LS 1 Form

What is the LS 1?

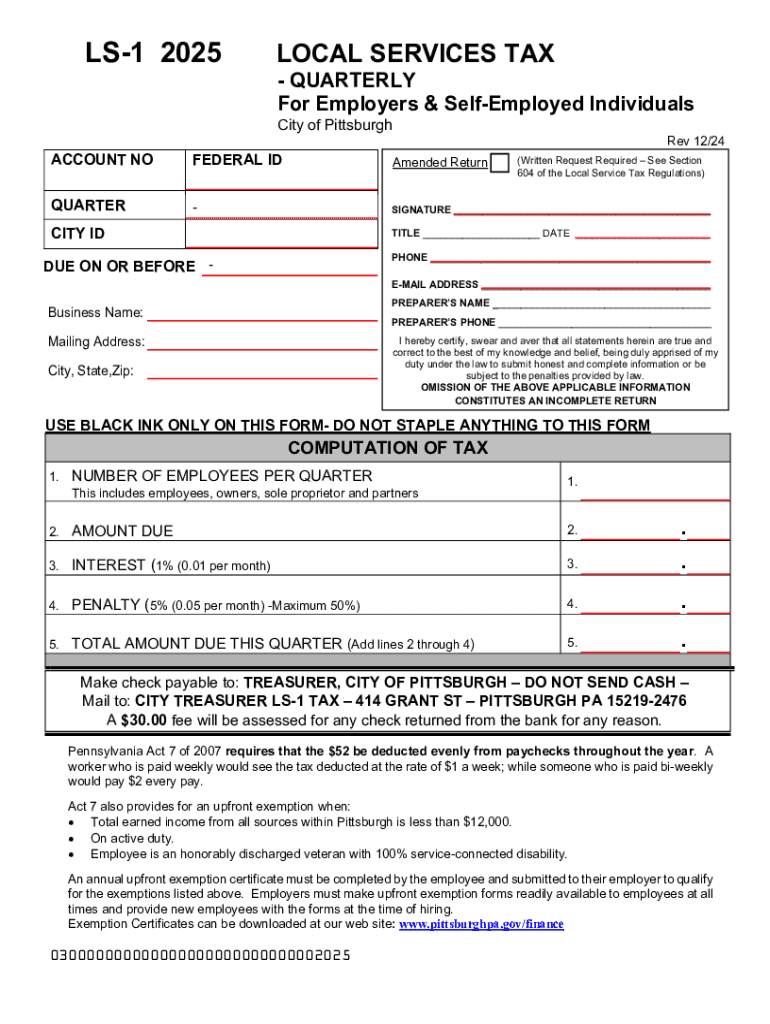

The LS 1 form, also known as the Local Services Tax form, is a document used primarily in Pennsylvania to report and pay local services taxes. This tax is levied on individuals who work within certain jurisdictions, typically to fund local services such as emergency services, infrastructure maintenance, and community programs. The LS 1 is essential for residents and non-residents who earn income in specific localities that impose this tax.

How to obtain the LS 1

To obtain the LS 1 form, individuals can visit the official website of their local tax authority or the Pennsylvania Department of Revenue. Many local jurisdictions provide the form in a downloadable PDF format. Additionally, individuals may request a physical copy by contacting their local tax office directly. It is important to ensure that the correct version of the LS 1 is used, as local requirements may vary.

Steps to complete the LS 1

Completing the LS 1 form involves several straightforward steps:

- Gather necessary information, including personal identification details and income sources.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total local services tax owed based on the income earned in the applicable jurisdiction.

- Review the form for accuracy before submission.

- Submit the completed form to the local tax authority by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the LS 1 form can vary by locality. Generally, the local services tax must be filed quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. It is crucial for taxpayers to check with their local tax authority for precise deadlines to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to file the LS 1 form on time or pay the due local services tax can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action by the local tax authority. It is advisable for individuals to stay informed about their filing obligations and make timely submissions to avoid these consequences.

Required Documents

When completing the LS 1 form, individuals may need to provide several documents, including:

- Proof of income, such as pay stubs or tax returns.

- Identification information, like a Social Security number or taxpayer identification number.

- Any prior year LS 1 forms, if applicable, for reference.

Who Issues the Form

The LS 1 form is issued by local tax authorities in Pennsylvania. Each municipality that imposes a local services tax has the authority to create and manage its own version of the LS 1. Therefore, it is important for taxpayers to ensure they are using the correct form for their specific locality to comply with local regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ls 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for services tax quarterly?

Using airSlate SignNow for services tax quarterly streamlines the document signing process, making it faster and more efficient. Our platform allows you to send and eSign documents securely, ensuring compliance and reducing the risk of errors. This can save your business time and resources, allowing you to focus on your core operations.

-

How does airSlate SignNow integrate with accounting software for services tax quarterly?

airSlate SignNow seamlessly integrates with various accounting software, enhancing your services tax quarterly management. This integration allows for automatic updates and easy access to signed documents, ensuring that your tax records are always up-to-date. By connecting your tools, you can improve workflow efficiency and accuracy.

-

What pricing plans does airSlate SignNow offer for services tax quarterly?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling services tax quarterly. Our plans are designed to be cost-effective, providing essential features without breaking the bank. You can choose from various options based on your document volume and required functionalities.

-

Is airSlate SignNow compliant with tax regulations for services tax quarterly?

Yes, airSlate SignNow is fully compliant with tax regulations, ensuring that your services tax quarterly documents meet legal standards. Our platform employs advanced security measures to protect sensitive information, giving you peace of mind. Compliance is a top priority, allowing you to focus on your business without worrying about legal issues.

-

Can I customize templates for services tax quarterly in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates specifically for services tax quarterly. This feature enables you to standardize your documents, ensuring consistency and saving time on repetitive tasks. Custom templates can be tailored to your business needs, enhancing your overall efficiency.

-

How does airSlate SignNow enhance collaboration for services tax quarterly?

airSlate SignNow enhances collaboration for services tax quarterly by allowing multiple users to review and sign documents simultaneously. This feature reduces turnaround time and improves communication among team members. With real-time updates and notifications, everyone stays informed throughout the signing process.

-

What support options are available for airSlate SignNow users handling services tax quarterly?

We offer comprehensive support options for airSlate SignNow users managing services tax quarterly. Our customer service team is available via chat, email, and phone to assist with any questions or issues. Additionally, we provide a rich knowledge base and tutorials to help you maximize the benefits of our platform.

Get more for LS 1

Find out other LS 1

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU