Nyc 1127 Form

What is the NYC 1127 Form?

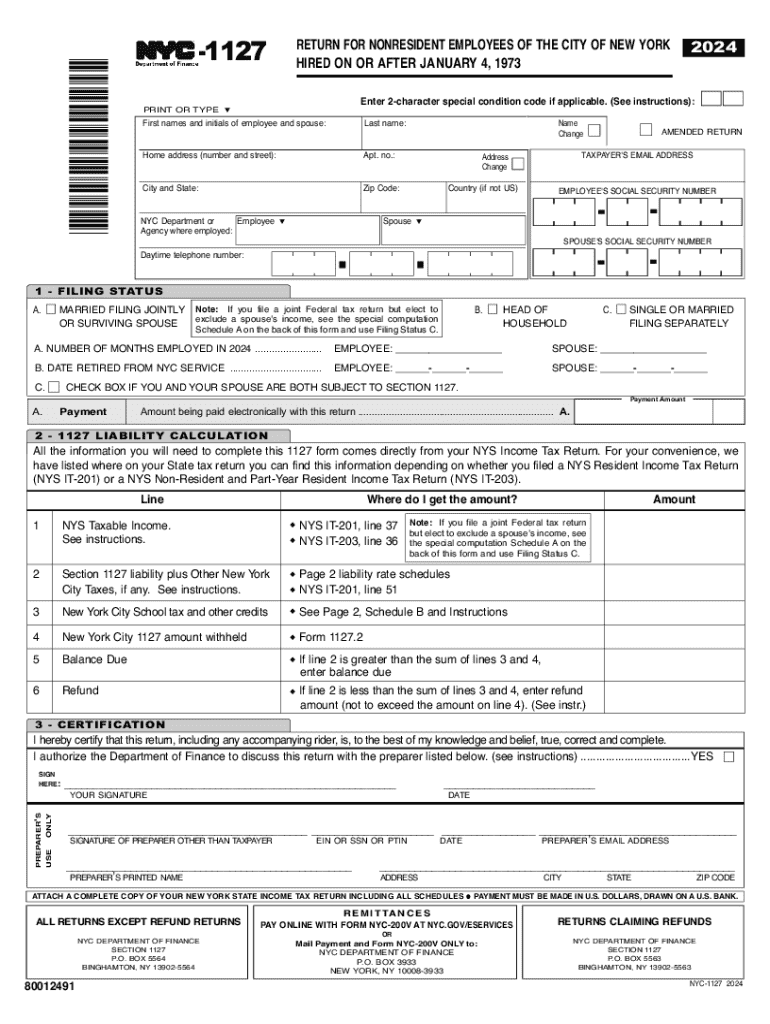

The NYC 1127 form is a tax document used by individuals and businesses in New York City to report certain income and expenses. This form is essential for those who need to declare their earnings and calculate their tax liabilities accurately. The NYC 1127 form is particularly relevant for self-employed individuals, freelancers, and small business owners who operate within the city limits. Understanding the purpose of this form is crucial for compliance with local tax regulations.

Steps to Complete the NYC 1127 Form

Completing the NYC 1127 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense receipts, and any other relevant records. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Then, report your income and expenses in the designated sections, ensuring that all figures are accurate. Finally, review the completed form for any errors before submitting it.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the NYC 1127 form. Typically, the form must be submitted by April fifteenth of the following tax year. However, specific deadlines may vary based on individual circumstances, such as extensions or changes in tax law. Staying informed about these dates can help avoid penalties and ensure timely compliance.

Required Documents

When preparing to file the NYC 1127 form, certain documents are required to support your claims. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Bank statements that reflect your financial activity.

- Any previous year’s tax returns for reference.

Having these documents on hand will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods

The NYC 1127 form can be submitted through various methods to accommodate different preferences. Individuals may choose to file online through the city’s tax portal, which offers a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own guidelines, so it is essential to follow the instructions carefully to avoid delays.

Penalties for Non-Compliance

Failure to file the NYC 1127 form on time or inaccuracies in the submitted information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing. It is advisable to consult with a tax professional if there are uncertainties regarding the form or its requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 1127 770368427

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC 1127 form 2024?

The NYC 1127 form 2024 is a tax form used by businesses in New York City to report specific financial information. It is essential for compliance with local tax regulations. Understanding this form is crucial for accurate tax filing and avoiding penalties.

-

How can airSlate SignNow help with the NYC 1127 form 2024?

airSlate SignNow provides an efficient platform for businesses to eSign and send the NYC 1127 form 2024 securely. Our solution simplifies the document management process, ensuring that your forms are completed and submitted on time. With our user-friendly interface, you can easily navigate through the signing process.

-

What are the pricing options for using airSlate SignNow for the NYC 1127 form 2024?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the NYC 1127 form 2024. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any features specifically designed for the NYC 1127 form 2024?

Yes, airSlate SignNow includes features that streamline the completion of the NYC 1127 form 2024. These features include customizable templates, automated reminders, and secure storage options. This ensures that your documents are not only completed accurately but also stored safely.

-

Can I integrate airSlate SignNow with other software for the NYC 1127 form 2024?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the NYC 1127 form 2024 alongside your existing tools. Whether you use accounting software or CRM systems, our integrations enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the NYC 1127 form 2024?

Using airSlate SignNow for the NYC 1127 form 2024 provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform allows for quick eSigning and document sharing, reducing the time spent on paperwork. Additionally, our security measures ensure that your sensitive information is protected.

-

Is airSlate SignNow compliant with regulations for the NYC 1127 form 2024?

Yes, airSlate SignNow is fully compliant with the regulations governing the NYC 1127 form 2024. We prioritize data security and compliance, ensuring that your documents meet all legal requirements. This gives you peace of mind when managing your tax forms.

Get more for Nyc 1127

- Demand for acknowledgment of satisfaction individual alabama form

- Quitclaim deed from individual to corporation alabama form

- Al corporation 497295569 form

- Demand for acknowledgment of satisfaction by corporation or llc alabama form

- Response to owners request for lien information individual alabama

- Quitclaim deed from individual to llc alabama form

- Warranty deed from individual to llc alabama form

- Response to owners request for lien information by corporation or llc alabama

Find out other Nyc 1127

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe