Form it 248 Claim for Empire State Film Production Credit Tax Year

What is the Form IT 248 Claim For Empire State Film Production Credit Tax Year

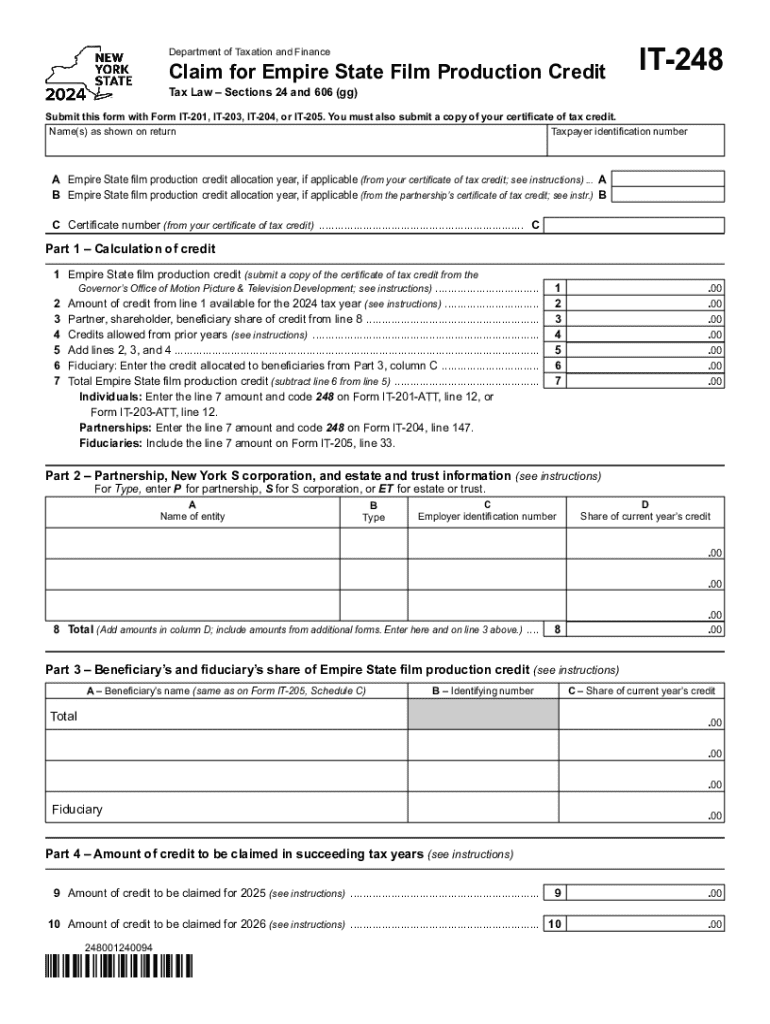

The Form IT 248 is a tax form used to claim the Empire State Film Production Credit in New York. This credit is designed to incentivize film and television production within the state, allowing eligible productions to receive a tax credit based on qualified production expenditures. The form must be completed accurately to ensure that the credit is applied correctly against the taxpayer's New York State tax liability.

How to use the Form IT 248 Claim For Empire State Film Production Credit Tax Year

To use the Form IT 248, taxpayers must first determine their eligibility for the Empire State Film Production Credit. Eligible productions typically include feature films, television series, and other qualifying media projects. Once eligibility is confirmed, the taxpayer should complete the form by providing necessary details about the production, including costs incurred and the nature of the project. After filling out the form, it should be submitted with the taxpayer's New York State tax return.

Steps to complete the Form IT 248 Claim For Empire State Film Production Credit Tax Year

Completing the Form IT 248 involves several key steps:

- Gather all necessary documentation related to the production, including receipts and invoices.

- Fill out the form with accurate financial information, detailing all qualified production expenses.

- Ensure all required signatures are included on the form.

- Review the completed form for accuracy before submission.

- Submit the form along with your New York State tax return by the specified deadline.

Eligibility Criteria

To qualify for the Empire State Film Production Credit, productions must meet specific eligibility criteria. Generally, these criteria include:

- The production must be filmed in New York State.

- Minimum spending thresholds must be met, typically involving a significant amount of qualified production expenditures.

- Productions must be intended for commercial distribution or broadcast.

- Compliance with all applicable state laws and regulations is required.

Required Documents

When filing the Form IT 248, certain documents are essential to support the claim. These may include:

- Invoices and receipts for all qualified production expenses.

- Proof of production activities, such as scripts or production schedules.

- Documentation demonstrating compliance with eligibility criteria.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT 248. Typically, the form must be submitted by the same deadline as the New York State tax return. Taxpayers should check the New York State Department of Taxation and Finance website for specific dates and any updates regarding extensions or changes to deadlines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 248 claim for empire state film production credit tax year 772088478

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 248 Claim For Empire State Film Production Credit Tax Year?

The Form IT 248 Claim For Empire State Film Production Credit Tax Year is a tax form used by eligible film production companies to claim tax credits for qualified production costs incurred in New York State. This form helps businesses reduce their tax liability while promoting film production in the region.

-

How can airSlate SignNow assist with the Form IT 248 Claim For Empire State Film Production Credit Tax Year?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Form IT 248 Claim For Empire State Film Production Credit Tax Year. Our user-friendly interface simplifies the document management process, ensuring that your claims are submitted accurately and on time.

-

What are the pricing options for using airSlate SignNow for the Form IT 248 Claim?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small production company or a large studio, you can choose a plan that fits your budget while ensuring you have access to the necessary tools for managing the Form IT 248 Claim For Empire State Film Production Credit Tax Year.

-

What features does airSlate SignNow offer for managing tax forms like Form IT 248?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for documents like the Form IT 248 Claim For Empire State Film Production Credit Tax Year. These features streamline the process, making it easier to manage your tax claims efficiently.

-

Are there any benefits to using airSlate SignNow for the Form IT 248 Claim?

Using airSlate SignNow for the Form IT 248 Claim For Empire State Film Production Credit Tax Year offers numerous benefits, including enhanced security, reduced processing time, and improved collaboration among team members. This ensures that your claims are handled professionally and promptly.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax preparation software, making it easier to manage the Form IT 248 Claim For Empire State Film Production Credit Tax Year. This integration helps streamline your workflow and ensures that all necessary data is readily available.

-

Is airSlate SignNow suitable for large film production companies?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including large film production companies. Our platform can handle multiple users and high-volume document transactions, making it ideal for managing the Form IT 248 Claim For Empire State Film Production Credit Tax Year efficiently.

Get more for Form IT 248 Claim For Empire State Film Production Credit Tax Year

Find out other Form IT 248 Claim For Empire State Film Production Credit Tax Year

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now