Birt Ez Form

What is the Birt ez form?

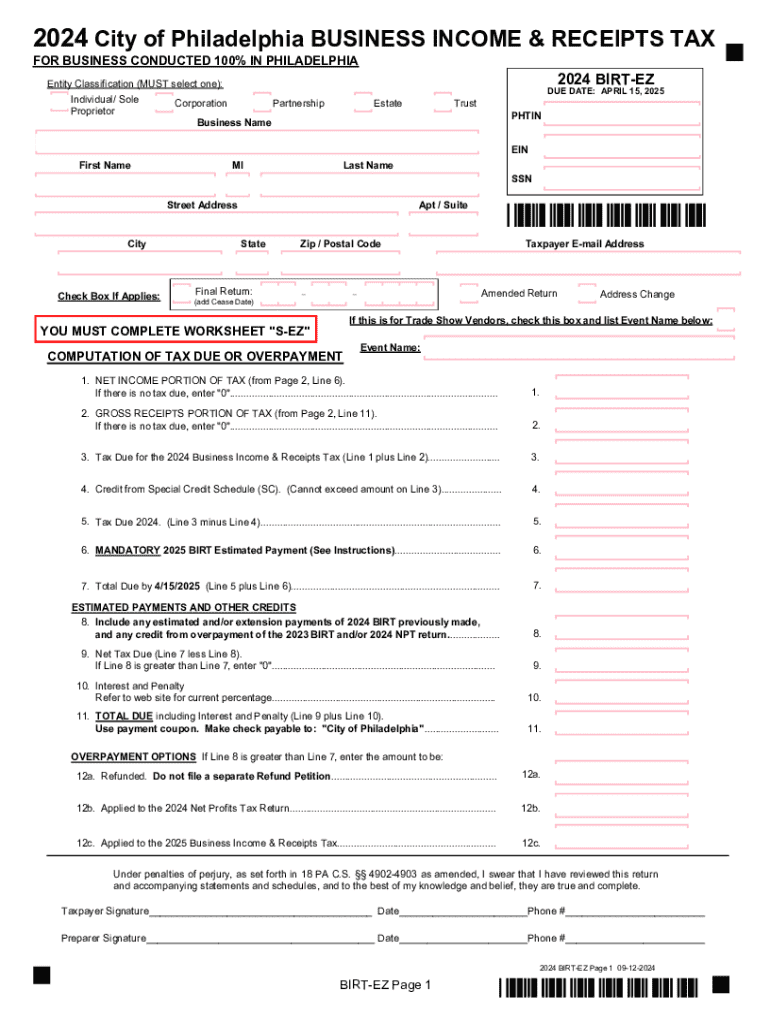

The Birt ez form, also known as the Business Income and Receipts Tax (BIRT) form, is a tax document used primarily in Philadelphia, Pennsylvania. It is designed for businesses to report their gross receipts and income for tax purposes. This form is essential for ensuring compliance with local tax regulations and is typically required for various business entities, including corporations, partnerships, and sole proprietorships. Understanding the Birt ez form is crucial for business owners to accurately report their earnings and fulfill their tax obligations.

How to use the Birt ez form

Using the Birt ez form involves several key steps. First, businesses must gather all necessary financial information, including total gross receipts and any applicable deductions. Next, the form should be filled out accurately, ensuring all figures are correct and up-to-date. After completing the form, businesses can submit it either electronically or by mail, depending on their preference and the specific requirements set by the city of Philadelphia. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Birt ez form

Completing the Birt ez form requires careful attention to detail. Follow these steps for accurate submission:

- Gather financial documents, including income statements and receipts.

- Fill out the form with your business information, including name, address, and tax identification number.

- Report total gross receipts and any allowable deductions, ensuring accuracy.

- Review the completed form for errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Birt ez form

The Birt ez form must be used in accordance with local tax laws and regulations. Businesses are legally obligated to file this form if they meet specific income thresholds or operate within the city limits of Philadelphia. Failure to file the Birt ez form can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their legal responsibilities regarding this form to avoid non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Birt ez form are critical for compliance. Typically, businesses must submit their Birt ez forms by the end of the tax year, which aligns with the calendar year in most cases. However, specific deadlines may vary based on the business structure or any extensions granted. It is advisable for businesses to stay informed about any changes to deadlines to ensure timely filing and avoid potential penalties.

Who Issues the Birt ez form?

The Birt ez form is issued by the City of Philadelphia's Department of Revenue. This department is responsible for overseeing the collection of local taxes, including the Business Income and Receipts Tax. Businesses can obtain the form directly from the Department of Revenue's website or through their office. Understanding the issuing authority helps businesses know where to seek assistance or clarification regarding the form and its requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the birt ez 771370528

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BIRT EZ form?

A BIRT EZ form is a user-friendly document designed for easy data collection and electronic signatures. It streamlines the process of filling out forms and ensures that all necessary information is captured efficiently. With airSlate SignNow, you can create and manage BIRT EZ forms seamlessly.

-

How does airSlate SignNow enhance BIRT EZ forms?

airSlate SignNow enhances BIRT EZ forms by providing a platform that allows for easy eSigning and document management. Users can customize their forms, automate workflows, and track the status of submissions in real-time. This integration signNowly improves efficiency and reduces the time spent on paperwork.

-

What are the pricing options for using BIRT EZ forms with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs when using BIRT EZ forms. You can choose from various subscription tiers, each providing a range of features to suit your requirements. Visit our pricing page for detailed information on plans and features.

-

Can I integrate BIRT EZ forms with other applications?

Yes, airSlate SignNow allows for seamless integration of BIRT EZ forms with various applications. This includes popular tools like Google Drive, Salesforce, and more. These integrations help streamline your workflow and enhance productivity by connecting your favorite apps.

-

What are the benefits of using BIRT EZ forms in my business?

Using BIRT EZ forms in your business can signNowly improve efficiency and accuracy in data collection. They reduce the need for paper forms and manual data entry, leading to faster processing times. Additionally, airSlate SignNow's eSigning capabilities ensure that your documents are legally binding and secure.

-

Is it easy to create a BIRT EZ form with airSlate SignNow?

Absolutely! Creating a BIRT EZ form with airSlate SignNow is straightforward and user-friendly. The platform provides intuitive tools and templates that guide you through the form creation process, allowing you to customize fields and settings to meet your specific needs.

-

How secure are BIRT EZ forms created with airSlate SignNow?

BIRT EZ forms created with airSlate SignNow are highly secure, utilizing advanced encryption and compliance measures. Your data is protected throughout the signing process, ensuring confidentiality and integrity. We prioritize security to give you peace of mind when handling sensitive information.

Get more for Birt ez

- John lewis pet insurance claim form 65382664

- Service record sample form

- Metu neter vol 4 pdf download form

- Unhcr vendor registration form rev feb 10 unhcr

- Shra forms 78692512

- Gopher tortoise permit refund request form 469025028

- Department of defense dod cloud information technology it project initial contact form

- Concourse loan agreementthis loan agreement ag form

Find out other Birt ez

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online