Tax Preparation Client Information Sheet

What is the Tax Preparation Client Information Sheet

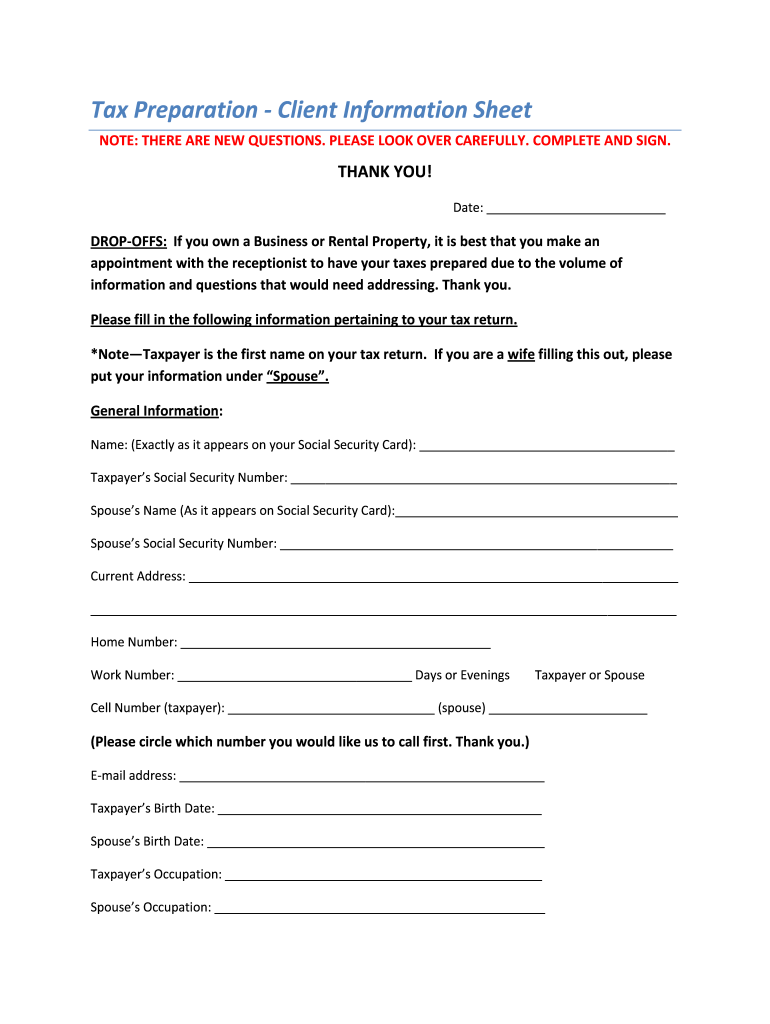

The tax preparation client information sheet is a crucial document used by tax professionals to gather essential information from clients. This form typically includes personal details, income sources, deductions, and credits that may apply to the client’s tax situation. By collecting this information, tax preparers can ensure accurate and efficient tax filing, ultimately helping clients maximize their tax benefits and comply with federal and state regulations.

How to Use the Tax Preparation Client Information Sheet

Using the tax preparation client information sheet involves several steps. First, clients should fill out the form completely, providing accurate and detailed information. It is important to review all entries for completeness and correctness. Once completed, the form can be submitted to the tax preparer, either electronically or in paper form. Tax professionals will then use the information provided to prepare the client’s tax return, ensuring that all relevant details are considered.

Steps to Complete the Tax Preparation Client Information Sheet

Completing the tax preparation client information sheet requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Fill out personal information, including name, address, and Social Security number.

- Provide details about income sources, including wages, self-employment income, and investment earnings.

- List any deductions or credits that may apply, such as mortgage interest, student loan interest, or education credits.

- Review the completed form for accuracy before submission.

Key Elements of the Tax Preparation Client Information Sheet

Several key elements are essential to the tax preparation client information sheet. These include:

- Personal Information: Basic details such as name, address, and Social Security number.

- Income Information: Comprehensive data on all income sources, including wages and self-employment earnings.

- Deductions and Credits: Information on potential deductions and tax credits applicable to the client.

- Filing Status: Indication of the client’s filing status, such as single, married, or head of household.

Legal Use of the Tax Preparation Client Information Sheet

The tax preparation client information sheet is legally recognized as a valid document when completed accurately. It serves as a record of the information provided by the client, which tax professionals rely on to prepare tax returns. Compliance with legal standards, such as the Internal Revenue Service (IRS) guidelines, ensures that the information is used appropriately and protects both the client and the preparer from potential legal issues.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the tax preparation client information sheet. Tax preparers must adhere to these guidelines to ensure compliance with federal tax laws. This includes maintaining confidentiality, ensuring accuracy in reporting, and following proper procedures for document retention. Understanding these guidelines helps tax professionals protect their clients and themselves from audits or penalties.

Quick guide on how to complete tax preparation client information sheet

Complete Tax Preparation Client Information Sheet effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage Tax Preparation Client Information Sheet on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Tax Preparation Client Information Sheet with ease

- Find Tax Preparation Client Information Sheet and then click Get Form to get started.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Tax Preparation Client Information Sheet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax preparation client information sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax client information sheet?

A tax client information sheet is a document that collects essential data from clients to streamline the tax preparation process. By utilizing airSlate SignNow, you can easily create and send customized tax client information sheets to your clients for efficient data collection.

-

How does airSlate SignNow enhance the management of tax client information sheets?

airSlate SignNow allows you to digitize and automate the process of managing tax client information sheets. With features like eSignature and document tracking, our platform ensures that your clients can fill out and return their information quickly and securely.

-

Is airSlate SignNow a cost-effective solution for managing tax client information sheets?

Yes, airSlate SignNow offers a cost-effective solution for creating and managing tax client information sheets. Our pricing plans are designed to suit various business sizes and needs, ensuring you get the best value while enhancing client communication and document management.

-

Can I integrate airSlate SignNow with my existing tax software for tax client information sheets?

Absolutely! airSlate SignNow seamlessly integrates with a variety of tax software solutions, allowing you to streamline your workflow. This integration means that you can manage your tax client information sheets alongside your other financial documents without any hassle.

-

What features does airSlate SignNow offer for tax client information sheets?

airSlate SignNow provides a robust set of features for tax client information sheets, including customizable templates, electronic signatures, and real-time tracking. These features ensure that your clients can submit their information accurately and efficiently, speeding up the tax preparation process.

-

How secure is the information collected via tax client information sheets on airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect the information collected through tax client information sheets, ensuring that your clients' data is safe and confidential.

-

Can I track the status of my tax client information sheets in airSlate SignNow?

Yes, airSlate SignNow offers features that enable you to track the status of your tax client information sheets. You can see when a document is viewed, signed, or completed, giving you better visibility and control over your client communications.

Get more for Tax Preparation Client Information Sheet

- State of new mexico taxation and revenue department tax form

- Tax shelter reporting and disclosure requirements form

- Fillable online supporting childrens writing in reception form

- Form cr q1 ampquotcommercial rent tax returnampquot new york city

- Form it 238 claim for rehabilitation of historic properties

- Pdf form it 605 claim for ez investment tax credit and ez employment

- Form it 631 claim for security officer training tax credit

- Form it 112 r new york state resident credit tax year 2020

Find out other Tax Preparation Client Information Sheet

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement