Virginia Individual Income Tax Declaration for Electronic Filing Form

What is the Virginia Individual Income Tax Declaration For Electronic Filing

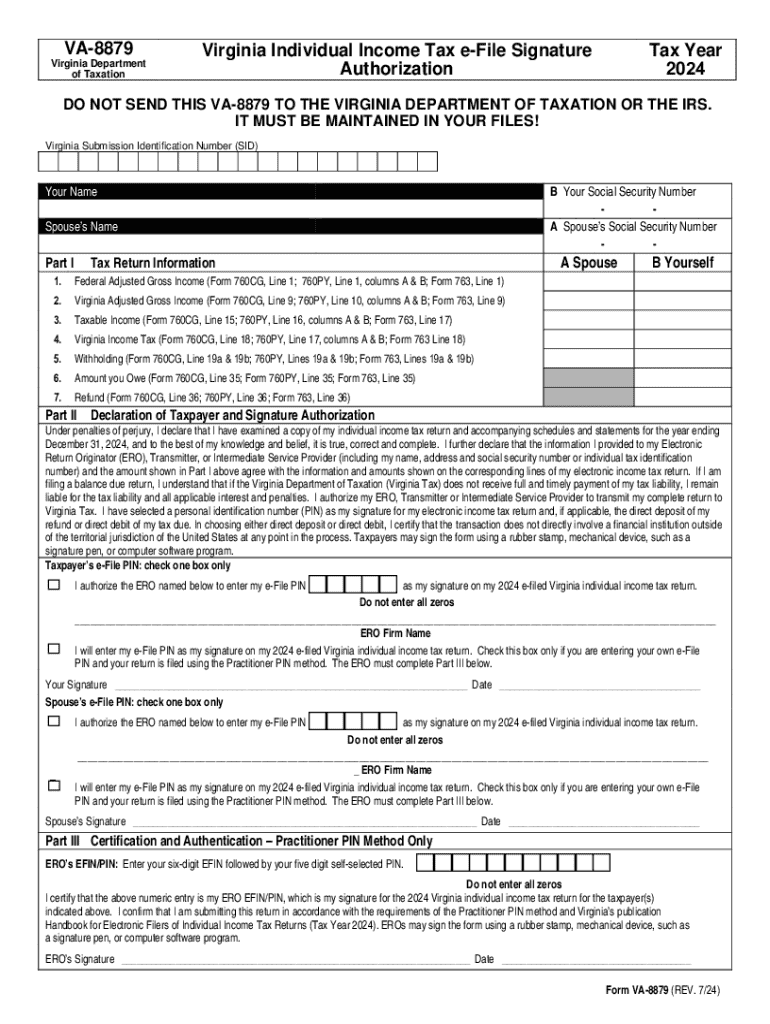

The Virginia Individual Income Tax Declaration For Electronic Filing, commonly referred to as the Virginia e-file authorization form, is a crucial document for taxpayers who wish to file their state income tax returns electronically. This form serves as a declaration that authorizes the use of electronic filing methods and confirms the taxpayer's consent for the electronic submission of their tax information. It is essential for ensuring that the filing process adheres to state regulations and provides a secure way to process sensitive financial information.

How to use the Virginia Individual Income Tax Declaration For Electronic Filing

Using the Virginia e-file authorization form involves several straightforward steps. First, taxpayers must complete the form with accurate personal information, including their name, Social Security number, and any relevant tax details. Once filled out, the form must be signed electronically or physically, depending on the filing method chosen. After signing, the form is submitted along with the electronic tax return to the Virginia Department of Taxation. It is important to ensure that all information is correct to avoid delays or issues with the filing process.

Steps to complete the Virginia Individual Income Tax Declaration For Electronic Filing

Completing the Virginia e-file authorization form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the Virginia Department of Taxation website or your tax preparation software.

- Fill in your personal information, including your full name, address, and Social Security number.

- Provide the necessary tax return details, including the type of return being filed.

- Sign the form electronically or manually, ensuring that your signature matches the name provided.

- Submit the completed form alongside your electronic tax return.

Legal use of the Virginia Individual Income Tax Declaration For Electronic Filing

The Virginia e-file authorization form is legally binding and must be used in accordance with state tax laws. By signing this form, taxpayers confirm their consent for electronic filing and acknowledge that the information provided is accurate to the best of their knowledge. Failure to comply with the legal requirements associated with this form can result in penalties or delays in processing tax returns. Taxpayers should retain a copy of the signed form for their records as proof of authorization.

Required Documents

To successfully complete the Virginia Individual Income Tax Declaration For Electronic Filing, taxpayers should have the following documents on hand:

- Personal identification, such as a driver's license or Social Security card.

- Previous year’s tax return for reference.

- W-2 forms from employers and any 1099 forms for additional income.

- Documentation for any deductions or credits being claimed.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Virginia e-file authorization form. Typically, the deadline for filing individual income tax returns in Virginia is May 1st of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may apply if they need additional time to gather necessary documentation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia individual income tax declaration for electronic filing 772038996

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia e file authorization form?

The Virginia e file authorization form is a document that allows taxpayers to authorize a third party to file their tax returns electronically on their behalf. This form simplifies the e-filing process and ensures that your tax information is handled securely and efficiently.

-

How can I obtain the Virginia e file authorization form?

You can easily obtain the Virginia e file authorization form from the Virginia Department of Taxation's official website. Additionally, airSlate SignNow provides a streamlined process to access and complete this form digitally, making it convenient for users.

-

What are the benefits of using the Virginia e file authorization form?

Using the Virginia e file authorization form allows for quicker processing of your tax returns and reduces the risk of errors. It also enables you to grant permission to trusted tax professionals, ensuring that your filings are handled accurately and on time.

-

Is there a cost associated with the Virginia e file authorization form?

The Virginia e file authorization form itself is free to obtain and submit. However, if you choose to use a tax professional or e-filing service, there may be associated fees for their services, which can vary based on the provider.

-

Can I eSign the Virginia e file authorization form?

Yes, you can eSign the Virginia e file authorization form using airSlate SignNow. Our platform allows you to securely sign documents electronically, ensuring that your authorization is valid and legally binding without the need for physical paperwork.

-

What features does airSlate SignNow offer for the Virginia e file authorization form?

airSlate SignNow offers a variety of features for the Virginia e file authorization form, including customizable templates, secure storage, and easy sharing options. These features enhance the efficiency of managing your tax documents and streamline the e-filing process.

-

How does airSlate SignNow integrate with other tax software for the Virginia e file authorization form?

airSlate SignNow seamlessly integrates with various tax software solutions, allowing you to easily manage the Virginia e file authorization form alongside your other tax documents. This integration simplifies the workflow and ensures that all necessary forms are completed and submitted accurately.

Get more for Virginia Individual Income Tax Declaration For Electronic Filing

- Carnet autosurveillance diabete gestationnel form

- Dd form 565

- Appeal form preferred medical plan medicare

- 595 1396 dhs criminal history record check dhs criminal history record check form b dhs iowa

- Download new india stevedores liability claim form download new india stevedores liability claim form

- Technology license agreement template form

- Technology loan agreement template form

- Technology transfer agreement template form

Find out other Virginia Individual Income Tax Declaration For Electronic Filing

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU