KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 Form

Understanding the Kentucky Estimated Tax Voucher Installment 1

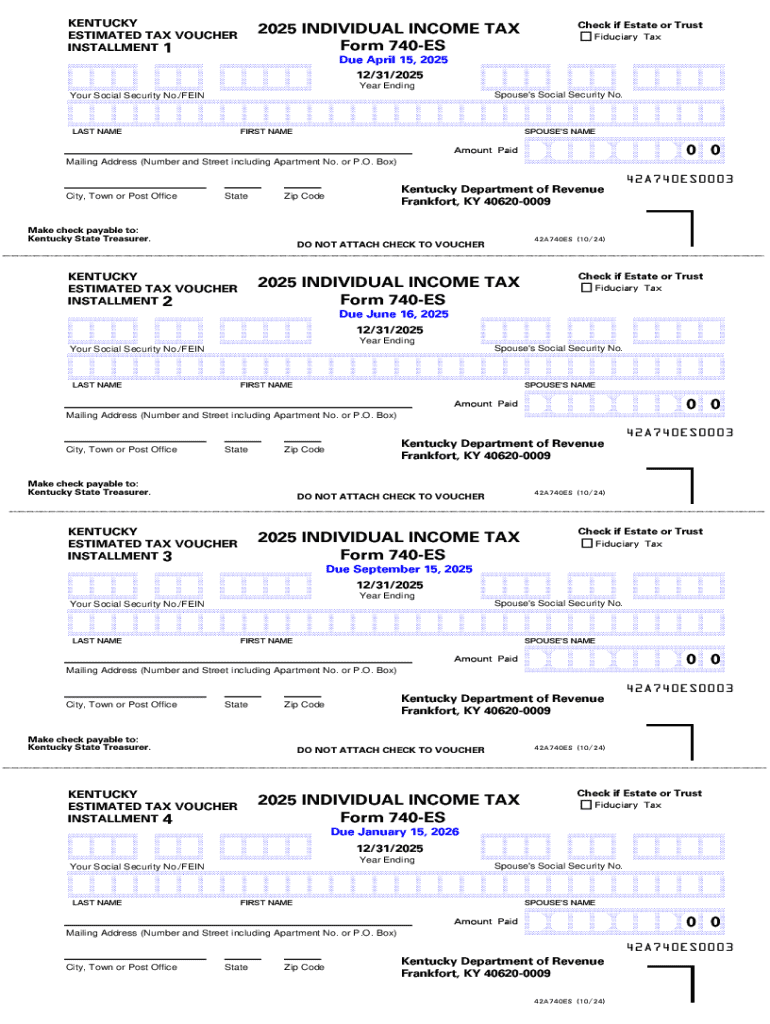

The Kentucky Estimated Tax Voucher Installment 1 is a crucial document for individuals and businesses in Kentucky who expect to owe state income tax. This voucher is specifically designed for making estimated tax payments throughout the year. It helps taxpayers manage their tax obligations by allowing them to pay in installments rather than in a lump sum at the end of the tax year. Understanding this form is essential for compliance with state tax laws and for avoiding penalties.

Steps to Complete the Kentucky Estimated Tax Voucher Installment 1

Completing the Kentucky Estimated Tax Voucher Installment 1 involves several straightforward steps:

- Gather necessary financial information, including your expected income and deductions for the year.

- Calculate your estimated tax liability using the appropriate tax rates.

- Fill out the voucher form with your personal information, including your name, address, and Social Security number.

- Indicate the amount of estimated tax you plan to pay with this installment.

- Review the form for accuracy before submission.

How to Obtain the Kentucky Estimated Tax Voucher Installment 1

Taxpayers can obtain the Kentucky Estimated Tax Voucher Installment 1 from the Kentucky Department of Revenue's website. The form is typically available for download in PDF format, allowing you to print it for completion. Additionally, you may request a physical copy by contacting the Department of Revenue directly. Ensure you have the most current version of the form for the tax year.

Filing Deadlines for the Kentucky Estimated Tax Voucher Installment 1

It is important to be aware of the filing deadlines for the Kentucky Estimated Tax Voucher Installment 1. Typically, the first installment is due on April 15 of the tax year. Subsequent installments are due on June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes, so timely submission is crucial.

Legal Use of the Kentucky Estimated Tax Voucher Installment 1

The Kentucky Estimated Tax Voucher Installment 1 is legally recognized as a means for taxpayers to fulfill their estimated tax payment obligations. Using this form properly ensures compliance with Kentucky tax laws. It is important to retain a copy of the completed voucher for your records, as it serves as proof of payment in case of any future inquiries or audits by the Kentucky Department of Revenue.

Penalties for Non-Compliance with Estimated Tax Payments

Failure to submit the Kentucky Estimated Tax Voucher Installment 1 on time can lead to significant penalties. Taxpayers may incur interest on the unpaid balance, as well as additional penalties for late payments. The Kentucky Department of Revenue may also assess a penalty based on the amount of tax owed. Understanding these consequences underscores the importance of timely and accurate submissions.

Handy tips for filling out KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 online

Quick steps to complete and e-sign KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant service for optimum straightforwardness. Use signNow to electronically sign and share KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kentucky estimated tax voucher installment 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2025 form 740es and why is it important?

The 2025 form 740es is a crucial document for individuals and businesses in Kentucky to report estimated income tax payments. Understanding this form is essential for compliance and avoiding penalties. Using airSlate SignNow, you can easily eSign and send your 2025 form 740es securely.

-

How can airSlate SignNow help with the 2025 form 740es?

airSlate SignNow simplifies the process of completing and submitting the 2025 form 740es by providing an intuitive platform for eSigning documents. You can quickly fill out the form, add your signature, and send it directly to the relevant authorities. This streamlines your tax filing process and ensures accuracy.

-

What are the pricing options for using airSlate SignNow for the 2025 form 740es?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial. For users needing to manage the 2025 form 740es and other documents, affordable monthly subscriptions are available. Each plan includes features that enhance document management and eSigning capabilities.

-

Is airSlate SignNow secure for handling the 2025 form 740es?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 2025 form 740es and other sensitive documents are protected. The platform uses advanced encryption and secure cloud storage to safeguard your information. You can trust that your data is safe while using our services.

-

Can I integrate airSlate SignNow with other software for the 2025 form 740es?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for the 2025 form 740es. Whether you use accounting software or CRM systems, our platform can connect with them to streamline your document management process.

-

What features does airSlate SignNow provide for the 2025 form 740es?

airSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking for the 2025 form 740es. These tools help you manage your documents efficiently and ensure timely submissions. The user-friendly interface makes it easy to navigate and utilize these features.

-

How does airSlate SignNow improve the efficiency of submitting the 2025 form 740es?

By using airSlate SignNow, you can signNowly reduce the time spent on submitting the 2025 form 740es. The platform allows for quick eSigning, document sharing, and tracking, which minimizes delays. This efficiency helps you meet deadlines and stay organized during tax season.

Get more for KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1

Find out other KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online