DR 1778 E Filer Attachment Form

What is the DR 1778 E Filer Attachment Form

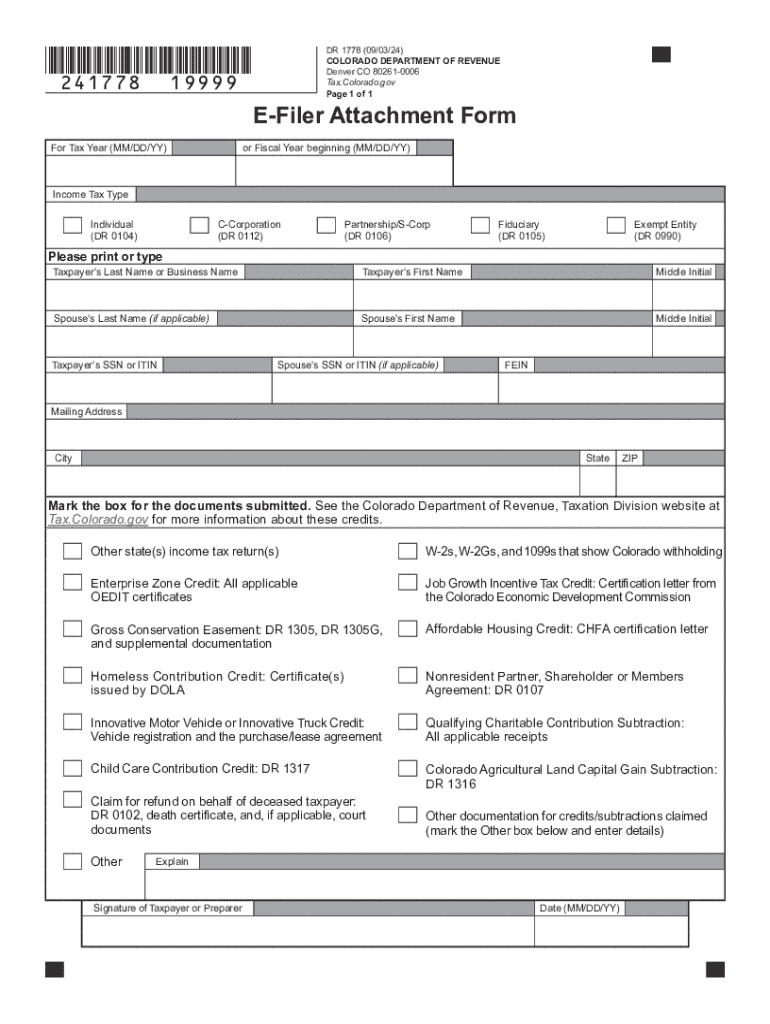

The DR 1778 E Filer Attachment Form is a specific document used in Colorado for electronic filing of state tax returns. This form serves as an attachment for taxpayers who need to submit additional information or documentation along with their electronic tax filings. It is essential for ensuring that all necessary details are included in the submission, which helps streamline the processing of tax returns by the Colorado Department of Revenue.

How to use the DR 1778 E Filer Attachment Form

To effectively use the DR 1778 E Filer Attachment Form, taxpayers must first determine if they need to submit this form based on their individual tax situation. Once confirmed, the form should be completed with accurate information, including any required attachments. After filling out the form, it can be uploaded electronically through the e-filing system used for submitting state tax returns. This process simplifies the filing experience and ensures that all relevant information is included in one submission.

Steps to complete the DR 1778 E Filer Attachment Form

Completing the DR 1778 E Filer Attachment Form involves several key steps:

- Download the form from the Colorado Department of Revenue's website or obtain it through your tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide any additional information or documentation required for your specific tax situation.

- Review the form for accuracy and completeness before submission.

- Upload the completed form as an attachment when filing your state tax return electronically.

Key elements of the DR 1778 E Filer Attachment Form

Key elements of the DR 1778 E Filer Attachment Form include:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Additional Documentation: Space is provided for taxpayers to list any additional documents being submitted as part of their tax filing.

- Signature: A signature line is included for the taxpayer to certify the information provided is accurate.

Legal use of the DR 1778 E Filer Attachment Form

The legal use of the DR 1778 E Filer Attachment Form is governed by Colorado tax laws. Taxpayers must ensure that the form is used in compliance with state regulations, which includes submitting it only when required. Misuse of the form, such as providing false information or failing to submit necessary documentation, can lead to penalties or legal repercussions. Understanding the legal implications is crucial for all taxpayers using this form.

Form Submission Methods

The DR 1778 E Filer Attachment Form can be submitted electronically through the Colorado Department of Revenue's e-filing system. This method is preferred as it allows for quicker processing and confirmation of receipt. Alternatively, if electronic filing is not an option, taxpayers may print the form and submit it via mail along with their tax return. However, submitting electronically is the most efficient way to ensure timely processing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 1778 e filer attachment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the colorado e filer attachment form?

The colorado e filer attachment form is a digital document that allows users to submit additional information electronically when filing taxes in Colorado. This form streamlines the filing process, making it easier for taxpayers to provide necessary attachments without the hassle of paper submissions.

-

How can airSlate SignNow help with the colorado e filer attachment form?

airSlate SignNow simplifies the process of completing and submitting the colorado e filer attachment form by providing an intuitive platform for eSigning and document management. Users can easily fill out the form, add signatures, and send it securely, ensuring compliance with Colorado's e-filing requirements.

-

Is there a cost associated with using airSlate SignNow for the colorado e filer attachment form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that facilitate the completion of the colorado e filer attachment form, ensuring that users can choose an option that fits their budget while benefiting from a cost-effective solution.

-

What features does airSlate SignNow offer for the colorado e filer attachment form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of using the colorado e filer attachment form. These tools help users manage their documents efficiently and ensure that all necessary information is submitted accurately.

-

Can I integrate airSlate SignNow with other software for the colorado e filer attachment form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing users to streamline their workflow when dealing with the colorado e filer attachment form. This means you can connect your existing tools and enhance productivity without disrupting your current processes.

-

What are the benefits of using airSlate SignNow for the colorado e filer attachment form?

Using airSlate SignNow for the colorado e filer attachment form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing the process, users can save time and ensure that their submissions are handled securely and in compliance with state regulations.

-

Is airSlate SignNow user-friendly for completing the colorado e filer attachment form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the colorado e filer attachment form. The platform's intuitive interface allows users to navigate through the process effortlessly, even if they are not tech-savvy.

Get more for DR 1778 E Filer Attachment Form

Find out other DR 1778 E Filer Attachment Form

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement