FORM 4972 K KENTUCKY TAX on LUMP SUM DISTRIBUTIONS

What is the 2024 Kentucky 4972K Tax on Lump Sum Distributions

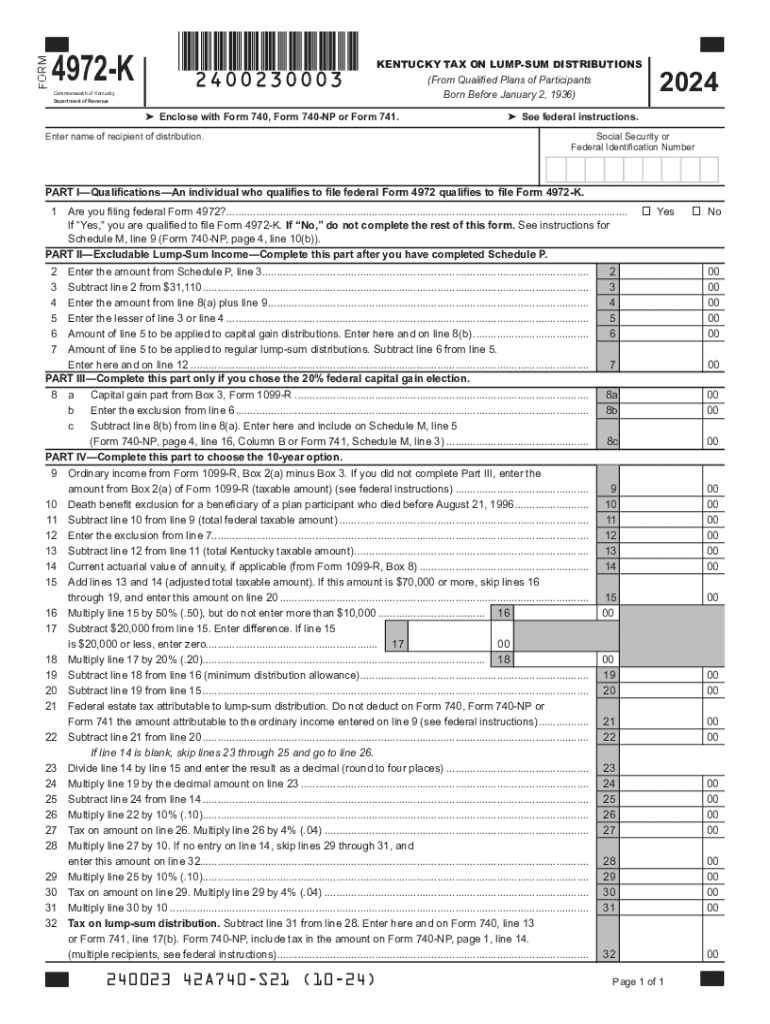

The 2024 Kentucky 4972K form is designed for taxpayers who receive lump sum distributions from retirement plans or pensions. This form allows individuals to calculate the state tax owed on these distributions. It is essential for those who wish to report their income accurately and comply with Kentucky tax regulations. The form specifically addresses the tax implications of receiving a one-time payment rather than regular income, which can significantly affect the overall tax liability.

How to Use the 2024 Kentucky 4972K Tax on Lump Sum Distributions

Using the 2024 Kentucky 4972K form involves several steps. First, gather all necessary information regarding the lump sum distribution, including the total amount received and any taxes withheld. Next, complete the form by entering the required financial details, including your personal information and the specifics of the distribution. Once filled out, the form should be submitted according to Kentucky state guidelines, either by mail or electronically, depending on your preference.

Steps to Complete the 2024 Kentucky 4972K Tax on Lump Sum Distributions

Completing the 2024 Kentucky 4972K form requires careful attention to detail. Follow these steps:

- Collect all relevant documents, including your W-2s and any 1099 forms related to the distribution.

- Fill in your personal information at the top of the form, ensuring accuracy.

- Report the total amount of the lump sum distribution in the designated section.

- Calculate any applicable taxes based on the provided instructions.

- Review the form for completeness and accuracy before submission.

Legal Use of the 2024 Kentucky 4972K Tax on Lump Sum Distributions

The 2024 Kentucky 4972K form is legally recognized for reporting state tax on lump sum distributions. It is important for taxpayers to use this form correctly to avoid penalties or issues with the Kentucky Department of Revenue. Filing this form accurately ensures compliance with state tax laws and helps in the proper assessment of tax liabilities related to retirement distributions.

Filing Deadlines / Important Dates

For the 2024 tax year, the filing deadline for the Kentucky 4972K form typically aligns with the federal tax filing deadline, which is usually April fifteenth. It is essential to be aware of any changes to this date, as well as any extensions that may apply. Timely submission of the form is crucial to avoid late fees or penalties imposed by the state.

Required Documents

When completing the 2024 Kentucky 4972K form, certain documents are required to ensure accurate reporting. These include:

- Your W-2 forms showing income and tax withheld.

- Any 1099 forms related to the lump sum distribution.

- Documentation of any previous tax payments made on the distribution.

Having these documents ready will streamline the process and help prevent errors in your submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4972 k kentucky tax on lump sum distributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Kentucky 4972 and how does it work?

The 2024 Kentucky 4972 is a document that facilitates the eSigning process for various business transactions. With airSlate SignNow, you can easily send, sign, and manage these documents online, ensuring a seamless workflow. This solution is designed to enhance efficiency and reduce the time spent on paperwork.

-

How much does airSlate SignNow cost for the 2024 Kentucky 4972?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing the 2024 Kentucky 4972. We offer flexible pricing tiers that cater to businesses of all sizes, ensuring you get the best value for your eSigning needs. Contact us for a detailed quote tailored to your requirements.

-

What features does airSlate SignNow offer for the 2024 Kentucky 4972?

airSlate SignNow provides a range of features for the 2024 Kentucky 4972, including customizable templates, real-time tracking, and secure cloud storage. These features streamline the signing process and enhance document management, making it easier for businesses to handle their paperwork efficiently. Additionally, our platform is user-friendly, ensuring a smooth experience for all users.

-

What are the benefits of using airSlate SignNow for the 2024 Kentucky 4972?

Using airSlate SignNow for the 2024 Kentucky 4972 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. By digitizing the signing process, businesses can save time and resources while ensuring compliance with legal standards. This solution also allows for easy access to documents from anywhere, promoting flexibility in business operations.

-

Can I integrate airSlate SignNow with other tools for the 2024 Kentucky 4972?

Yes, airSlate SignNow can be integrated with various tools and platforms to enhance your workflow for the 2024 Kentucky 4972. Our solution supports integrations with popular applications like Google Drive, Salesforce, and more. This interoperability allows you to streamline your processes and manage documents more effectively.

-

Is airSlate SignNow secure for handling the 2024 Kentucky 4972?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents, including the 2024 Kentucky 4972, are protected with advanced encryption and compliance measures. We adhere to industry standards to safeguard your data, giving you peace of mind while managing sensitive information. Your security is our top priority.

-

How can I get started with airSlate SignNow for the 2024 Kentucky 4972?

Getting started with airSlate SignNow for the 2024 Kentucky 4972 is simple. You can sign up for a free trial on our website to explore the features and benefits firsthand. Once you're ready, choose a plan that fits your needs and start sending and signing documents with ease.

Get more for FORM 4972 K KENTUCKY TAX ON LUMP SUM DISTRIBUTIONS

- Jury instruction plaintiffs instructions personal injury auto accident mississippi form

- 808 336 7377 sob form

- Instructions for completion of the application and form

- Recording requested by and when recorded mail to form

- Project quest attendance verification form

- Shs form b paste 2x2 colored picture w white back ground usls edu

- Employment bapplicationb lnss non ca lifetouch lifetouch form

- Prc form 61 participant statement u s postal regulatory prc

Find out other FORM 4972 K KENTUCKY TAX ON LUMP SUM DISTRIBUTIONS

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement