Instructions for Form CT 34 SH New York S Corporation

What is the Instructions For Form CT 34 SH New York S Corporation

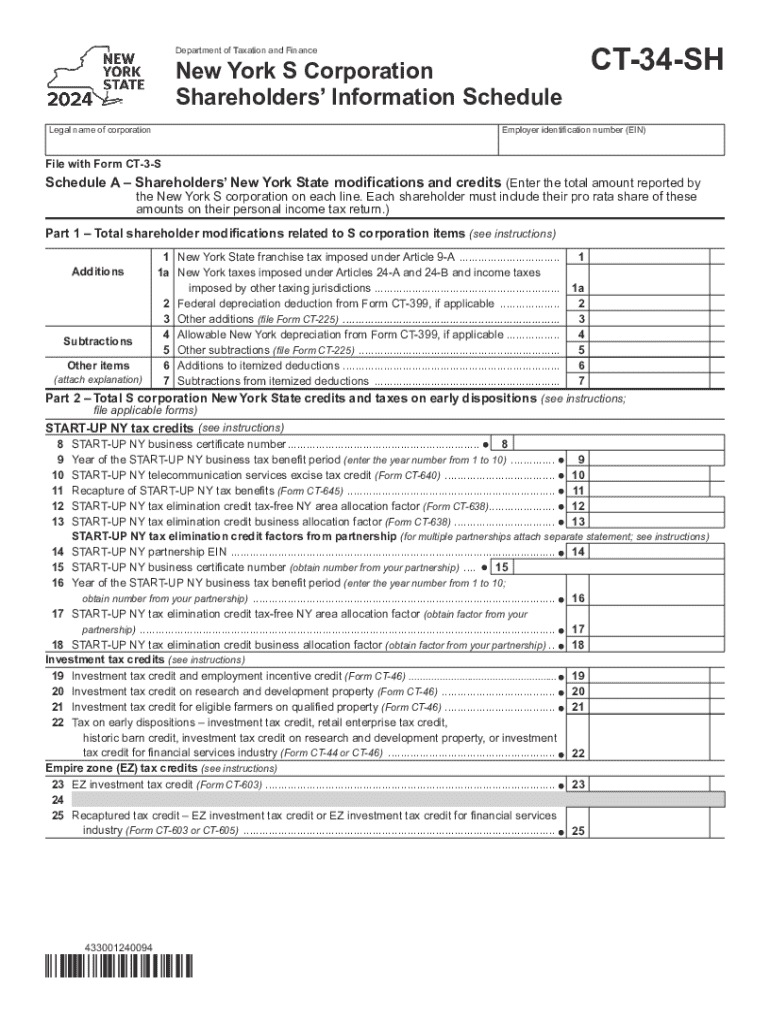

The Instructions for Form CT 34 SH pertain to the New York S Corporation, which is used by S corporations to report their income, gains, losses, deductions, and credits. This form is essential for ensuring compliance with New York state tax laws. It provides guidance on how to accurately complete the form, detailing the necessary information that must be included, such as the corporation's name, address, and federal employer identification number (EIN). Understanding these instructions is crucial for S corporations to avoid penalties and ensure proper tax reporting.

Steps to complete the Instructions For Form CT 34 SH New York S Corporation

Completing the Instructions for Form CT 34 SH involves several key steps:

- Gather necessary documents, including financial statements and prior tax returns.

- Fill in the corporation's identifying information accurately, including the name and EIN.

- Report income, deductions, and credits as outlined in the instructions, ensuring all figures are correct.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Following these steps can help streamline the filing process and reduce the likelihood of errors.

Key elements of the Instructions For Form CT 34 SH New York S Corporation

The key elements of the Instructions for Form CT 34 SH include:

- Eligibility requirements: Criteria that determine who must file the form.

- Filing requirements: Specifics on what needs to be included in the form.

- Tax rates: Information on applicable tax rates for S corporations in New York.

- Amendment procedures: Instructions on how to amend a previously filed form if necessary.

These elements are vital for ensuring compliance and accurate reporting of tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for Form CT 34 SH are crucial for S corporations to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. Corporations must be aware of these deadlines to ensure timely submission and compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Form CT 34 SH can be submitted through various methods:

- Online: Many corporations opt to file electronically through the New York State Department of Taxation and Finance's online services.

- Mail: The completed form can be printed and mailed to the appropriate address as specified in the instructions.

- In-Person: Corporations may also choose to deliver the form in person at designated tax offices.

Choosing the right submission method can enhance the efficiency of the filing process.

Penalties for Non-Compliance

Failure to file Form CT 34 SH accurately and on time can result in significant penalties. These may include fines for late filing, as well as interest on any unpaid taxes. Additionally, non-compliance can lead to further scrutiny from tax authorities, potentially resulting in audits. It is essential for S corporations to adhere to the filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 34 sh new york s corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys ct 34 sh form?

The nys ct 34 sh form is a tax form used in New York State for certain tax filings. It is essential for businesses to understand its requirements to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help with the nys ct 34 sh form?

airSlate SignNow simplifies the process of completing and submitting the nys ct 34 sh form. Our platform allows you to fill out the form electronically, eSign it, and send it directly to the relevant authorities, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the nys ct 34 sh form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion and submission of the nys ct 34 sh form, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the nys ct 34 sh form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the nys ct 34 sh form. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for the nys ct 34 sh form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when dealing with the nys ct 34 sh form. This means you can connect with your existing tools for a seamless experience.

-

What are the benefits of using airSlate SignNow for the nys ct 34 sh form?

Using airSlate SignNow for the nys ct 34 sh form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are processed quickly and safely, allowing you to focus on your business.

-

Is airSlate SignNow user-friendly for completing the nys ct 34 sh form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy to complete the nys ct 34 sh form. Our intuitive interface allows users of all skill levels to navigate the platform effortlessly, ensuring a smooth document management process.

Get more for Instructions For Form CT 34 SH New York S Corporation

- Sample credit report equifax pdf form

- Workers compensation waiver 100081833 form

- Fifa pre competition medical assessment form

- Complete these sixteen sentences to score your knowledge of possessive grammar form

- Merl reagle printable crossword puzzles form

- Container checklist excel 403951687 form

- Newborn baby information sheet

- Affidavit of financial support philippines form

Find out other Instructions For Form CT 34 SH New York S Corporation

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template