Rev 1500 Form

What is the Rev 1500

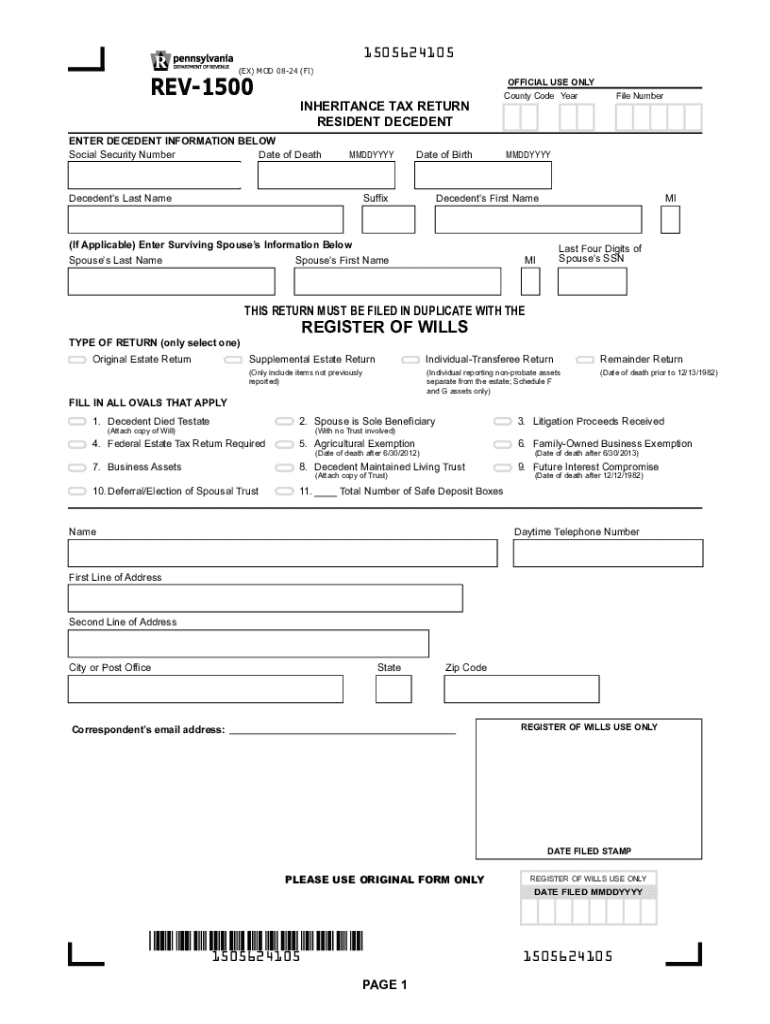

The Rev 1500 is the official Pennsylvania inheritance tax return form. It is utilized by individuals or estates to report and calculate the inheritance tax owed on assets transferred after a person's death. This form is essential for ensuring compliance with state tax laws regarding inheritance, as it provides the necessary information to determine the tax liability based on the value of the estate and the relationship of the heirs to the deceased.

How to use the Rev 1500

Using the Rev 1500 involves several steps to accurately report inheritance tax. First, gather all relevant financial information regarding the deceased's assets, including real estate, bank accounts, and personal property. Next, complete the form by providing details such as the decedent's information, the value of the estate, and the names and relationships of the beneficiaries. Once completed, the form must be submitted to the Pennsylvania Department of Revenue for processing.

Steps to complete the Rev 1500

Completing the Rev 1500 requires careful attention to detail. Follow these steps:

- Obtain the Rev 1500 form from the Pennsylvania Department of Revenue.

- Fill in the decedent's name, date of death, and social security number.

- List all assets and their values, including real estate and personal property.

- Identify the beneficiaries and their relationship to the decedent.

- Calculate the inheritance tax based on the total value of the estate and applicable rates.

- Sign and date the form before submission.

Required Documents

When filing the Rev 1500, certain documents are necessary to support the information provided. These may include:

- A copy of the death certificate.

- Appraisals for real estate and valuable personal property.

- Bank statements and financial documents showing asset values.

- Any previous tax returns that may affect the inheritance tax calculation.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Rev 1500 to avoid penalties. The inheritance tax return must be filed within nine months of the decedent's date of death. If the return is filed within three months, a discount on the tax due may be available. Failure to meet these deadlines can result in additional interest and penalties on the owed tax.

Form Submission Methods

The Rev 1500 can be submitted through various methods. Taxpayers have the option to file the form online through the Pennsylvania Department of Revenue's e-filing system, or they can mail a completed paper form to the appropriate address. In-person submissions may also be possible at designated revenue offices, providing additional flexibility for those needing assistance with the process.

Handy tips for filling out Rev 1500 online

Quick steps to complete and e-sign Rev 1500 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a HIPAA and GDPR compliant service for maximum simplicity. Use signNow to e-sign and send out Rev 1500 for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1500 771243666

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the inheritance tax in Pennsylvania?

The inheritance tax in Pennsylvania is a tax imposed on the transfer of assets from a deceased person to their heirs. The rate varies based on the relationship of the heir to the deceased, with direct descendants typically facing lower rates. Understanding the inheritance tax Pennsylvania can help you plan your estate effectively.

-

How does airSlate SignNow help with inheritance tax documentation?

airSlate SignNow provides a streamlined solution for managing and signing documents related to inheritance tax Pennsylvania. With its easy-to-use interface, you can quickly prepare, send, and eSign necessary forms, ensuring compliance and reducing delays in the inheritance process.

-

What are the costs associated with using airSlate SignNow for inheritance tax documents?

airSlate SignNow offers a cost-effective solution for managing inheritance tax Pennsylvania documents. Pricing plans are flexible, allowing you to choose a package that fits your needs, whether you're an individual or a business. This ensures you get the best value while handling important tax-related paperwork.

-

Can I integrate airSlate SignNow with other software for managing inheritance tax?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage inheritance tax Pennsylvania efficiently. Whether you use accounting software or document management systems, these integrations help streamline your workflow and improve productivity.

-

What features does airSlate SignNow offer for handling inheritance tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing inheritance tax Pennsylvania forms. These tools simplify the process, making it easier to ensure that all necessary documents are completed accurately and on time.

-

Is airSlate SignNow secure for handling sensitive inheritance tax information?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive inheritance tax Pennsylvania information. You can confidently manage and sign documents, knowing that your data is secure and private.

-

How can airSlate SignNow benefit estate planners dealing with inheritance tax?

For estate planners, airSlate SignNow offers a powerful tool to manage inheritance tax Pennsylvania efficiently. Its user-friendly platform allows for quick document preparation and eSigning, which can signNowly reduce the time spent on administrative tasks, allowing planners to focus on their clients' needs.

Get more for Rev 1500

- Providence request record set form

- Widexpro form

- Indian overseas bank deposit slip form

- Stock transfer form equiniti shareview

- How to demit from eastern star form

- Travel permit lake county fl probation services lakecountyfl form

- Induction certificate template form

- 1 60 017 02 15 household inventory booklet website layoutindd afi form

Find out other Rev 1500

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF