What is Schedule K 1 Form 1120s

What is Schedule K-1 Form 1120S

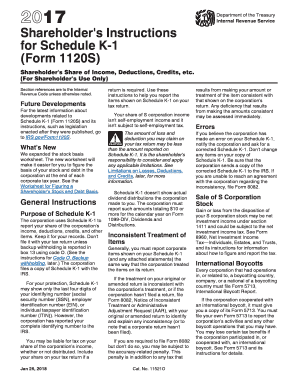

The Schedule K-1 Form 1120S is a tax document used by S corporations to report income, deductions, and credits to shareholders. It provides detailed information about each shareholder's share of the corporation's income, losses, and other tax attributes. This form is essential for shareholders to accurately report their earnings on their individual tax returns. Each shareholder receives a separate K-1, which reflects their specific financial stake in the corporation.

Key elements of Schedule K-1 Form 1120S

Understanding the key elements of the Schedule K-1 Form 1120S is crucial for accurate tax reporting. The form includes:

- Shareholder Information: Name, address, and taxpayer identification number of the shareholder.

- Entity Information: Name and Employer Identification Number (EIN) of the S corporation.

- Income and Losses: Breakdown of the shareholder's share of ordinary business income, rental income, and capital gains.

- Deductions and Credits: Information on any deductions or credits that the shareholder can claim.

- Other Information: Additional details that may affect the shareholder's tax situation, such as foreign transactions or tax-exempt income.

Steps to complete Schedule K-1 Form 1120S

Completing the Schedule K-1 Form 1120S involves several steps to ensure accuracy and compliance. Here are the steps to follow:

- Gather Information: Collect all necessary financial data from the corporation's records, including income, deductions, and credits.

- Fill Out the Form: Enter the shareholder's information, including their name, address, and taxpayer identification number. Provide the corporation's details as well.

- Report Income and Deductions: Accurately report the shareholder's share of income, losses, and any applicable deductions or credits.

- Review for Accuracy: Double-check all entries for correctness to avoid any discrepancies that could lead to tax issues.

- Distribute Copies: Provide each shareholder with their completed K-1 form for their tax filings.

IRS Guidelines for Schedule K-1 Form 1120S

The IRS provides specific guidelines for the preparation and submission of the Schedule K-1 Form 1120S. It is important for S corporations to adhere to these guidelines to ensure compliance. Key points include:

- Timely filing of the form with the IRS and distribution to shareholders is required.

- Accurate reporting of all income, deductions, and credits is essential to avoid penalties.

- Shareholders must report the information from the K-1 on their personal tax returns, typically on Form 1040.

Filing Deadlines for Schedule K-1 Form 1120S

Filing deadlines for the Schedule K-1 Form 1120S are important for both the corporation and its shareholders. The S corporation must file its tax return, including the K-1s, by the fifteenth day of the third month after the end of its tax year. For calendar year filers, this typically falls on March 15. Shareholders must use the information from the K-1 to complete their individual tax returns, which are due on April 15.

Legal use of Schedule K-1 Form 1120S

The legal use of the Schedule K-1 Form 1120S is governed by IRS regulations. It is essential for shareholders to use the information provided on the K-1 to accurately report their income and deductions on their tax returns. Failure to do so can result in penalties or audits. Additionally, the K-1 serves as a legal document that substantiates the shareholder's income from the S corporation, which is critical for tax compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is schedule k 1 form 1120s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1120s instructions k 1 codes?

1120s instructions k 1 codes are specific codes used on Schedule K-1 forms to report income, deductions, and credits from S corporations. Understanding these codes is crucial for accurate tax reporting and compliance. Our platform provides resources to help you navigate these instructions effectively.

-

How can airSlate SignNow help with 1120s instructions k 1 codes?

airSlate SignNow simplifies the process of managing documents related to 1120s instructions k 1 codes. With our eSigning capabilities, you can easily send, sign, and store important tax documents securely. This streamlines your workflow and ensures compliance with tax regulations.

-

What features does airSlate SignNow offer for tax document management?

Our platform offers features such as customizable templates, automated workflows, and secure cloud storage, all designed to assist with tax document management, including those related to 1120s instructions k 1 codes. These features enhance efficiency and reduce the risk of errors in your tax filings.

-

Is airSlate SignNow cost-effective for small businesses dealing with 1120s instructions k 1 codes?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing 1120s instructions k 1 codes. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning features without breaking the bank. This affordability helps small businesses stay compliant with tax requirements.

-

Can I integrate airSlate SignNow with other accounting software for 1120s instructions k 1 codes?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage documents related to 1120s instructions k 1 codes. This integration allows for a smoother workflow, enabling you to sync data and documents effortlessly across platforms.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those involving 1120s instructions k 1 codes, offers numerous benefits. You gain access to a user-friendly interface, enhanced security features, and the ability to track document status in real-time. These advantages help ensure that your tax processes are efficient and compliant.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including those related to 1120s instructions k 1 codes. Our platform is designed to keep your information safe, giving you peace of mind when managing important tax filings.

Get more for What Is Schedule K 1 Form 1120s

Find out other What Is Schedule K 1 Form 1120s

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple