A 4 Arizona and W 4 Federal Tax Withholding Form

What is the A-4 Arizona and W-4 Federal Tax Withholding?

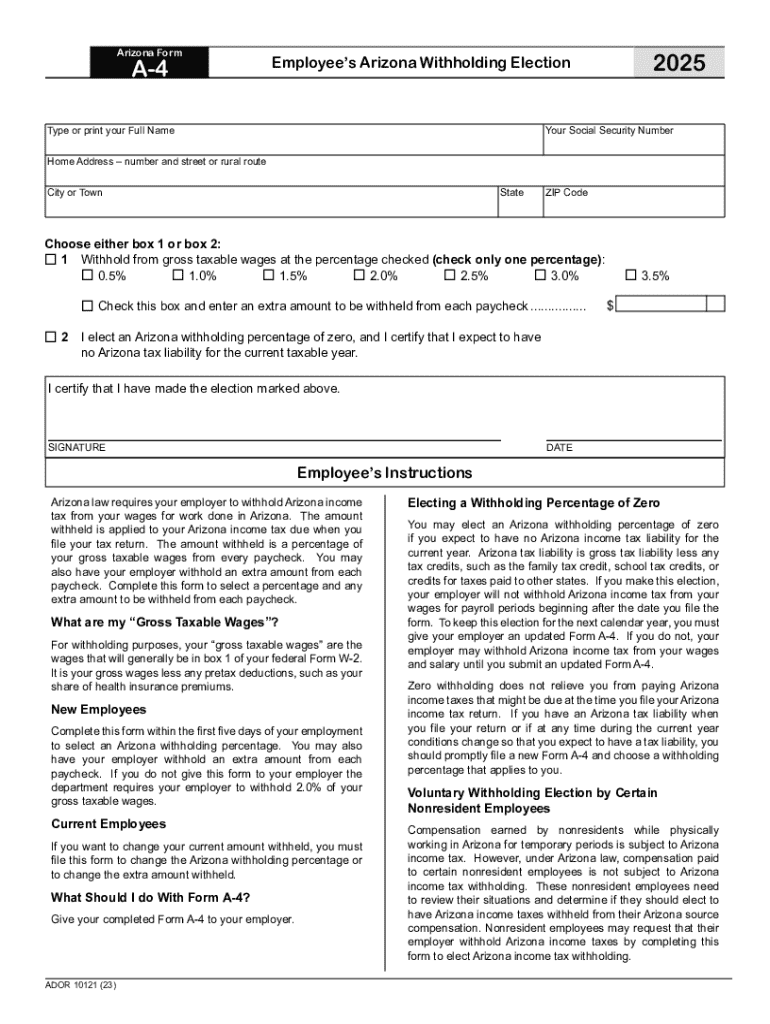

The A-4 Arizona form is a state-specific tax withholding form used by employees in Arizona to determine the amount of state income tax to be withheld from their paychecks. It allows individuals to claim personal allowances that can reduce their tax liability. The W-4 form, on the other hand, is a federal withholding form used nationwide to determine federal income tax withholding. Both forms are essential for ensuring that the correct amount of taxes is withheld throughout the year, helping taxpayers avoid underpayment penalties or large tax bills at year-end.

Steps to Complete the A-4 Arizona and W-4 Federal Tax Withholding

Completing the A-4 Arizona and W-4 forms involves several straightforward steps:

- Begin with the A-4 form by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status and the number of allowances you wish to claim. This can affect your withholding amount.

- For the W-4 form, provide your personal details and filing status. Calculate the number of allowances based on your situation.

- Review both forms for accuracy before submission to ensure the correct information is provided.

- Submit the completed forms to your employer, who will use them to adjust your withholding accordingly.

Legal Use of the A-4 Arizona and W-4 Federal Tax Withholding

Both the A-4 Arizona and W-4 forms are legally required for employees to ensure proper tax withholding. Employers must maintain these forms on file to comply with state and federal tax laws. Employees are encouraged to review and update their forms whenever their financial situation changes, such as a change in marital status or the birth of a child, to maintain compliance and avoid potential tax issues.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the A-4 Arizona and W-4 forms. Generally, employees should submit these forms to their employer at the start of employment or whenever there is a change in their tax situation. Employers are required to implement the changes in withholding as soon as possible, typically within the first payroll period after receiving the updated forms. Additionally, keeping track of annual tax deadlines, such as the filing date for income tax returns, is essential for proper tax management.

Required Documents

When completing the A-4 Arizona and W-4 forms, certain documents may be necessary to support your claims for allowances. These can include:

- Social Security card or number for identification.

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of any other income sources or deductions that may affect your withholding.

Having these documents on hand can facilitate accurate completion of the forms and ensure compliance with tax regulations.

Form Submission Methods

Employees can typically submit the A-4 Arizona and W-4 forms to their employer through various methods, including:

- In-person delivery to the human resources or payroll department.

- Email submission, if permitted by the employer.

- Mailing the forms directly to the employer’s office, although this method may take longer for processing.

Employers should provide clear guidelines on how they prefer to receive these forms to streamline the process.

Handy tips for filling out A 4 Arizona And W 4 Federal Tax Withholding online

Quick steps to complete and e-sign A 4 Arizona And W 4 Federal Tax Withholding online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a GDPR and HIPAA compliant service for maximum simplicity. Use signNow to e-sign and send out A 4 Arizona And W 4 Federal Tax Withholding for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a 4 arizona and w 4 federal tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it benefit businesses in Arizona?

airSlate SignNow is a powerful eSignature solution that empowers businesses in Arizona from various industries to streamline their document signing processes. By using our platform, companies can save time and reduce costs associated with traditional paper-based methods. The user-friendly interface ensures that even those unfamiliar with technology can easily navigate the system.

-

How much does airSlate SignNow cost for businesses in Arizona?

Pricing for airSlate SignNow varies based on the plan you choose, making it a cost-effective solution for businesses in Arizona from startups to large enterprises. We offer flexible pricing tiers that cater to different needs, ensuring that you only pay for the features you require. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow offer for users in Arizona?

airSlate SignNow offers a range of features designed to enhance document management for businesses in Arizona from eSigning to document templates and real-time tracking. Users can easily create, send, and sign documents securely, ensuring compliance with legal standards. Our platform also integrates with various applications to streamline workflows.

-

Can airSlate SignNow integrate with other software commonly used in Arizona?

Yes, airSlate SignNow can seamlessly integrate with a variety of software applications that businesses in Arizona from different sectors commonly use. This includes CRM systems, cloud storage solutions, and productivity tools, allowing for a more efficient workflow. Our integration capabilities help you connect your existing tools with ease.

-

Is airSlate SignNow secure for businesses operating in Arizona?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents signed by businesses in Arizona from various sectors are protected. We utilize advanced encryption methods and comply with industry standards to safeguard sensitive information. You can trust that your documents are secure with us.

-

How does airSlate SignNow improve efficiency for Arizona businesses?

By using airSlate SignNow, businesses in Arizona from all industries can signNowly improve their operational efficiency. The platform allows for quick document turnaround times, reducing the need for physical signatures and paperwork. This leads to faster decision-making and improved productivity across teams.

-

What types of documents can be signed using airSlate SignNow in Arizona?

airSlate SignNow supports a wide variety of document types that businesses in Arizona from different fields may need to sign. This includes contracts, agreements, forms, and more. Our platform is versatile, making it easy to manage all your document signing needs in one place.

Get more for A 4 Arizona And W 4 Federal Tax Withholding

Find out other A 4 Arizona And W 4 Federal Tax Withholding

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer