If Your Nebraska Individual Income Tax, After Allowance of Nebraska Personal Exemption Form

Understanding the Nebraska Individual Income Tax After Allowance of Personal Exemption

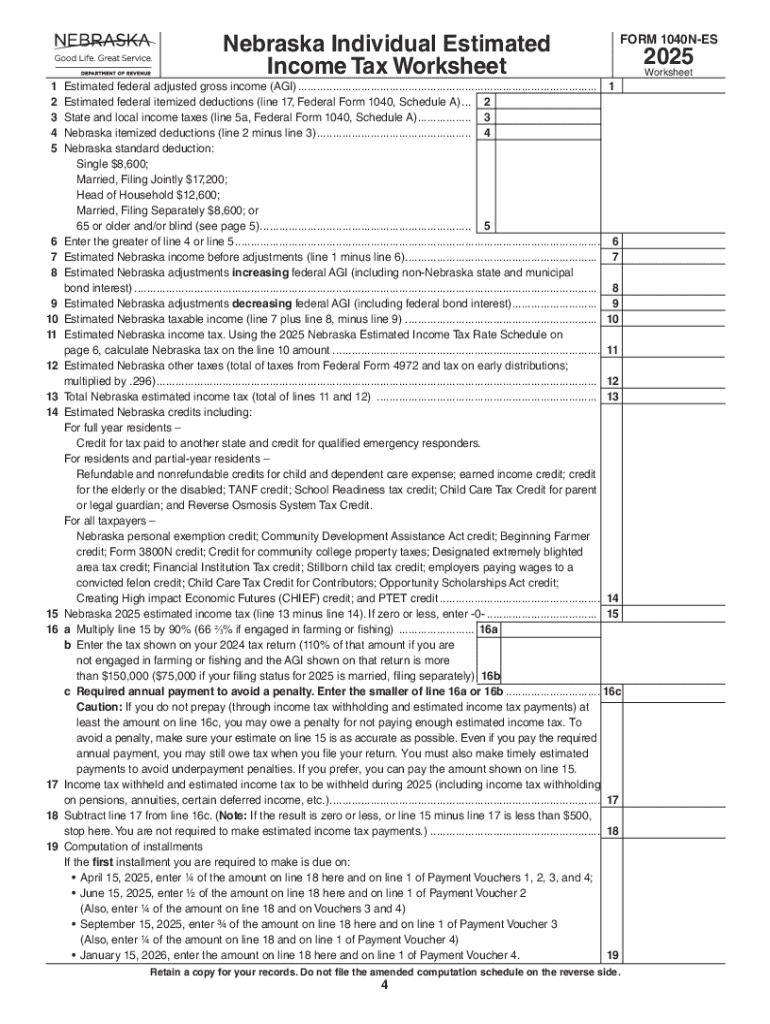

The Nebraska Individual Income Tax is calculated based on a taxpayer's total income, adjusted for specific exemptions, including the Nebraska personal exemption. This exemption allows individuals to reduce their taxable income, which can lead to a lower overall tax liability. For 2025, taxpayers should be aware of the specific amounts allowed for personal exemptions, as these can vary annually and impact the final tax calculation.

Steps to Complete the Nebraska Individual Income Tax Form 1040N ES

Filling out the Nebraska Form 1040N ES involves several key steps:

- Gather Documentation: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Calculate Total Income: Sum all sources of income to determine your total income for the year.

- Apply Deductions: Deduct the Nebraska personal exemption and any other applicable deductions from your total income.

- Determine Tax Liability: Use the Nebraska tax tables to find your tax liability based on your taxable income.

- Estimate Payments: If applicable, calculate any estimated tax payments due using the 1040N ES form.

- Review and Submit: Double-check all entries for accuracy before submitting the form either online or by mail.

Filing Deadlines for Nebraska Individual Estimated Income Tax

Taxpayers should be aware of the important deadlines associated with the Nebraska Form 1040N ES. Generally, estimated tax payments for the year are due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Filing on time is crucial to avoid penalties and interest on unpaid taxes.

Required Documents for Completing the Nebraska Form 1040N ES

To accurately complete the Nebraska Form 1040N ES, taxpayers need to gather several essential documents:

- Income Statements: W-2 forms from employers, 1099 forms for freelance or contract work, and any other income documentation.

- Deductions and Exemptions: Records of any deductions claimed, including the Nebraska personal exemption.

- Previous Tax Returns: It may be helpful to reference prior year returns for consistency and accuracy.

Submission Methods for Nebraska Form 1040N ES

Taxpayers have several options for submitting the Nebraska Form 1040N ES:

- Online Submission: Many taxpayers choose to file electronically through the Nebraska Department of Revenue's website or authorized e-filing services.

- Mail Submission: The form can also be printed and mailed to the appropriate address provided by the Nebraska Department of Revenue.

- In-Person Submission: Taxpayers may visit local tax offices for assistance and to submit forms directly.

Penalties for Non-Compliance with Nebraska Tax Regulations

Failure to comply with Nebraska tax regulations, including timely filing and payment of estimated taxes, can result in penalties. These may include:

- Late Filing Penalty: A percentage of the unpaid tax amount for each month the return is late.

- Late Payment Penalty: A penalty for not paying the tax owed by the due date.

- Interest Charges: Interest accrues on unpaid taxes from the due date until paid in full.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the if your nebraska individual income tax after allowance of nebraska personal exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Form 1040N ES?

The Nebraska Form 1040N ES is an estimated tax payment form used by individuals in Nebraska to report and pay their estimated income taxes. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. Using airSlate SignNow, you can easily eSign and submit your Nebraska Form 1040N ES online.

-

How can airSlate SignNow help with the Nebraska Form 1040N ES?

airSlate SignNow simplifies the process of completing and submitting the Nebraska Form 1040N ES by providing an intuitive platform for eSigning documents. You can fill out the form, sign it electronically, and send it directly to the appropriate tax authorities, saving you time and reducing paperwork. This ensures that your estimated tax payments are submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the Nebraska Form 1040N ES?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that streamline the eSigning process, including the ability to manage multiple documents like the Nebraska Form 1040N ES. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Nebraska Form 1040N ES?

airSlate SignNow provides features such as document templates, real-time tracking, and secure cloud storage, which are beneficial for managing the Nebraska Form 1040N ES. You can create templates for your tax forms, track who has signed them, and store them securely for future reference. These features enhance efficiency and organization in your tax preparation process.

-

Can I integrate airSlate SignNow with other software for the Nebraska Form 1040N ES?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly connect your workflow when handling the Nebraska Form 1040N ES. Whether you use accounting software or customer relationship management tools, these integrations help streamline your document management and eSigning processes.

-

What are the benefits of using airSlate SignNow for tax forms like the Nebraska Form 1040N ES?

Using airSlate SignNow for tax forms like the Nebraska Form 1040N ES offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. The platform allows for quick eSigning and submission, minimizing the risk of mistakes that can occur with paper forms. Additionally, your documents are stored securely, ensuring compliance and peace of mind.

-

Is airSlate SignNow user-friendly for completing the Nebraska Form 1040N ES?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Nebraska Form 1040N ES. The platform features a straightforward interface that guides users through the process of filling out and signing documents. Whether you're tech-savvy or not, you'll find it simple to navigate and use.

Get more for If Your Nebraska Individual Income Tax, After Allowance Of Nebraska Personal Exemption

- 19419 texas administrative code texas secretary of state form

- Non disclosure agreement nda template sample form

- State flood hazard disclosures survey national association form

- Motion for waiver of 90 day waiting period in the form

- Pa affidavit service form

- State of south carolina in the family court county of form

- Tennessee power of attorney revocation form

- Form power attorney minor child

Find out other If Your Nebraska Individual Income Tax, After Allowance Of Nebraska Personal Exemption

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free