. Typically, individual taxpayers must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to these deadlines to avoid late fees or penalties.

Quick guide on how to complete 612 arizona department of revenue azdor

Complete 612 Arizona Department Of Revenue Azdor easily on any gadget

Online document organization has become favored by enterprises and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage 612 Arizona Department Of Revenue Azdor on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to adjust and eSign 612 Arizona Department Of Revenue Azdor effortlessly

- Obtain 612 Arizona Department Of Revenue Azdor and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from your chosen device. Adjust and eSign 612 Arizona Department Of Revenue Azdor and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 612 arizona department of revenue azdor

Create this form in 5 minutes!

How to create an eSignature for the 612 arizona department of revenue azdor

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the 612 Arizona Department Of Revenue Azdor and how can it assist businesses?

The 612 Arizona Department Of Revenue Azdor is a vital resource for businesses operating in Arizona, as it provides crucial tax information and guidelines. By utilizing the resources and tools offered by Azdor, businesses can ensure compliance and streamline their tax reporting processes.

-

How does airSlate SignNow support the 612 Arizona Department Of Revenue Azdor requirements?

airSlate SignNow helps businesses create, send, and eSign documents that comply with the 612 Arizona Department Of Revenue Azdor standards. Our platform ensures that all signed documents are legally binding and securely stored, making it easier for businesses to maintain compliance with state regulations.

-

What features does airSlate SignNow offer for eSigning documents related to the 612 Arizona Department Of Revenue Azdor?

airSlate SignNow provides features such as customizable templates, advanced security options, and seamless workflow integrations to simplify eSigning your documents related to the 612 Arizona Department Of Revenue Azdor. These features enhance user experience and ensure that your documents are processed efficiently.

-

Is airSlate SignNow cost-effective for handling the 612 Arizona Department Of Revenue Azdor documents?

Yes, airSlate SignNow is a cost-effective solution for businesses managing documents related to the 612 Arizona Department Of Revenue Azdor. Our pricing plans are designed to fit various business sizes and ensure that you can manage your eSignature needs without breaking the bank.

-

Can I integrate airSlate SignNow with other applications to facilitate 612 Arizona Department Of Revenue Azdor processes?

Absolutely! airSlate SignNow offers extensive integration capabilities with various applications, enhancing your workflow when dealing with 612 Arizona Department Of Revenue Azdor processes. You can easily connect with tools like CRM systems, document management software, and more for a seamless experience.

-

What benefits can I expect from using airSlate SignNow for 612 Arizona Department Of Revenue Azdor paperwork?

Using airSlate SignNow for your 612 Arizona Department Of Revenue Azdor paperwork provides numerous benefits, including improved efficiency, secure document storage, and expedited signing processes. This empowers your business to focus more on growth and less on administrative tasks, ensuring compliance with Azdor regulations.

-

How does airSlate SignNow ensure the security of documents related to the 612 Arizona Department Of Revenue Azdor?

airSlate SignNow employs advanced security measures to protect your documents related to the 612 Arizona Department Of Revenue Azdor. Our platform uses encryption, secure access controls, and comprehensive audit trails to ensure that your sensitive information remains confidential and secure.

Get more for 612 Arizona Department Of Revenue Azdor

Find out other 612 Arizona Department Of Revenue Azdor

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors