Business Activities Questionnaire REV 203D Form

What is the Business Activities Questionnaire REV 203D

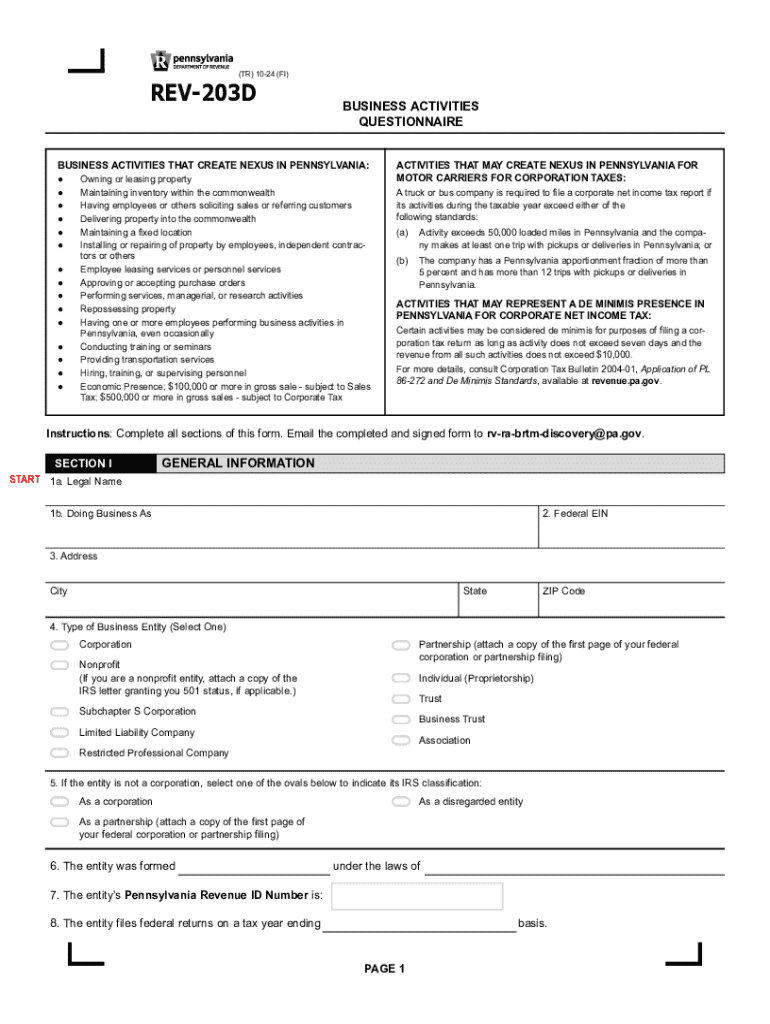

The Business Activities Questionnaire REV 203D is a vital form used in Pennsylvania for businesses to report their activities to the state. This questionnaire helps determine the tax obligations of various business entities operating within Pennsylvania. It is essential for compliance with state regulations and provides the necessary information for the Pennsylvania Department of Revenue to assess business tax liabilities accurately.

How to use the Business Activities Questionnaire REV 203D

To effectively use the Business Activities Questionnaire REV 203D, businesses should first gather all relevant information regarding their operations. This includes details about the nature of the business, revenue sources, and any partnerships or affiliations. Once the necessary information is compiled, businesses can fill out the form, ensuring all sections are completed accurately to avoid delays or penalties. The completed questionnaire can then be submitted to the appropriate state department for processing.

Steps to complete the Business Activities Questionnaire REV 203D

Completing the Business Activities Questionnaire REV 203D involves several key steps:

- Gather necessary business information, including financial records and operational details.

- Obtain the latest version of the REV 203D form from the Pennsylvania Department of Revenue.

- Fill out the form, providing accurate and complete information in all sections.

- Review the completed form for any errors or omissions.

- Submit the form via the designated submission method, whether online, by mail, or in person.

Legal use of the Business Activities Questionnaire REV 203D

The legal use of the Business Activities Questionnaire REV 203D is crucial for maintaining compliance with Pennsylvania tax laws. Businesses are required to submit this form to report their activities accurately. Failure to do so can result in penalties, fines, or other legal repercussions. It is essential that businesses understand their obligations under state law and ensure timely and accurate submissions of the questionnaire.

Key elements of the Business Activities Questionnaire REV 203D

The key elements of the Business Activities Questionnaire REV 203D include:

- Business identification information, such as name, address, and federal tax identification number.

- A detailed description of business activities, including types of services or products offered.

- Revenue information, detailing sources of income and financial performance.

- Information on partnerships, affiliations, or other business relationships.

Filing Deadlines / Important Dates

Filing deadlines for the Business Activities Questionnaire REV 203D are crucial for compliance. Businesses should be aware of the specific dates set by the Pennsylvania Department of Revenue to avoid late submissions. Typically, the form must be filed annually, and any changes in business activities should be reported promptly. Keeping track of these deadlines helps ensure that businesses remain in good standing with state tax authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business activities questionnaire rev 203d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing Pennsylvania activities?

airSlate SignNow offers a range of features that streamline document management for Pennsylvania activities. Users can easily create, send, and eSign documents, ensuring a smooth workflow. The platform also includes templates and automation tools that enhance efficiency, making it ideal for businesses involved in various activities across Pennsylvania.

-

How does airSlate SignNow support businesses in Pennsylvania activities?

airSlate SignNow supports businesses in Pennsylvania activities by providing a user-friendly platform for document signing and management. This solution helps organizations save time and reduce paperwork, allowing them to focus on their core activities. With its robust features, businesses can efficiently handle contracts, agreements, and other essential documents.

-

What is the pricing structure for airSlate SignNow for Pennsylvania activities?

The pricing structure for airSlate SignNow is designed to be cost-effective for businesses engaging in Pennsylvania activities. Plans are available to suit various needs, from small businesses to larger enterprises. Each plan includes essential features, ensuring that users can find a solution that fits their budget while effectively managing their document workflows.

-

Can airSlate SignNow integrate with other tools for Pennsylvania activities?

Yes, airSlate SignNow offers integrations with various tools that are commonly used for Pennsylvania activities. This includes CRM systems, project management software, and cloud storage services. These integrations enhance the platform's functionality, allowing users to streamline their processes and improve overall productivity.

-

What benefits does airSlate SignNow provide for Pennsylvania activities?

The benefits of using airSlate SignNow for Pennsylvania activities include increased efficiency, reduced turnaround times, and enhanced security for document handling. Businesses can quickly send and receive signed documents, which accelerates their operations. Additionally, the platform ensures compliance with legal standards, providing peace of mind for users.

-

Is airSlate SignNow suitable for all types of Pennsylvania activities?

Absolutely! airSlate SignNow is suitable for a wide range of Pennsylvania activities, from real estate transactions to legal agreements. Its versatility makes it an ideal choice for various industries, ensuring that all businesses can benefit from its document management capabilities. Regardless of the activity, users can customize their workflows to meet specific needs.

-

How secure is airSlate SignNow for handling Pennsylvania activities?

airSlate SignNow prioritizes security, making it a reliable choice for handling Pennsylvania activities. The platform employs advanced encryption and security protocols to protect sensitive documents. Users can trust that their information is safe while managing their eSigning processes, ensuring compliance with industry regulations.

Get more for Business Activities Questionnaire REV 203D

Find out other Business Activities Questionnaire REV 203D

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy