Direct Transfer under Subsection 2022-2026

What is the Direct Transfer Under Subsection

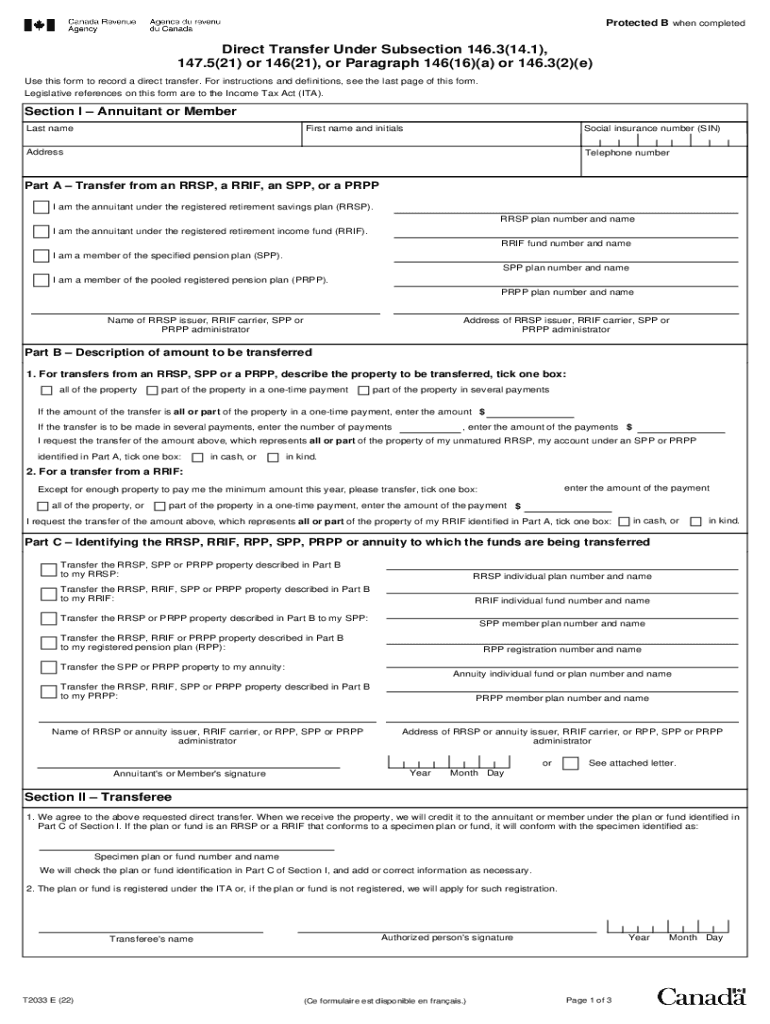

The Direct Transfer Under Subsection refers to a specific provision that allows individuals to transfer funds directly between retirement accounts without incurring tax penalties. This process is particularly relevant for those managing retirement savings, as it enables seamless transitions between accounts, such as from a 401(k) to an IRA. Understanding this provision is crucial for effective retirement planning and maintaining the tax-advantaged status of your savings.

How to use the Direct Transfer Under Subsection

To utilize the Direct Transfer Under Subsection, an individual must first ensure that the accounts involved are eligible for direct transfer. This typically includes employer-sponsored retirement plans and individual retirement accounts. The process generally involves completing the necessary paperwork provided by the receiving institution, which may include the t2033 form. It is essential to provide accurate account details and follow the instructions carefully to avoid delays or complications.

Steps to complete the Direct Transfer Under Subsection

Completing a Direct Transfer Under Subsection involves several key steps:

- Identify the accounts you wish to transfer funds between.

- Contact the receiving institution to obtain their specific transfer forms, including the t2033 fillable form.

- Fill out the required forms accurately, ensuring all information matches your account details.

- Submit the completed forms to the receiving institution, either online or via mail, as specified.

- Monitor the transfer process to ensure that funds are received and properly allocated in the new account.

Key elements of the Direct Transfer Under Subsection

Several key elements define the Direct Transfer Under Subsection:

- Eligibility: Only certain types of retirement accounts qualify for direct transfer.

- Tax Implications: Transfers conducted under this provision are generally tax-free, preserving the tax benefits of retirement savings.

- Documentation: Proper documentation, including the t2033 form, is essential for a smooth transfer process.

- Timeframe: Transfers typically take a few weeks to process, depending on the institutions involved.

Required Documents

When initiating a Direct Transfer Under Subsection, specific documents are necessary to facilitate the process:

- The completed t2033 form, which outlines the details of the transfer.

- Account statements from both the current and receiving institutions.

- Any additional forms required by the receiving institution, which may vary by provider.

Form Submission Methods

The t2033 form can typically be submitted through various methods, depending on the preferences of the receiving institution. Common submission methods include:

- Online: Many institutions allow for electronic submission through their secure portals.

- Mail: You can send the completed form via postal service to the designated address provided by the institution.

- In-Person: Some individuals may prefer to deliver the form in person at the receiving institution's branch.

Quick guide on how to complete direct transfer under subsection

Effortlessly Prepare Direct Transfer Under Subsection on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to acquire the necessary form and safely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Handle Direct Transfer Under Subsection on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Edit and Electronically Sign Direct Transfer Under Subsection with Ease

- Locate Direct Transfer Under Subsection and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Direct Transfer Under Subsection to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct direct transfer under subsection

Create this form in 5 minutes!

How to create an eSignature for the direct transfer under subsection

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2033 form and why is it important?

The t2033 form is a crucial document used for tax purposes in Canada, specifically for transferring funds between registered accounts. Understanding its significance can help individuals manage their investments more effectively and ensure compliance with tax regulations.

-

How can airSlate SignNow help with the t2033 form?

airSlate SignNow simplifies the process of completing and signing the t2033 form by providing an intuitive platform for electronic signatures. This ensures that your documents are securely signed and stored, making it easier to manage your tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for the t2033 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the signing process for documents like the t2033 form, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing the t2033 form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which enhance the management of the t2033 form. These tools help users efficiently handle their documents while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other software for the t2033 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to connect your workflow for the t2033 form with tools you already use. This integration capability enhances productivity and streamlines document management.

-

What are the benefits of using airSlate SignNow for the t2033 form?

Using airSlate SignNow for the t2033 form provides numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy for anyone to complete and sign documents efficiently.

-

Is airSlate SignNow secure for handling the t2033 form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your t2033 form and other documents are protected. The platform employs advanced encryption and security measures to safeguard your sensitive information.

Get more for Direct Transfer Under Subsection

- Information for incoming wires zions bank

- Automatic transfer authorization agreement the clay city form

- Compassionate finance application form

- Woody phomopsis galls bygl ohio state university form

- Credit application account transtar industries form

- New tenant update alternate address form

- Ctoc owner form

- Primerica rollover form

Find out other Direct Transfer Under Subsection

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract