Form CT 5 1 Request for Additional Extension of Time to File

What is the Form CT 5 1 Request For Additional Extension Of Time To File

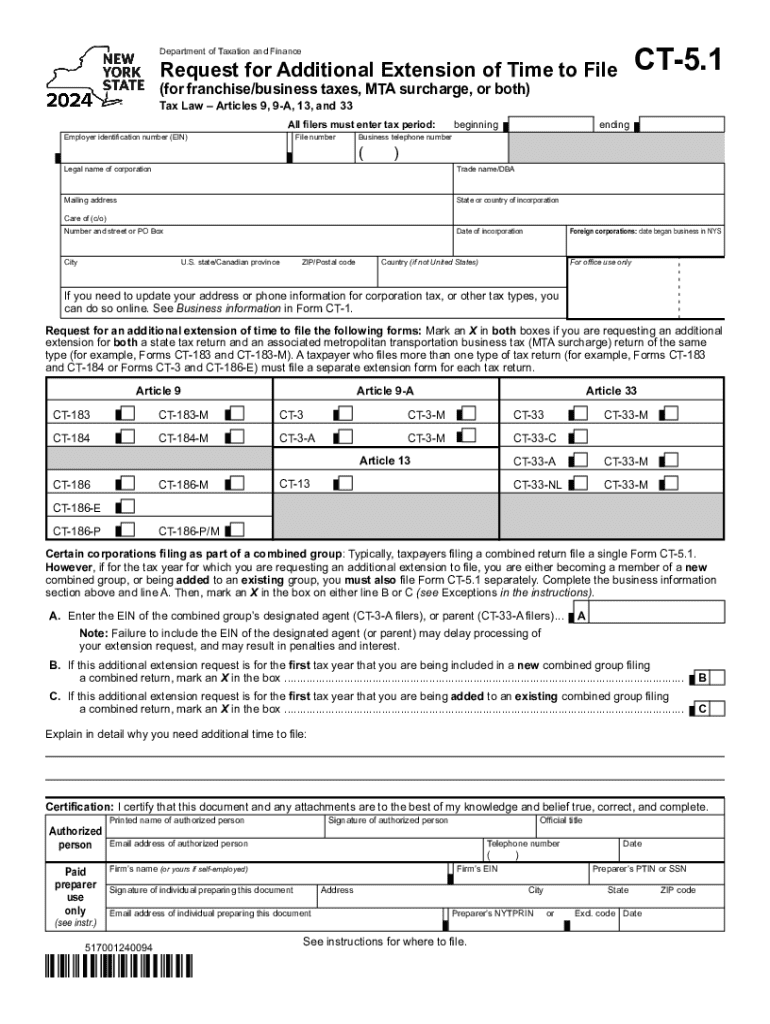

The Form CT 5 1 is a request used by taxpayers in New York to apply for an additional extension of time to file their tax returns. This form is particularly important for individuals and businesses that may need more time beyond the original extension granted by the state. By submitting this form, taxpayers can avoid penalties associated with late filing, ensuring compliance with New York tax regulations. The CT 5 1 form is specifically designed to accommodate various taxpayer scenarios, including those who may be self-employed or managing a business entity.

How to use the Form CT 5 1 Request For Additional Extension Of Time To File

Using the Form CT 5 1 involves several straightforward steps. First, taxpayers must ensure they meet the eligibility criteria for requesting an additional extension. Next, they should accurately complete the form, providing necessary details such as their name, address, and the original filing date. It is essential to indicate the reason for the extension request clearly. Once completed, the form can be submitted to the appropriate tax authority. Taxpayers should retain a copy for their records, as it serves as proof of their request for an extension.

Steps to complete the Form CT 5 1 Request For Additional Extension Of Time To File

Completing the Form CT 5 1 involves a series of methodical steps:

- Begin by downloading the form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of tax return for which you are requesting an extension.

- Provide the original due date of the return and the reason for the extension request.

- Review the form for accuracy, ensuring all information is complete.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form CT 5 1 is crucial for compliance. Generally, the request for an additional extension must be submitted before the original due date of the tax return. For most taxpayers, this means filing the CT 5 1 by the April deadline for individual income tax returns. It is advisable to check the New York State Department of Taxation and Finance for any updates or changes to these deadlines, as they can vary based on specific circumstances or legislative changes.

Eligibility Criteria

To be eligible for the Form CT 5 1, taxpayers must have already filed for an initial extension using the appropriate form. The request for an additional extension is typically granted if the taxpayer can demonstrate a valid reason for needing more time. This may include circumstances such as unforeseen personal issues, complications in gathering necessary documentation, or other valid reasons that hinder timely filing. Taxpayers should ensure they meet these criteria to avoid potential penalties.

Penalties for Non-Compliance

Failing to file the Form CT 5 1 or not meeting the original filing deadlines can result in significant penalties. New York imposes late filing penalties, which can accumulate quickly, leading to additional financial burdens. Additionally, interest may accrue on any unpaid taxes. It is essential for taxpayers to adhere to all filing requirements and deadlines to avoid these consequences. Understanding the implications of non-compliance can help motivate timely action and ensure adherence to state tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 5 1 request for additional extension of time to file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is extension time in airSlate SignNow?

Extension time in airSlate SignNow refers to the additional time granted to signers to complete their document signing process. This feature ensures that users have the flexibility they need to review and sign documents without feeling rushed, enhancing the overall user experience.

-

How can I set extension time for my documents?

You can easily set extension time for your documents within the airSlate SignNow platform. During the document preparation phase, simply specify the desired extension time in the settings, allowing signers to have extra time to complete their signatures.

-

Is there a cost associated with using extension time?

No, there is no additional cost for utilizing extension time in airSlate SignNow. This feature is included in our pricing plans, allowing you to provide your signers with the necessary time to complete their tasks without incurring extra fees.

-

What are the benefits of using extension time?

Using extension time can signNowly improve the completion rates of your documents. By allowing signers more time, you reduce the pressure they may feel, leading to a higher likelihood of obtaining completed signatures and enhancing customer satisfaction.

-

Can I customize the extension time for different documents?

Yes, airSlate SignNow allows you to customize the extension time for each document individually. This flexibility enables you to tailor the signing experience based on the complexity of the document and the needs of the signers.

-

Does extension time affect the overall signing process?

Extension time does not negatively impact the overall signing process; rather, it enhances it. By providing additional time, you ensure that signers can thoroughly review documents, which can lead to fewer errors and a smoother workflow.

-

What integrations support the extension time feature?

The extension time feature in airSlate SignNow is supported by various integrations, including popular CRM and document management systems. This allows you to seamlessly incorporate the extension time functionality into your existing workflows and applications.

Get more for Form CT 5 1 Request For Additional Extension Of Time To File

Find out other Form CT 5 1 Request For Additional Extension Of Time To File

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form