Form 205 Collector S Annual Settlement

What is the Form 205 Collector’s Annual Settlement

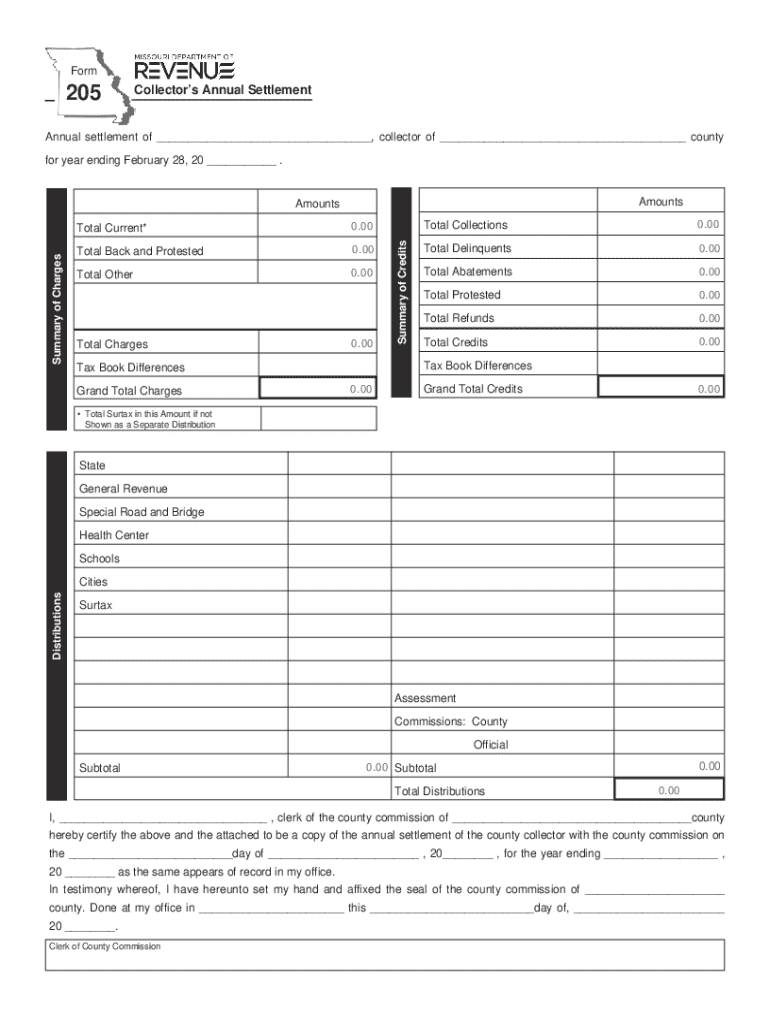

The Form 205 Collector’s Annual Settlement is a crucial document used by local government entities in the United States to report and reconcile the collection of taxes and other revenues. This form provides a comprehensive overview of the financial activities of a collector over the course of a year. It ensures transparency and accountability in the management of public funds.

Typically, the form includes details such as total collections, refunds issued, and the distribution of funds to various governmental departments. It is essential for maintaining accurate records and ensuring compliance with state and federal regulations.

How to use the Form 205 Collector’s Annual Settlement

Using the Form 205 Collector’s Annual Settlement involves several steps that ensure accurate reporting of financial activities. First, gather all relevant financial records, including receipts, invoices, and bank statements, to support the information reported on the form.

Next, fill out the form by entering the required data in the designated fields. This includes total amounts collected, any adjustments made, and the distribution of funds. After completing the form, review it carefully for accuracy and completeness before submission.

Steps to complete the Form 205 Collector’s Annual Settlement

Completing the Form 205 Collector’s Annual Settlement requires attention to detail and adherence to specific guidelines. Follow these steps:

- Collect all necessary financial documentation, including records of collections and disbursements.

- Begin filling out the form, starting with the identification section, which includes the collector's name and the reporting period.

- Input total collections, ensuring to categorize them correctly according to the type of revenue.

- Include any refunds or adjustments made during the reporting period.

- Calculate the net collections and ensure all figures are accurate.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Form 205 Collector’s Annual Settlement

The Form 205 Collector’s Annual Settlement is legally mandated for local government collectors to ensure compliance with state laws regarding financial reporting. This form must be filed annually to provide a transparent account of revenue collection and distribution.

Failure to submit this form accurately and on time can result in penalties or legal repercussions for the collector and the governing body. It is essential to understand the legal implications of the information reported on the form, as it may be subject to audits and reviews by state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 205 Collector’s Annual Settlement can vary by state and local jurisdiction. Generally, the form must be submitted annually, often by a specific date following the end of the fiscal year.

It is crucial to check with local government guidelines to determine the exact deadlines. Missing these deadlines can lead to penalties or complications in the financial reporting process.

Required Documents

To complete the Form 205 Collector’s Annual Settlement accurately, several documents are typically required:

- Detailed records of all collections made during the reporting period.

- Documentation of any refunds or adjustments issued.

- Bank statements that reflect the total amounts collected and deposited.

- Any relevant correspondence or notices from state or local authorities regarding financial reporting.

Having these documents organized and readily available will facilitate a smoother completion of the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 205 collectors annual settlement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 205 Collector’s Annual Settlement?

The Form 205 Collector’s Annual Settlement is a crucial document used by tax collectors to report their financial activities for the year. It provides a comprehensive overview of collected taxes and ensures transparency in financial reporting. Understanding this form is essential for compliance and accurate record-keeping.

-

How can airSlate SignNow help with the Form 205 Collector’s Annual Settlement?

airSlate SignNow streamlines the process of preparing and submitting the Form 205 Collector’s Annual Settlement. Our platform allows users to easily create, send, and eSign the necessary documents, ensuring that all information is accurately captured and securely stored. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the Form 205 Collector’s Annual Settlement?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, including those preparing the Form 205 Collector’s Annual Settlement. Our plans are designed to be cost-effective, providing access to essential features without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for managing the Form 205 Collector’s Annual Settlement?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow when managing the Form 205 Collector’s Annual Settlement. These integrations allow you to connect with accounting software, CRM systems, and other tools, ensuring that all your data is synchronized and easily accessible.

-

What features does airSlate SignNow offer for the Form 205 Collector’s Annual Settlement?

airSlate SignNow provides a range of features specifically designed to assist with the Form 205 Collector’s Annual Settlement. These include customizable templates, secure eSigning, and document tracking, which help ensure that your submissions are accurate and timely. Our user-friendly interface makes it easy to navigate through the process.

-

How does airSlate SignNow ensure the security of the Form 205 Collector’s Annual Settlement?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the Form 205 Collector’s Annual Settlement. We utilize advanced encryption protocols and secure cloud storage to protect your data. Additionally, our platform complies with industry standards to ensure that your information remains confidential.

-

Can I access the Form 205 Collector’s Annual Settlement from multiple devices?

Absolutely! airSlate SignNow is designed to be accessible from any device with internet connectivity. Whether you’re using a desktop, tablet, or smartphone, you can easily manage and eSign your Form 205 Collector’s Annual Settlement on the go, ensuring flexibility and convenience.

Get more for Form 205 Collector s Annual Settlement

Find out other Form 205 Collector s Annual Settlement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement