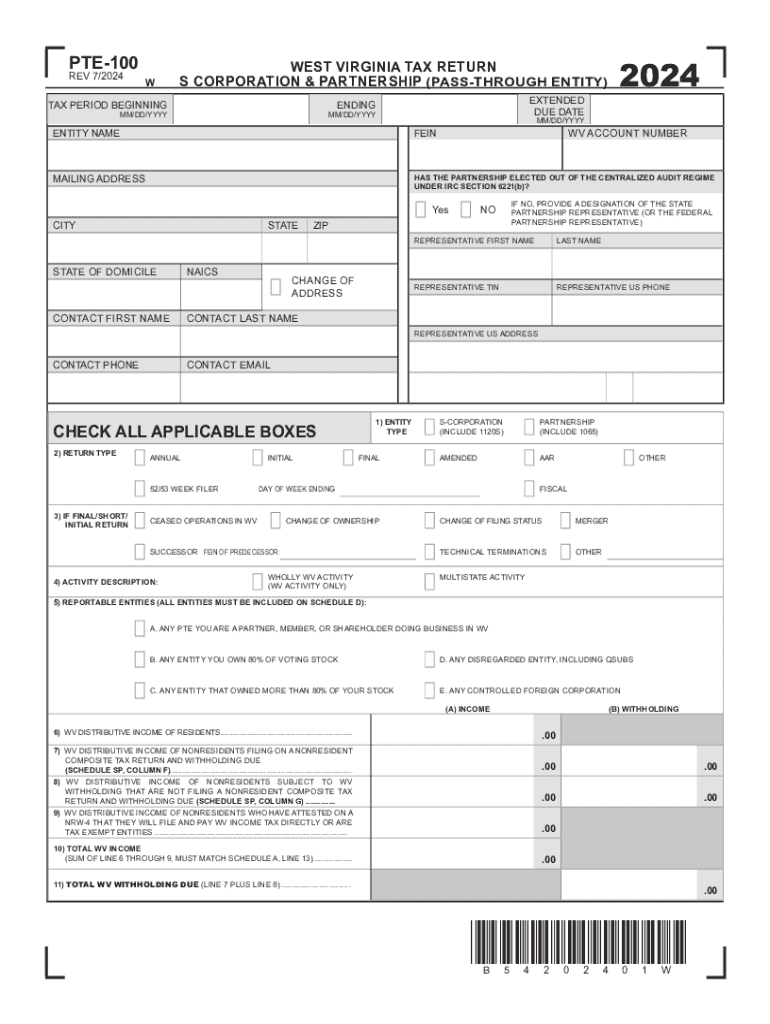

PTE 100 REV 7 W WEST VIRGINIA TAX RETURN S CO 2024-2026

Understanding the West Virginia Partnership Return Form SPF 100

The West Virginia Form SPF 100 is a tax return specifically designed for partnerships operating within the state. This form is essential for reporting income, deductions, and other tax-related information for partnerships. It is important to understand that this form must be filed annually to comply with state tax regulations.

Partnerships are required to report their income and pay taxes on behalf of their partners. The SPF 100 captures various details, including the partnership's total income, distributive share of income, and any applicable deductions. Accurately completing this form is crucial to avoid penalties and ensure compliance with West Virginia tax laws.

Steps to Complete the West Virginia Form SPF 100

Filling out the West Virginia Form SPF 100 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Complete the identification section of the form, including the partnership's name, address, and federal employer identification number (EIN).

- Report total income earned by the partnership during the tax year.

- Detail any deductions that the partnership is eligible to claim, such as business expenses.

- Calculate the distributive share of income for each partner and ensure it is accurately reported.

- Review the completed form for accuracy and completeness before submission.

Each step is crucial to ensure the form is filled out correctly, which can help avoid delays in processing or potential audits by the state.

Filing Deadlines for the West Virginia Form SPF 100

The filing deadline for the West Virginia Form SPF 100 typically aligns with the federal tax filing deadline. Partnerships must submit their returns by the fifteenth day of the fourth month following the end of their tax year. For most partnerships operating on a calendar year, this means the form is due by April 15.

It is essential to be aware of any changes in deadlines or extensions that may apply, especially in light of any state-specific regulations or announcements. Timely filing helps avoid penalties and interest charges on any taxes owed.

Required Documents for the West Virginia Form SPF 100

To complete the West Virginia Form SPF 100, partnerships must gather several key documents:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of all expenses and deductions claimed.

- Partner agreements that outline each partner's share of income and losses.

- Any prior year tax returns that may be relevant for comparison.

Having these documents organized and readily available can streamline the filing process and ensure accuracy in reporting.

Form Submission Methods for the West Virginia SPF 100

Partnerships have multiple options for submitting the West Virginia Form SPF 100:

- Online Submission: Partnerships can file electronically through the West Virginia State Tax Department's e-filing system, which is often the fastest method.

- Mail: Completed forms can be printed and mailed to the appropriate state tax office. Ensure that the correct address is used to avoid delays.

- In-Person: Some partnerships may choose to deliver their forms directly to a local tax office, which can provide immediate confirmation of receipt.

Choosing the right submission method can help ensure timely processing of the tax return.

Key Elements of the West Virginia Form SPF 100

The West Virginia Form SPF 100 includes several key elements that are crucial for accurate reporting:

- Partnership Identification: This section captures the basic information about the partnership, including its legal name and EIN.

- Income Reporting: Partnerships must detail all sources of income, including sales and services rendered.

- Deductions: This section allows partnerships to claim various business-related expenses, which can reduce taxable income.

- Distributive Share: Each partner's share of income and deductions must be reported, ensuring transparency and compliance.

Understanding these elements is vital for completing the form accurately and efficiently.

Create this form in 5 minutes or less

Find and fill out the correct pte 100 rev 7 w west virginia tax return s co

Create this form in 5 minutes!

How to create an eSignature for the pte 100 rev 7 w west virginia tax return s co

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv form spf 100 2024?

The wv form spf 100 2024 is a specific document required for certain business transactions in West Virginia. It is essential for compliance and ensures that all necessary information is accurately captured. Using airSlate SignNow, you can easily create, send, and eSign this form, streamlining your workflow.

-

How can airSlate SignNow help with the wv form spf 100 2024?

airSlate SignNow simplifies the process of managing the wv form spf 100 2024 by providing an intuitive platform for document creation and eSigning. You can customize the form to meet your specific needs and ensure that all parties can sign it electronically, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the wv form spf 100 2024?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the management of documents like the wv form spf 100 2024. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for the wv form spf 100 2024 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the wv form spf 100 2024. These integrations allow you to connect with tools you already use, making it easier to automate workflows and improve efficiency.

-

What features does airSlate SignNow offer for the wv form spf 100 2024?

airSlate SignNow provides a range of features designed to streamline the handling of the wv form spf 100 2024. Key features include customizable templates, secure eSigning, and real-time tracking of document status, ensuring that you have complete control over your documents.

-

How does airSlate SignNow ensure the security of the wv form spf 100 2024?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the wv form spf 100 2024. The platform employs advanced encryption and compliance measures to protect your data, ensuring that your documents are safe and secure throughout the signing process.

-

Can I access the wv form spf 100 2024 on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage the wv form spf 100 2024 from your smartphone or tablet. This flexibility ensures that you can send, sign, and track documents on the go, enhancing your productivity.

Get more for PTE 100 REV 7 W WEST VIRGINIA TAX RETURN S CO

- Motion in limine 374151677 form

- Canadian c spine rule form

- Request for work permit work experience ca dept of education the statement of intent to employ minor and request for work form

- Maryland state retirement form 714

- Bright house networks form

- Bws honolulu test forms for bfpa

- Manulife gp5232 form

- Notice to terminate lease agreement template form

Find out other PTE 100 REV 7 W WEST VIRGINIA TAX RETURN S CO

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple