FTB 3536 Estimated Fee for LLCs Form

What is the FTB 3536 Estimated Fee For LLCs

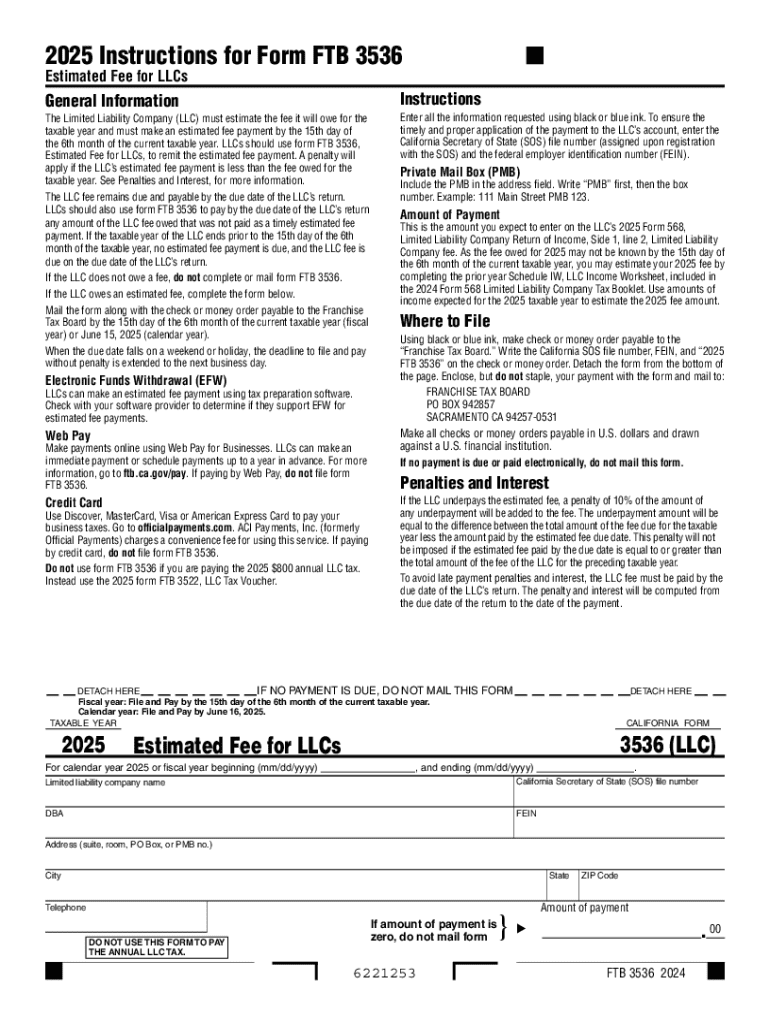

The FTB 3536 form, officially known as the California Estimated Fee for Limited Liability Companies (LLCs), is a crucial document for LLCs operating in California. This form is used to report and pay the estimated annual fee that LLCs are required to submit to the California Franchise Tax Board (FTB). The fee is based on the total income of the LLC and is essential for maintaining compliance with state regulations. Understanding this fee is vital for LLC owners to avoid penalties and ensure their business remains in good standing.

How to use the FTB 3536 Estimated Fee For LLCs

Using the FTB 3536 form involves several steps to ensure accurate completion and timely submission. First, LLC owners must calculate their estimated fee based on their projected total income for the year. Once the amount is determined, the form can be filled out with the necessary information, including the LLC's name, address, and the calculated fee. After completing the form, it can be submitted to the FTB either online or via mail, depending on the preference of the LLC owner. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the FTB 3536 Estimated Fee For LLCs

Completing the FTB 3536 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the LLC's total income projections for the year.

- Download the FTB 3536 form from the California Franchise Tax Board website.

- Fill out the form with accurate details, including the LLC's name, address, and estimated fee.

- Review the completed form for any errors or omissions.

- Submit the form either electronically through the FTB's online portal or by mailing it to the appropriate address.

Filing Deadlines / Important Dates

Timely filing of the FTB 3536 form is essential to avoid penalties. The estimated fee is typically due on the 15th day of the 4th month of the taxable year. For most LLCs, this means that the form must be submitted by April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable for LLC owners to mark these important dates on their calendars to ensure compliance.

Penalties for Non-Compliance

Failing to submit the FTB 3536 form on time can result in significant penalties for LLCs. The California Franchise Tax Board imposes a late filing penalty, which can be a percentage of the estimated fee owed. Additionally, interest may accrue on any unpaid fees, increasing the overall amount due. To avoid these financial repercussions, LLC owners should prioritize the timely submission of the FTB 3536 form and ensure that all required payments are made promptly.

Who Issues the Form

The FTB 3536 form is issued by the California Franchise Tax Board, the state agency responsible for administering California's tax laws. The FTB oversees the collection of taxes and fees from businesses, including LLCs, ensuring compliance with state regulations. LLC owners can access the form and additional resources directly through the FTB's official website, which provides guidance on completing and submitting the form accurately.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 3536 estimated fee for llcs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3536 and how can airSlate SignNow help with it?

Form 3536 is a document used for various business purposes, and airSlate SignNow simplifies the process of sending and eSigning this form. With our platform, you can easily upload, edit, and share form 3536, ensuring that all signatures are collected efficiently. Our user-friendly interface makes it accessible for everyone, regardless of technical expertise.

-

Is there a cost associated with using airSlate SignNow for form 3536?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when handling form 3536. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your budget and requirements for managing form 3536.

-

What features does airSlate SignNow offer for managing form 3536?

airSlate SignNow provides a range of features for managing form 3536, including customizable templates, automated workflows, and secure cloud storage. These features streamline the process of preparing and signing the form, making it faster and more efficient. Additionally, you can track the status of your form 3536 in real-time.

-

Can I integrate airSlate SignNow with other applications for form 3536?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage form 3536 alongside your existing tools. Whether you use CRM systems, project management software, or cloud storage services, our integrations enhance your workflow and improve productivity. This flexibility makes handling form 3536 even easier.

-

What are the benefits of using airSlate SignNow for form 3536?

Using airSlate SignNow for form 3536 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed quickly and securely, minimizing delays in your business processes. Additionally, the ability to access form 3536 from anywhere boosts collaboration among team members.

-

How secure is airSlate SignNow when handling form 3536?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like form 3536. We implement advanced encryption protocols and comply with industry standards to protect your data. You can trust that your form 3536 and other documents are safe and secure on our platform.

-

Can I track the status of my form 3536 in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 3536 in real-time. You will receive notifications when the form is viewed, signed, or completed, ensuring you stay informed throughout the process. This feature enhances accountability and helps you manage your documents more effectively.

Get more for FTB 3536 Estimated Fee For LLCs

- Ct 6559 submitter report for form w 2 cd filing

- Wwwctreg14orguploadedhumanresourcesdepartment of revenue services state of connecticut form ct

- Ny dtf it 2663 2021 2022 fill out tax template online form

- Fillable online form it 2664 fax email print pdffiller

- Form ct 1041 ct income tax return for trusts ans estates

- Ny dtf it 2104 2021 2022 fill out tax template online form

- Form ct 1041 k 1t transmittal of schedule ct 1041 k 1

- Nyc tc201 2021 2022 fill out tax template onlineus form

Find out other FTB 3536 Estimated Fee For LLCs

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile