PITADJNEW MEXICO SCHEDULE of ADDITIONS, DEDUC 2023

Understanding the New Mexico Schedule of Additions and Deductions

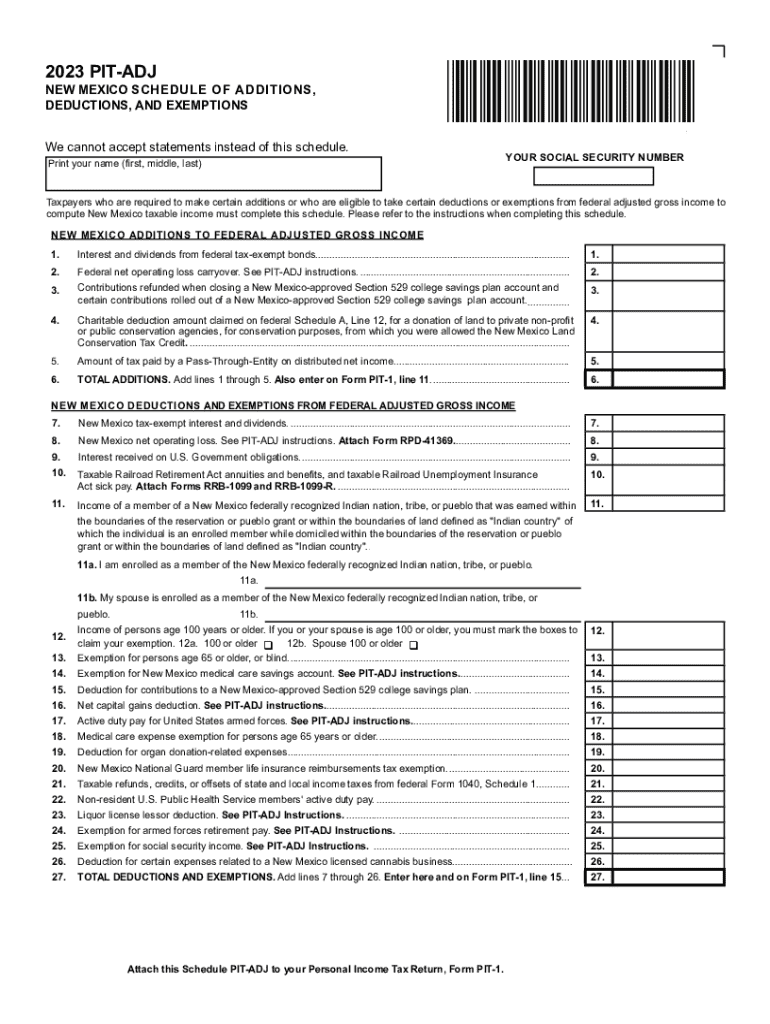

The 2019 NM PIT ADJ, or New Mexico Schedule of Additions and Deductions, is a tax form used by residents to report specific adjustments to their income. This form allows taxpayers to add or deduct certain amounts from their federal adjusted gross income, ensuring compliance with state tax regulations. Understanding the purpose of this form is essential for accurate tax filing and maximizing potential deductions.

Steps to Complete the New Mexico Schedule of Additions and Deductions

Completing the 2019 NM PIT ADJ involves several key steps:

- Gather necessary documents, including your federal tax return and any supporting documentation for additions and deductions.

- Review the instructions for the NM PIT ADJ to understand which adjustments apply to your situation.

- Fill out the form by entering your federal adjusted gross income and any applicable additions or deductions.

- Double-check your entries for accuracy and completeness.

- Submit the completed form along with your New Mexico personal income tax return.

Key Elements of the New Mexico Schedule of Additions and Deductions

Several important elements must be considered when filling out the NM PIT ADJ:

- Additions: These may include items such as interest from non-governmental bonds and certain business income.

- Deductions: Common deductions include contributions to retirement accounts and certain educational expenses.

- Documentation: Keep all supporting documents on hand to substantiate your claims in case of an audit.

Legal Use of the New Mexico Schedule of Additions and Deductions

The NM PIT ADJ is legally required for New Mexico residents who need to report adjustments to their income. Proper use of this form ensures compliance with state tax laws and helps avoid potential penalties. Taxpayers should be aware of the legal implications of misreporting information on this form, which could lead to audits or fines.

Filing Deadlines for the New Mexico Schedule of Additions and Deductions

Filing deadlines for the NM PIT ADJ typically align with the overall personal income tax return deadlines in New Mexico. Taxpayers should ensure that they submit the form by the due date to avoid late fees and interest. For the 2019 tax year, the standard deadline is usually April 15, unless an extension has been filed.

Examples of Using the New Mexico Schedule of Additions and Deductions

Here are a few scenarios where the NM PIT ADJ may be applicable:

- A self-employed individual may need to report additional business income that is not included in their federal adjusted gross income.

- A retiree might claim deductions for pension contributions made during the tax year.

- A student could use the form to deduct qualified educational expenses from their taxable income.

Create this form in 5 minutes or less

Find and fill out the correct pitadjnew mexico schedule of additions deduc

Create this form in 5 minutes!

How to create an eSignature for the pitadjnew mexico schedule of additions deduc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 nm pit adj. and how does it work?

The 2019 nm pit adj. refers to a specific adjustment in the New Mexico tax code that affects businesses. It allows for certain deductions and credits that can signNowly impact your tax liability. Understanding this adjustment is crucial for businesses looking to optimize their financial strategies.

-

How can airSlate SignNow help with the 2019 nm pit adj. documentation?

airSlate SignNow provides a seamless platform for creating, sending, and eSigning documents related to the 2019 nm pit adj. Our solution ensures that all necessary paperwork is handled efficiently, allowing you to focus on your business operations without the hassle of manual documentation.

-

What are the pricing options for airSlate SignNow when dealing with the 2019 nm pit adj.?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you are a small business or a large enterprise, our pricing is designed to be cost-effective while providing the necessary features to manage your 2019 nm pit adj. documentation efficiently.

-

What features does airSlate SignNow offer for managing the 2019 nm pit adj.?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools are specifically designed to streamline the process of handling the 2019 nm pit adj., making it easier for businesses to stay compliant and organized.

-

Can airSlate SignNow integrate with other software for the 2019 nm pit adj.?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when dealing with the 2019 nm pit adj. Whether you use accounting software or CRM systems, our integrations ensure that your documentation process is smooth and efficient.

-

What are the benefits of using airSlate SignNow for the 2019 nm pit adj.?

Using airSlate SignNow for the 2019 nm pit adj. offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your documents digitally, saving time and resources while ensuring compliance with tax regulations.

-

Is airSlate SignNow secure for handling sensitive information related to the 2019 nm pit adj.?

Absolutely. airSlate SignNow employs advanced security measures to protect your sensitive information related to the 2019 nm pit adj. Our platform is compliant with industry standards, ensuring that your documents are safe from unauthorized access and bsignNowes.

Get more for PITADJNEW MEXICO SCHEDULE OF ADDITIONS, DEDUC

Find out other PITADJNEW MEXICO SCHEDULE OF ADDITIONS, DEDUC

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself