PIT ADJ NEW MEXICO SCHEDULE of ADDITIONS, DED 2024

Understanding the PIT ADJ New Mexico Schedule of Additions and Deductions

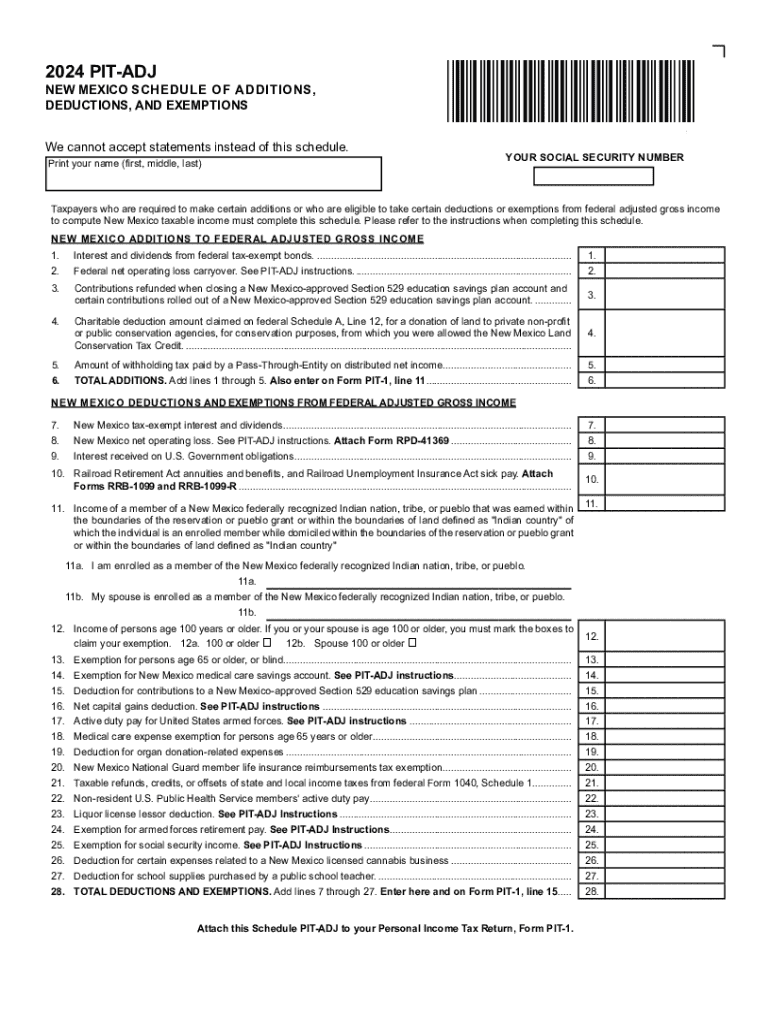

The PIT ADJ New Mexico Schedule of Additions and Deductions is a crucial form for taxpayers in New Mexico. It allows individuals to report specific additions and deductions that may affect their state income tax liability. This form is particularly important for accurately calculating taxable income, as it helps ensure that taxpayers receive the appropriate credits and deductions available under New Mexico law. Familiarity with this form can lead to more efficient tax filing and potential savings.

Steps to Complete the PIT ADJ New Mexico Schedule of Additions and Deductions

Completing the PIT ADJ requires careful attention to detail. Here are the general steps to follow:

- Gather necessary documentation, including income statements and previous tax returns.

- Identify the specific additions and deductions applicable to your situation.

- Fill out the form accurately, ensuring all information is current and complete.

- Review all entries for accuracy before submission.

- Submit the completed form along with your state tax return by the deadline.

Obtaining the PIT ADJ New Mexico Schedule of Additions and Deductions

The PIT ADJ form can be obtained through the New Mexico Taxation and Revenue Department's website. It is available for download in a printable format, allowing taxpayers to fill it out by hand or electronically. Additionally, tax preparation software may include the PIT ADJ form, streamlining the process for users who prefer digital filing.

Key Elements of the PIT ADJ New Mexico Schedule of Additions and Deductions

Understanding the key elements of the PIT ADJ is essential for effective tax filing. The form typically includes sections for reporting various types of income, such as wages, self-employment income, and interest. It also allows for deductions related to retirement contributions, education expenses, and other qualifying items. Each section requires precise information to ensure compliance with state tax regulations.

State-Specific Rules for the PIT ADJ New Mexico Schedule of Additions and Deductions

New Mexico has unique tax laws that govern the use of the PIT ADJ. Taxpayers should be aware of specific rules regarding what can be added or deducted. For instance, certain expenses may only be deductible under specific conditions, and some income types may require additional reporting. Staying informed about these rules helps taxpayers maximize their deductions while ensuring compliance with state laws.

Filing Deadlines and Important Dates

Timely submission of the PIT ADJ is critical to avoid penalties. The filing deadline typically aligns with the federal tax return due date, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary. Additionally, any extensions granted for federal filings may also apply to state returns, but it is essential to check for confirmation.

Create this form in 5 minutes or less

Find and fill out the correct pit adj new mexico schedule of additions ded

Create this form in 5 minutes!

How to create an eSignature for the pit adj new mexico schedule of additions ded

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to pit adj?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The term 'pit adj' refers to the advantages of using such a platform, which include increased efficiency and reduced turnaround times for document management.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effectiveness of the solution makes it an attractive option for companies looking to streamline their document processes, aligning perfectly with the benefits of pit adj.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the overall user experience, making it a top choice for businesses seeking the advantages of pit adj in their document workflows.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and more. This integration capability enhances the functionality of your existing systems, providing the benefits of pit adj by simplifying document management.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security for your documents. These advantages align with the concept of pit adj, as they contribute to a more streamlined and effective business operation.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow employs advanced security measures such as encryption and secure access controls. This ensures that your sensitive documents are protected, which is a crucial aspect of the pit adj benefits for businesses handling confidential information.

-

How can airSlate SignNow improve my business processes?

airSlate SignNow can signNowly improve your business processes by automating document workflows and reducing manual tasks. This efficiency is a key component of pit adj, allowing your team to focus on more strategic initiatives rather than paperwork.

Get more for PIT ADJ NEW MEXICO SCHEDULE OF ADDITIONS, DED

- Dance admission form

- Microblading consultation record form

- Ncnda form

- Funeral cover application form template doc

- Essentials of firefighting 6th edition download form

- Download the eap duplicate score report request bformb pdf ets ets

- Permission form for arkansas physical therapy tele therapy

- Voluntary request to relinquish position with intent to re form

Find out other PIT ADJ NEW MEXICO SCHEDULE OF ADDITIONS, DED

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast