Form it 606 Claim for QEZE Credit for Real Property Taxes Tax Year 2024-2026

Understanding the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

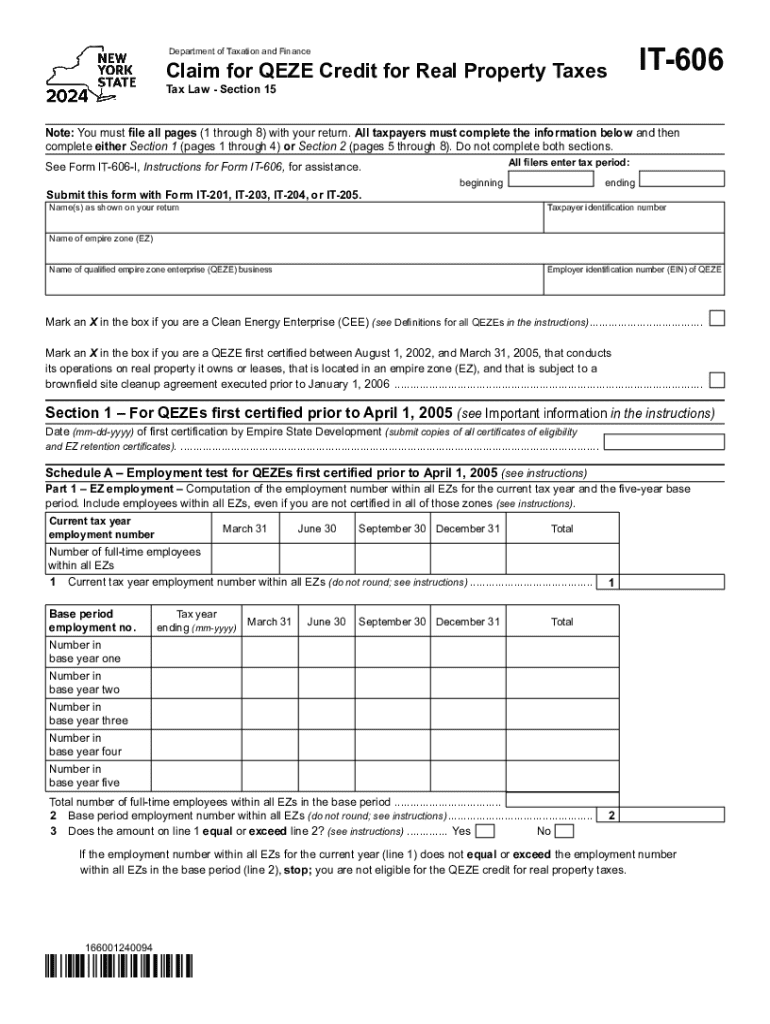

The Form IT 606 is a tax form used by businesses in New York to claim the Qualified Empire Zone Enterprise (QEZE) credit for real property taxes. This credit is designed to provide financial relief to qualified businesses operating within designated Empire Zones. By utilizing this form, eligible entities can reduce their real property tax burden, contributing to their overall financial health and sustainability.

Steps to Complete the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

Completing the Form IT 606 requires several steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of property taxes paid and evidence of eligibility as a QEZE. Next, fill out the form by providing information such as the business name, address, and the specific tax year for which the credit is being claimed. Be sure to calculate the amount of credit accurately based on the guidelines provided. Finally, review the form for completeness and accuracy before submission.

Eligibility Criteria for the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

To qualify for the QEZE credit, businesses must meet specific eligibility criteria. These include being designated as a Qualified Empire Zone Enterprise and operating within a designated Empire Zone. Additionally, the business must have paid real property taxes for the relevant tax year and must not be disqualified from receiving the credit due to any outstanding tax liabilities or non-compliance with state regulations.

Required Documents for the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

When submitting the Form IT 606, businesses must include several supporting documents. These typically consist of proof of real property taxes paid, such as tax bills or receipts, and documentation demonstrating the business's status as a QEZE. It may also be necessary to provide additional financial statements or records that verify the business's eligibility and compliance with the program requirements.

Filing Deadlines for the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

Timely submission of the Form IT 606 is crucial for businesses seeking the QEZE credit. The filing deadline generally aligns with the annual tax return due date for the business entity. It is important to check specific state regulations for any variations in deadlines or extensions that may apply, ensuring that the form is submitted on time to avoid penalties or disqualification from receiving the credit.

Form Submission Methods for the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

Businesses can submit the Form IT 606 through various methods. The form may be filed electronically via the New York State Department of Taxation and Finance website, or it can be submitted by mail. In some cases, in-person submissions may also be accepted at designated tax offices. It is essential to follow the specific submission guidelines provided by the state to ensure proper processing of the claim.

Create this form in 5 minutes or less

Find and fill out the correct form it 606 claim for qeze credit for real property taxes tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 606 claim for qeze credit for real property taxes tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year?

The Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year is a tax form used by qualified businesses to claim a credit against real property taxes. This form is essential for businesses looking to benefit from the Qualified Empire Zone Enterprise (QEZE) program. By submitting this form, businesses can potentially reduce their tax liabilities signNowly.

-

How can airSlate SignNow help with the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year. Our user-friendly interface simplifies the document management process, ensuring that your claims are submitted accurately and on time. This can help you maximize your tax credits with minimal hassle.

-

What features does airSlate SignNow offer for managing tax forms like Form IT 606?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are ideal for managing tax forms like the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year. These features streamline the process, allowing you to focus on your business while ensuring compliance with tax regulations. Additionally, our platform supports collaboration among team members for efficient document handling.

-

Is there a cost associated with using airSlate SignNow for the Form IT 606 Claim?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our plans are designed to be cost-effective, providing excellent value for the features offered. By using airSlate SignNow, you can save time and resources while ensuring your Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year is processed efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your workflow when dealing with forms like the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year. This integration allows for easy data transfer and ensures that all your documents are in sync, making tax preparation more efficient.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year, offers numerous benefits. These include enhanced security for sensitive information, faster processing times, and improved accuracy in document handling. Our platform also provides a user-friendly experience, making it easier for businesses to manage their tax documentation.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes the security of your documents, including the Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year. We implement advanced encryption and security protocols to protect your data from unauthorized access. You can trust that your sensitive tax information is safe with us.

Get more for Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

Find out other Form IT 606 Claim For QEZE Credit For Real Property Taxes Tax Year

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement