Rep Craven Bill Calls for Tax Relief for Retirees Form

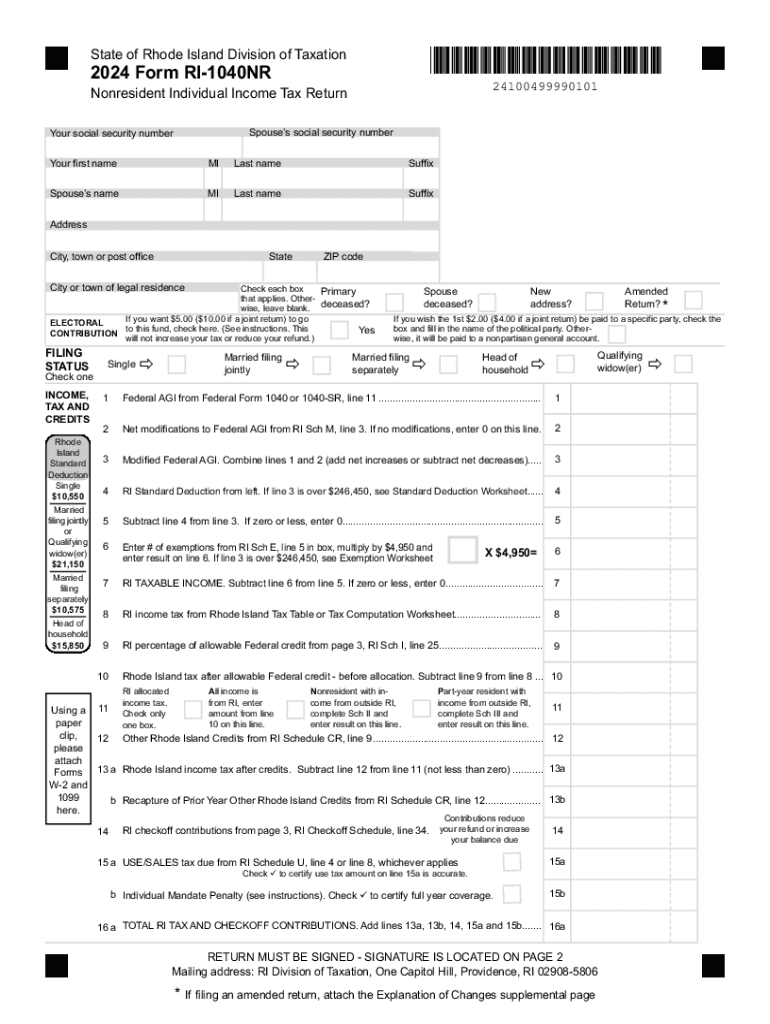

Understanding the RI Non-Resident Tax Form

The Rhode Island non-resident tax form, known as the RI-1040NR, is specifically designed for individuals who earn income in Rhode Island but do not reside in the state. This form allows non-residents to report their income sourced from Rhode Island and calculate their tax liability accordingly. It is essential for non-residents to accurately complete this form to comply with state tax regulations and avoid potential penalties.

Steps to Complete the RI Non-Resident Tax Form

Completing the RI-1040NR involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your total income earned within Rhode Island.

- Fill out the RI-1040NR form, ensuring all sections are completed accurately.

- Calculate your tax liability using the Rhode Island tax table for the relevant year.

- Review your completed form for any errors before submission.

Filing Deadlines for the RI Non-Resident Tax Form

It is crucial to be aware of the filing deadlines for the RI-1040NR. Generally, the form must be submitted by April fifteenth of the year following the tax year in question. For example, for the tax year 2023, the deadline would be April fifteenth, 2024. Late submissions may incur penalties and interest on any unpaid taxes.

Required Documents for Filing

When preparing to file the RI-1040NR, you will need several key documents:

- W-2 forms from employers for income earned in Rhode Island.

- 1099 forms for any freelance or contract work done in the state.

- Records of any other income sources that may be taxable in Rhode Island.

- Documentation of any deductions or credits you may be eligible for.

Who Issues the RI Non-Resident Tax Form

The RI-1040NR is issued by the Rhode Island Division of Taxation. This agency is responsible for administering tax laws in the state, including the processing of non-resident tax returns. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Penalties for Non-Compliance

Failure to file the RI non-resident tax form or pay any taxes owed can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, calculated from the original due date.

- Potential legal action for persistent non-compliance.

Eligibility Criteria for Filing

To file the RI-1040NR, you must meet specific eligibility criteria. You should be a non-resident of Rhode Island, have earned income from sources within the state, and not meet the residency requirements defined by Rhode Island tax law. Understanding these criteria ensures that you file correctly and avoid issues with the tax authority.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rep craven bill calls for tax relief for retirees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI non resident tax form?

The RI non resident tax form is a document required for individuals who earn income in Rhode Island but do not reside there. This form allows non-residents to report their income and pay any applicable taxes. Understanding how to fill out this form correctly is crucial for compliance with state tax laws.

-

How can airSlate SignNow help with the RI non resident tax form?

airSlate SignNow provides a seamless platform for electronically signing and sending the RI non resident tax form. With our user-friendly interface, you can easily upload your completed form, add signatures, and send it securely. This streamlines the process, saving you time and ensuring your documents are handled efficiently.

-

Is there a cost associated with using airSlate SignNow for the RI non resident tax form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective while providing robust features for managing documents like the RI non resident tax form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the RI non resident tax form?

airSlate SignNow includes features such as document templates, customizable workflows, and secure cloud storage, all of which are beneficial for managing the RI non resident tax form. Additionally, our platform supports real-time collaboration, allowing multiple parties to review and sign documents efficiently. These features enhance the overall experience of handling tax forms.

-

Can I integrate airSlate SignNow with other applications for the RI non resident tax form?

Absolutely! airSlate SignNow offers integrations with various applications, including popular accounting and tax software. This allows you to streamline your workflow when preparing the RI non resident tax form and ensures that all your documents are easily accessible across platforms. Integration enhances productivity and simplifies the tax filing process.

-

What are the benefits of using airSlate SignNow for the RI non resident tax form?

Using airSlate SignNow for the RI non resident tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and sent quickly, minimizing delays in tax filing. Additionally, the electronic signature feature is legally binding, giving you peace of mind.

-

How secure is airSlate SignNow when handling the RI non resident tax form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including the RI non resident tax form. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure throughout the signing process.

Get more for Rep Craven Bill Calls For Tax Relief For Retirees

- Quitclaim deed from corporation to llc mississippi form

- Motion for discovery form

- Motion for blood tests in order to help determine paternity court ordered mississippi form

- Notice creditors sample form

- Quitclaim deed from corporation to corporation mississippi form

- Warranty deed from corporation to corporation mississippi form

- Mississippi probate form

- Muniment of title form

Find out other Rep Craven Bill Calls For Tax Relief For Retirees

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors